Loadshedding destroying production, growth, jobs in the metals and engineering sector

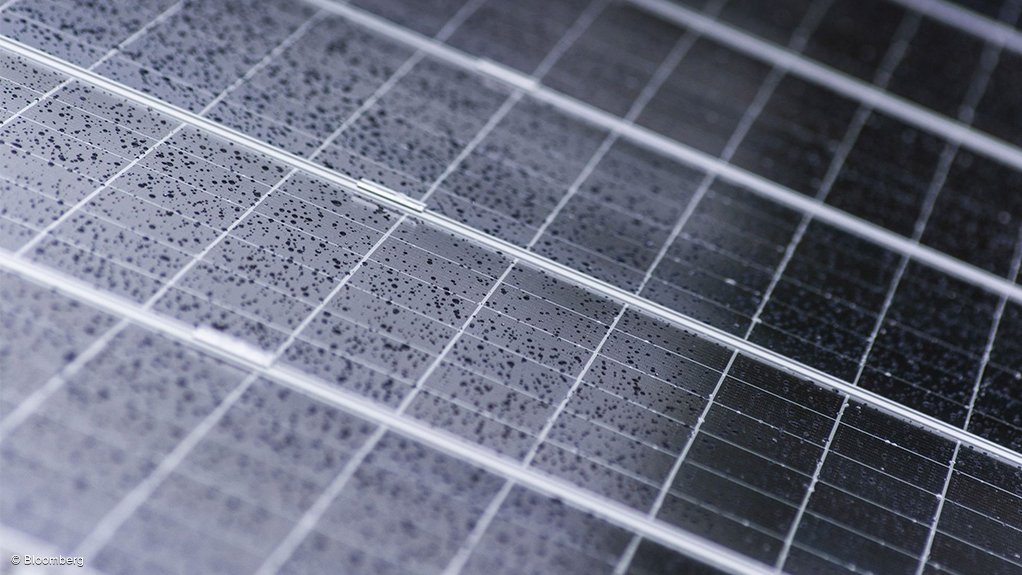

Metals and engineering companies are investing in alternative power solutions

Photo by Bloomberg

Companies in the metals and engineering sector have seen production decline by 34.2% over the past year, and production in the sector is estimated to contract by 5.3% this year, industry organisation the Steel and Engineering Industries Federation of Southern Africa (Seifsa) reports.

Seifsa undertook a loadshedding impact survey of its members to measure the impact of the energy crisis on them between February 2022 and February this year.

Employment in the sector has mirrored the production trends, contracting by 1.1% over the year and contributing to the country’s unemployment crisis.

“The employment losses over the period indicate some very concerning trends, although these losses are mostly attributable to companies responding to the energy crisis over the year period,” it said.

Specifically, one-quarter of companies indicated that they had had to reduce headcount in response to the electricity crisis, some by as much as one-quarter of their employment, equating to 9 432 people. One-third of the respondents indicated that they were working short-time owing to the electricity crisis.

“An even more concerning outcome is the fact that half of the companies that are implementing short-time have already reduced headcount.

“We assign the status of vulnerable to these companies because, while the other half of companies have not reduced headcount, short-time is a good leading indicator to track for potential future job losses,” Seifsa highlighted.

Further, 42.6% of the companies that responded have cancelled investment and/or expansion plans, owing to the uncertainty presented by the electricity crisis.

The value of these investments amounts to R2.64-billion with the potential of creating 1 620 new jobs. Of the cancelled investments, 3% were in greenfield, 41% in brownfield and 56% in sustaining projects.

“The long-term implications of this energy crisis to the future prospects of the sector are devastating. Over the past 15 years, net investment into the sector has been on the decline, which has led to the value of fixed capital stock deteriorating at a 0.3% compound annual growth rate, and threatening the competitiveness of the sector,” Seifsa said.

In terms of input costs, companies reported increases in monthly operating costs of up to 24.9% from the extensive use of generators. This does not bode well for a sector whose total input costs were 17.6% higher year-on-year in February.

“Further, factoring in the results of the survey to the input cost model shows that input costs increased by 1.7 percentage points to 19.3% for the sector.”

The crisis not only has implications for the immediate survival of companies but also for the investment prospects of the country, Seifsa said.

“The crisis has been particularly damaging on the metals and engineering sector, which is the backbone of industrialisation and for which electricity, particularly baseload electricity, is fundamental to its survival.”

The metals and engineering sector has been in a structural recession since the global financial crisis of 2008/9, with production recording a 1.2% contraction on a compound annual basis over this 15-year period.

ENERGY INVESTMENTS

Of the companies that responded, 79.2% indicated that they have had to install alternative electricity sources in the past 12 months to counter the pressing challenge presented by the electricity crisis.

“The combined value of this investment is R985-million. This number is considerable when considering that it accounts for 37% of the value of investments cancelled. This, again, highlights that companies are sacrificing scarce long-term capital to fulfil an immediate survival need, presenting long-term adverse implications for the sustainability of the sector,” Seifsa emphasised.

Further, it is not surprising that, given the relatively intense electricity consumption nature of the sector, the most practical alternative energy sources are generators representing 67%.

Solar accounts for 20% of the investment made. However, the 125% tax incentive afforded to companies in the February 2023 National Budget should result in an increase in the uptake of solar as an alternative source, but the electricity consumption profile of the sector remains a limitation to solar being a full-scale option, the organisation added.

“On aggregate, the companies have a generator installed capacity of 116 MW, while solar is 36.2 MW.”

Additionally, the respondents highlighted that they had a very limited ability to feed in any excess electricity generated from their solar installations, largely owing to the fact that the solar installations have been put in as a marginal hedge or top-up to their baseload needs.

This picture may well change given the 125% tax incentive, although to a limited degree, as the sector's electricity consumption pattern is the main determinant for the technology deployed, Seifsa said.

The metals and engineering sector constitutes 26.5% of the manufacturing sector, based on output, and 2.6% of gross domestic product on a value-add basis. In December 2022, the sector employed 374 496, of which 217 618 are factory workers.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Research Reports

Latest Multimedia

Latest News

Showroom

AirNox (Pty) Ltd is a level 1 BBBEE manufacturer of complete AdBlue® solutions for operators of SCR diesel engines and AUS40 across South Africa...

VISIT SHOWROOMAstore Keymak is one of South Africa’s leading suppliers of high-quality Thermoplastic Pipeline Systems, with branches in the major provinces.

VISIT SHOWROOMPress Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation