Logistics strain far from over, but rail moving in the right direction – Ctrack index

The Ctrack Transport and Freight Index (Ctrack TFI) declined for eight consecutive months to reach an index level of 112.8 in January, the lowest level since December 2022.

This decline resembles the strain experienced amidst the Covid-19 pandemic, when the economy slumped into a deep recession.

At this level, the index is 5% below a year earlier, and 10.1% below the May, 2024 level of 126.5, suggesting a significant downturn in the latter months of last year.

The Ctrack TFI found that the weakness in the South African logistics sector was quite broad-based last year, resulting in the sector subtracting from overall economic growth.

“This is quite a disappointing performance as the transport sector has in the past often been an outperformer relative to the broader economy, but that trend had changed abruptly,” states the report on the newest index.

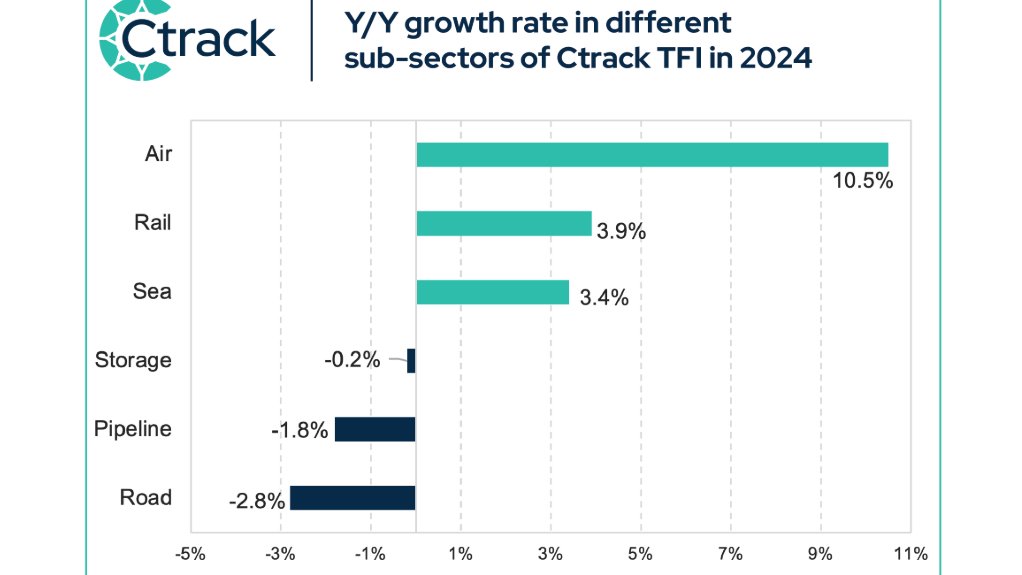

For calendar year 2024, the Ctrack TFI shows that three subsectors contracted, with the heavy-weighted road-freight subsector leading the way with a contraction of 2.8%.

Transport via pipelines shrunk for a second consecutive year, by 1.8% (–1% in 2023), while storage and handling (–0.2%) declined for a third consecutive year.

The air-freight sector turned out to be 2024’s star performer, growing by 10.5%, while the rail freight and sea freight sectors grew by 3.9% and 3.4%, respectively.

The further monthly decline in the Ctrack TFI in January suggests that the country’s logistics sector remained on the back foot as it entered the new year.

Road Freight Down as Ports Struggle

The Ctrack TFI’s road-freight subsector, which has grown notably in recent years and currently accounts for 83.1% of all freight payload in South Africa, contracted by a significant margin last year.

Following on growth of 1.5% in 2023, road-freight payload in South Africa dropped by 8.3% in 2024.

While the ongoing weakness in the South African economy has been a factor in this performance (despite economic growth being at similar levels, on average, in 2024 compared with 2023), other challenges probably played a bigger role, states the Ctrack TFI report.

This includes the redirection of cargo ships towards other ports in Africa, especially during periods when Durban’s terminals were plagued by inefficiencies, resulting in less demand for heavy vehicle transport domestically.

As an illustration, the number of heavy trucks (class 3 and 4) passing through the Tugela Toll Plaza on the N3 dropped by 1% in 2024, compared with growth of 0.5% in 2023.

Similarly, heavy-vehicle traffic on the N4 route towards the Maputo port also declined last year, following on notable growth in the preceding two years.

The political unrest following elections in Mozambique played a notable role in the decline in road-freight transport on the N4.

“The efficiency of our maritime gateways is critical not only for the success of the freight industry, but for the entire supply chain,” notes the Ctrack TFI report.

“Ongoing challenges at our ports have highlighted the urgent need for modernisation, increased capacity and improved management.”

Proof of this also rests in the relatively poor performance of the sea-freight subsector in the Ctrack index, regarded as the logistics sector’s Achilles heel.

After contracting for two consecutive years, the sea-freight component of the Ctrack TFI increased by 3.4% in 2024.

However, according to Transnet National Ports Authority, the number of containers handled in 2024 may have increased by 4.6% compared with 2023, but total cargo handled at ports inched up by a mere 0.3%.

Rail Sector is Recovering Very Slowly

While the momentum moderated somewhat in 2024, the recovery in the rail-freight sector is still on track, and likely to see more cargo moving from road to rail in coming years.

This is a very slow-moving trend, however, and not the main driver of slack in the road-freight sector in 2024 – it is, in fact, a minor role-player in road freight’s under-performance in 2024, says the Ctrack TFI report.

“Rail-freight payload in South Africa increased only marginally in 2024, with an increase of 0.8% in 2024 compared with 2.4% in 2023.

“Still, these two years represent a hesitant, but welcome, turnaround in the rail-freight space after five consecutive years of contraction (2018 to 2022).

“From reaching a rock-bottom low of only 10.3% of total freight payload in November, 2022, the performance of rail has improved to 17.8% in December, 2024.

This is, however, still notably lower than the ten-year average of 25.9% from 2008 to 2017, prior to the onset of the period of significant deterioration.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation