Long-run gold bull market expected by CPM Group of the US

Flashback to CPM Group's Jeffrey Christian (right) being interviewed by Mining Weekly's Martin Creamer.

Photo by Creamer Media

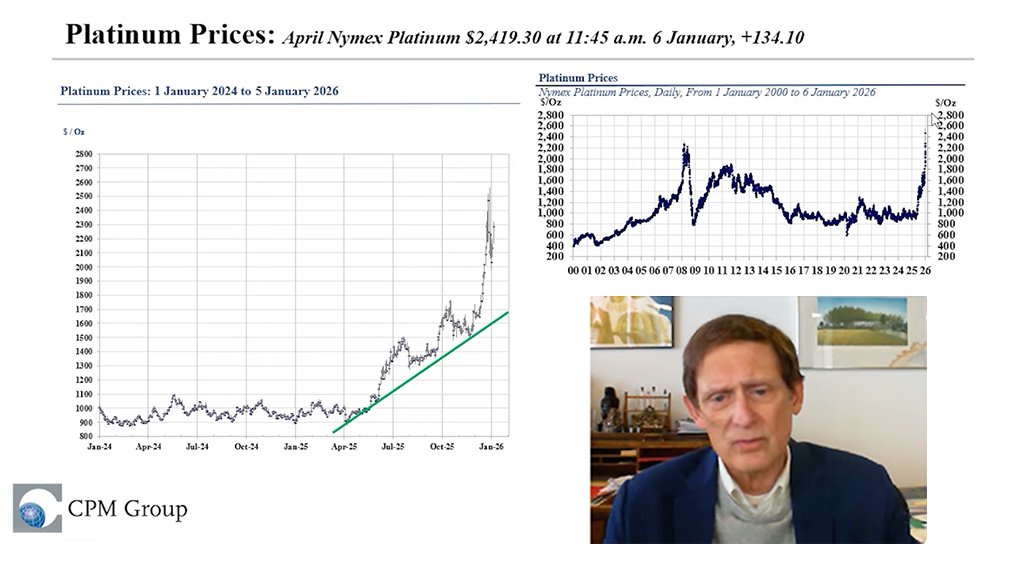

Platinum price rise.

JOHANNESBURG (miningweekly.com) – Given the state of the world politically, economically, financially and socially, the gold bull market is expected to continue in the long run, says Jeffrey Christian of New York-based CPM Group.

While 2025 was an extraordinary year for the world and for precious metals markets, 2026 threatens to be even more extraordinary as last year’s trends continue to unfold, perhaps in more volatile fashion.

As metals continue to reach record levels, CPM Group this week also provided a market update on platinum and palladium prices amid US and international events becoming a dominant driver of investment demand.

The move away from traditional economic fundamentals was noted along with investor anxiety and renewed buying interest being heightened by rising political uncertainty and strained international relations.

It was also pointed out that, as the US government catches up from its October and early November furlough, the high volume of US administration data due to be released this month and next, may be economically impactful to the extent that it elevates the prices of precious metals even more.

“We’re going to see a lot of data ... and a lot of that data may be economically hostile, which could add to the fuel that’s driving precious metals prices higher,” Christian pointed out in his ‘what happens next?’ video, covered by Mining Weekly.

The data coming out will cover the third and fourth quarters of 2025 and provide early first-quarter 2026 pointers.

“There are a lot of domestic and international political issues that are creating greater uncertainties, higher risks and greater investor anxieties, and that's going to continue until things change.

“We don't see necessarily a better change on the immediate horizon, so gold prices have risen very high. Our expectation has been that they would be stronger in the first quarter of this year and then possibly plateau. That continues to be our expectation.

“Over the course of 2025 gold prices rose from January through March, moved sideways in April, May, June and July, and then in late August, they rose again,” Christian recalled.

WEALTH PRESERVATION INVESTORS

The presentation also highlighted the emergence of unconventional affluence-safeguarding price-trend investors entering the gold, silver, platinum, palladium, copper and aluminium markets.

“We've seen a lot of short-term investors. These are not traditional precious metals investors. These are momentum traders and short-term speculative people coming into the gold and silver markets, as well as into platinum and palladium and copper and aluminium markets.

“These investors are now wedded to the idea of having and holding physical gold and silver as a form of wealth preservation.

“They're looking for capital appreciation, and if they see the price plateau, they can leave very quickly, so it's something to watch out for.

“But given the state of the world, given the political developments that we’ve seen and that we expect to see, given the breakdown of the United States relationships with its European allies, as well as Canada and Mexico, two of its three largest trading partners, as well as China, the third major trading partner, there are a lot of issues that probably are going to keep investors interested in precious metals this year,” Christian observed.

PLATINUM PRICES

It was noted that platinum prices are higher now than they were at the beginning of 2008, when electricity failure in South Africa significantly disrupted platinum, palladium and rhodium production.

The chart displayed showed the steady rise of the platinum price from 2001 right into 2007. “Then the power went out,” Christian recalled, which resulted in the platinum price first soaring to $2 300/oz, and then plummeting with a thud to $800/oz as a result of the US’ Great Depression, which spread panic in the platinum-reliant automotive industry.

The panic was bought brought about by the automotive sector having bought a lot of platinum to ensure supply in the wake of South Africa’s first-quarter 2008 power crisis, then being confronted by a major second-quarter 2008 car and truck sales slump.

South Africa’s power crisis drove the first-quarter 2008 platinum price to $2 300/oz and then the US financial crisis pushed it down to a second-quarter 2008 $800/oz.

A similar situation took place with palladium and rhodium with Christian recalling how a trader who had sold rhodium to the automotive industry at $10 000/oz in the first quarter of 2008, bought it back at a tenth of the price – $1 000/oz – the following quarter.

“We went through a long period of gestation, and now the price is rising again, primarily on investment demand,” Christian noted.

However, the palladium price has not returned to the records levels seen in 2021 and 2022, when Russia threatened to and then did invade Ukraine.

Investors were concerned about disruptions and palladium supplies from Russia or embargoes on them, none of which occurred. The price came down and then more than doubled over the course of last year.

VARIATION MARGIN MISINFORMATION

Christian reported that misinformation is circulating in the market and on the internet about the variation margin – a variable payment made to a clearing house when a clearing member's collateral loses value. Variation margin is paid by clearing members to reduce the exposure of carrying high-risk positions.

“If you're actually familiar with commodity markets, you know that margin requirements change quite often across commodities.

“In the futures market, you trade with the clearing house and are exposed to the financial wherewithal and stability of the clearing house, not to a particular market participant.

“The clearing house has a formula and it changes the margins. There's an initial margin and then there's variation margin as the prices rise or fall…to make sure that the companies that are long and short have the financial wherewithal to meet their obligations. They need to put up more margin as performance bonds to show that they can perform and meet their financial obligations. That's how margins work and that's why futures markets tend not to default.

“Wilful ignorance is a legal term related to not performing as you have agreed to perform. It's your responsibility, under caveat emptor or let the buyer beware, to be wilfully informed about what you're buying and how that market works.

“Today, everything's much more complex, including futures markets and options markets and you have an obligation to be wilfully informed,” said Christian, who drew attention to the financial deregulation that allowed non-bank financial institutions to grow in power and activity and to take over and compete with the activities that were formerly limited to banks.

This put banks at a competitive disadvantage because non-bank financial institutions were taking over their markets while not having to meet to the financial obligations of banks.

“If you look where the problems were created, from 1998 to 2001 and then again from 2004 to 2011, the problems didn't come from the banking side, which suffered from it.

“The problems started in non-bank financial institutions, which didn't come under the Glass-Steagall guidelines that were done away with to give the banks a fighting chance to compete on a level playing field,” Christian pointed out.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation