New-vehicle market showing strain – WesBank, NADA

New-vehicle sales stumbled in August, showing the first potential signs of strain amid growing economic headwinds, says WesBank.

To date this year, the market has shown resilience, despite tightening household budgets, low business and consumer confidence, and the impact of the energy crisis, among other factors.

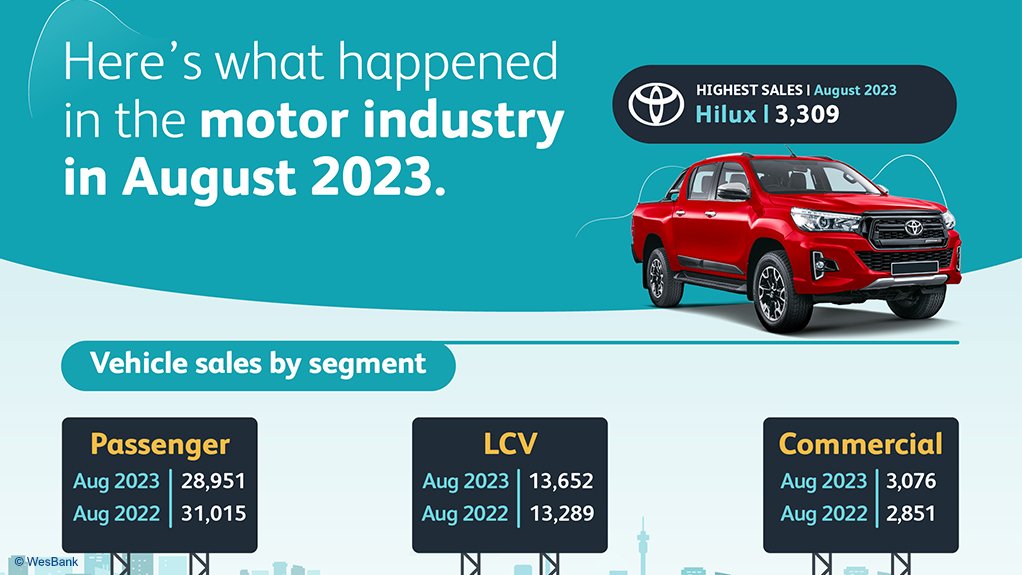

According to data released by naamsa | the Automotive Business Council, South Africa’s new vehicle sales fell 3.1% in August, to 45 679 units, the biggest year-on-year decline in sales since December 2021.

“August’s negative growth shouldn’t dismay completely, however,” says WesBank marketing and communications head Lebo Gaoaketse.

“Although August sales experienced their biggest decline in 21 months, the volume is still 5.2% ahead of July sales.

“In addition, August 2022 sales were amongst the best-performing sales months last year.”

Year-to-date new-vehicle sales have now softened off the back of the August performance, and were down 1%, to show overall market growth of 3.4% compared with last year.

Total sales volume for the year to August is 355 246 units.

The National Automobile Dealers’ Association (NADA) also believes that August signals the month in which the domestic new-vehicle market could no longer withstand the pressure from rising interest rates, fuel prices and vehicle costs, as well as a significant decrease in households’ spending ability, owing to the increased cost of living.

“The resilience of the South African retail motor industry in 2023 continues to astound us, but we knew there had to be a tipping point, and this is what happened in August,” says NADA chairperson Brandon Cohen.

“Interest rates represent the most significant obstacle to vehicle sales presently.

“Not only does it strain individuals with existing financial commitments, resulting in higher debt instalments, but each increase in rates also changes the affordability model for consumers in terms of the maximum rand value for which they can secure approval for a loan at a financial institution.

"When we factor in new-car pricing and the negative impact of a weak rand, we are witnessing a perfect storm of reduced affordability.”

"I believe we need to be realistic,” adds Cohen.

“We must acknowledge that the current economic conditions are very challenging, although there is still demand, albeit under pressure.

“Fortunately, financial institutions have not ceased funding as they did during the global financial crisis, and mobility remains essential for most South Africans.

“Therefore, there are generous special offers and other incentives in the market for consumers, while interest rates appear to be stable and unlikely to rise further,” says Cohen.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation