Northam increases credit facility by R2bn to support renewables programme

JSE-listed Northam Platinum has successfully concluded and implemented an agreement to increase its existing revolving credit facility (RCF) from R11.3-billion to R13.3-billion to support its renewable-energy rollout.

Northam’s total available banking facilities now amount to R14.3-billion, comprising the increased RCF of R13.3-billion, which matures in August 2027, and existing general banking facilities of R1-billion.

As a large and growing energy user, Northam has been pursuing an alternative and renewable-energy programme to improve security and diversity of energy supply, while simultaneously reducing long-term energy costs and the company’s impact on the environment.

To date, it has entered into various power purchase agreements with independent power producers for new renewable-energy projects, which are in advanced construction phases, with some already producing renewable energy.

Northam is also developing various own-build and owned renewable-energy projects at the company’s mine sites, comprising solar PV plants supplemented with utility-scale battery storage.

The RCF increase allows Northam to accelerate construction of these various own-build projects.

Northam’s alternative energy programme is scheduled to provide more than 70% of the company’s total energy requirement from renewable sources before the end of the current decade, with a concomitant significant reduction in its carbon emissions and increase in energy availability factor on a competitive cost basis.

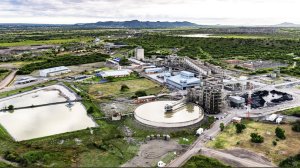

Northam has three main operations in South Africa – Zondereinde, in Limpopo; Booysendal, in Mpumalanga; and Eland, in North West.

“The RCF increase provides Northam with the necessary flexibility and additional capacity to accelerate our efforts to enhance the security of our energy supply through the use of renewable sources and to also significantly decrease our contribution towards greenhouse-gas emissions, without affecting our other capital programmes or our ability to return value to shareholders whilst doing so,” says CFO Alet Coetzee.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation