Neo Energy Metals to acquire two uranium, gold projects in South Africa’s Witwatersrand basin

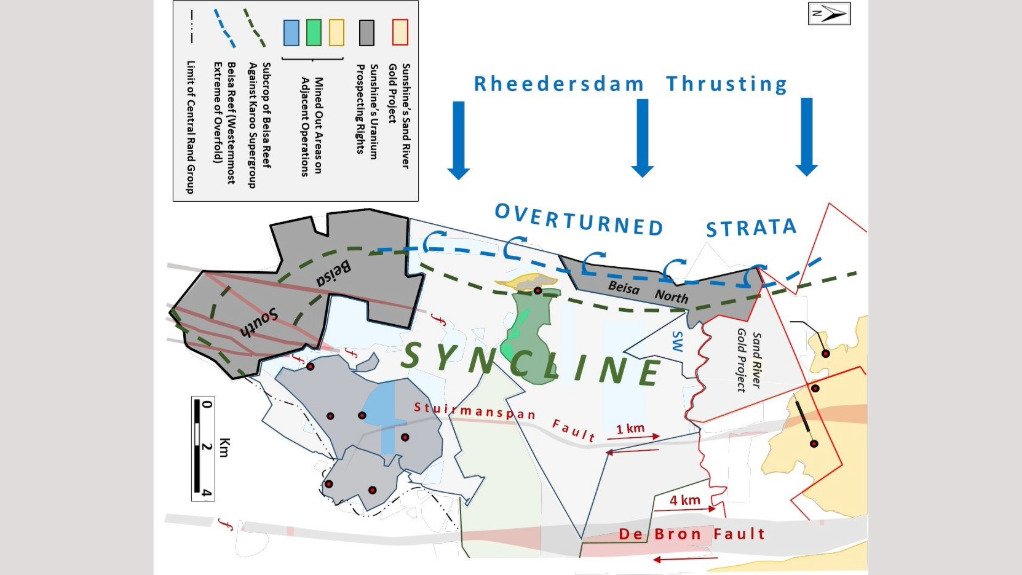

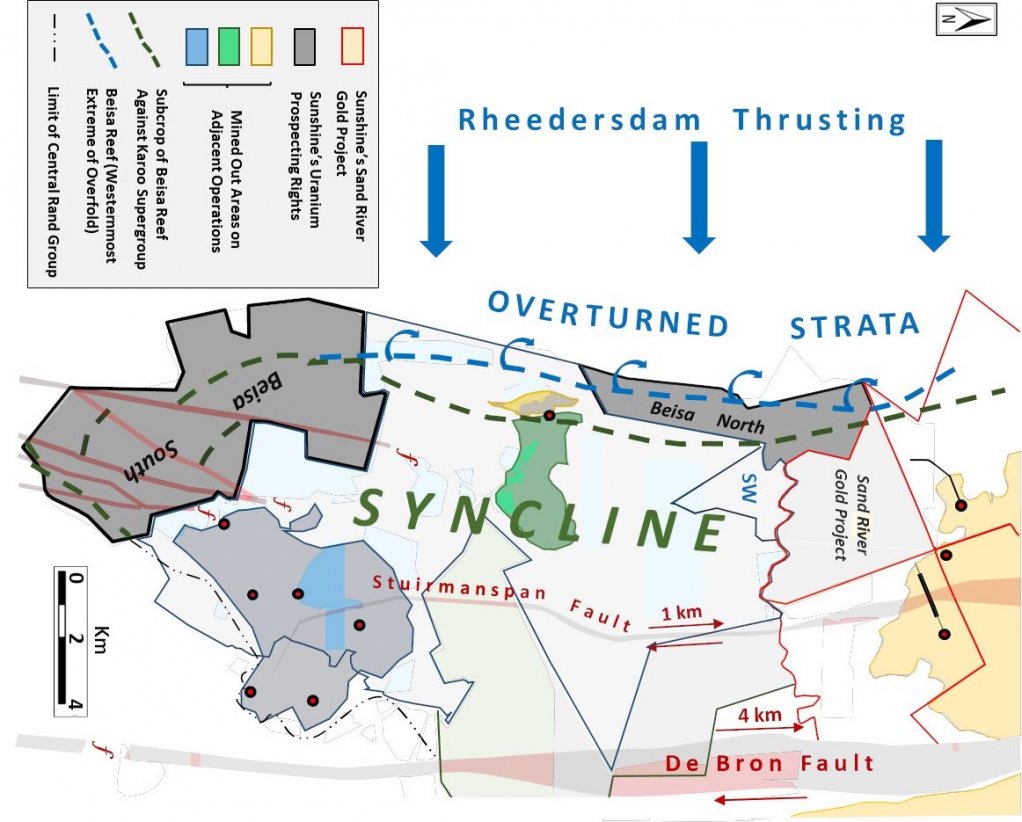

A map indicating the location of the Beisa North and South projects

Photo by Neo Energy Metals

A map indicating the location of the Beisa North and South projects

Neo Uranium Resources Beisa Mine (NURB), a subsidiary of South Africa- and London-listed Neo Energy Metals (NEO), has signed a binding agreement to acquire the Beisa North and Beisa South uranium and gold projects in the Witwatersrand basin from Sunshine Mineral Reserve.

The projects comprise resources of 90.24-million pounds of triuranium octoxide (U3O8) and 4.17-million ounces of gold and lie immediately north and south of the previous producing high-grade Beisa uranium mine and adjoin existing multimillion-ounce gold mining operations of Harmony Gold Mining Company and Sibanye-Stillwater.

NEO, which also owns the Henkries uranium project, near Springbok, in South Africa’s Northern Cape province, says the acquisition is in line with the company’s strategy to establish itself as a major South African and African uranium mining company and the first of several potential acquisitions being advanced.

“This acquisition marks a major milestone for Neo Energy Metals and significantly expands our footprint in one of the richest and long-standing uranium-producing regions in the world. The projects not only bolster our uranium resource base but also further strengthen the company’s ability to achieve its strategic goal of becoming a major player in the global uranium market and as South Africa’s leading uranium company.

“We are very excited about the potential these projects hold and look forward to advancing them towards production, leveraging off the existing infrastructure that surrounds these projects and off our team’s expertise. In the coming weeks, we will look to finalise the formal documentation and regulatory approvals for the acquisition with the team at Sunshine and, in parallel with that, finalise the debt funding arrangements,” says NEO CEO Sean Heathcote.

The company points out that the projects have been extensively explored since 1936 with multiple diamond drilling resource programmes having been completed by various South African mining companies.

Further, it notes that the uranium-bearing Beisa Reef, on both project areas, is considered the shallowest deposit in the Welkom Goldfield in the Witwatersrand Basin. On the Beisa North uranium project, the Beisa Reef is present from as shallow as 350 m to the north of the Beisa uranium mine.

The shallow depths and steep configuration of the Beisa Reef are considered to favour the typical narrow underground mining methods of the Witwatersrand Basin, which are considered to also reduce dilution of the uranium-gold ore, NEO adds.

NEO states that the Beisa North project has the potential to be a standalone mining operation, or to be developed and accessed from existing nearby mine, shaft and underground infrastructure in the region.

At Beisa South, further in-fill drilling will be undertaken to increase the resource confidence levels across the 56 km2 project area.

Transaction Details

As part of the initial agreement concluded between NURB and Sunshine, NEO has agreed to pay a R2.5-million exclusivity fee, as well as to issue 20-million new NEO shares to Sunshine.

NEO expects formal acquisition documentation with Sunshine to be concluded by September 30.

To acquire the projects, NEO will pay Sunshine R175-million in cash and issue new ordinary shares to the value of R200-million, provided that Sunshine’s shareholding in NEO does not exceed 29.9%.

It will also grant Sunshine a royalty on uranium produced at the Beisa projects of between $3/lb and $5/lb when the uranium spot price is between $100/lb and $150/lb and a gold royalty of $7.50/oz.

NEO points out that the acquisition is being supported by its major shareholder Dubai-based AUO Commercial Brokerage.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation