Ozow unlocks real-time payments for merchants with Payshap Request

This article has been supplied and will be available for a limited time only on this website.

South African payments processing platform Ozow today announced the official launch of PayShap Request, a brand-new real-time payment feature now available to its extensive network of merchants. Ozow has already enabled PayShap Request for its first merchant, with more merchants being activated daily.

This significant milestone not only positions Ozow as taking the lead in enabling PayShap Request in a live environment but also underscores its staunch support for the South African Reserve Bank’s (SARB) vision for payments modernisation and financial inclusion within the country.

The Ozow experience caters for those who have a ShapID registered at their bank while those who don’t, can use their account number to complete the payment. No app, card, or login required.

Since its introduction, the PayShap ecosystem has already processed over R100 billion across 136 million transactions, with more than 4.5 million ShapIDs registered. As demand for instant, secure digital payments grow, Ozow’s launch of PayShap Request ensures that merchants can immediately tap into this fast-expanding network, without requiring customers to pre-register a ShapID.

Recent insights from the SARB underscore the need for greater collaboration and modernisation across South Africa’s payments ecosystem. Ozow’s implementation of PayShap Request is a direct response to these calls, offering a fast, secure, and user-centric solution that supports the PEM’s goals.

The introduction of PayShap Request by Ozow aligns with current trends in the South African fintech and payments landscape, which emphasise instant payments, enhanced security, and broader financial accessibility.

The SARB's Rapid Payments Programme (RPP), of which PayShap Request is a principal component, aims to transform the national payments ecosystem by driving digital adoption and ensuring more inclusive financial services for all South Africans.

This launch is a crucial step towards the goals that the SARB has outlined regarding modernising the payments ecosystem in South Africa, particularly in the context of recent discussions around cash and the Payments Ecosystem Modernisation (PEM).

"We are incredibly proud to be at the forefront of enabling PayShap Request for South African merchants," said Rachel Cowan, Interim CEO of Ozow.

"This launch truly demonstrates our commitment to innovation and our dedication to providing businesses with the most efficient and user-friendly payment solutions. By being among the first to bring PayShap Request to a live environment, we are not only offering a significant competitive edge to our merchants but also helping deliver on the SARB’s mandate for a modern, inclusive payments future,” said Cowan.

Ozow’s first-to-market advantage and alignment with SARB’s vision.

While other players in the market may have indicated their intentions regarding PayShap Request, Ozow has taken the decisive step of enabling it in a live environment.

This implementation directly supports the SARB's broader mandate to modernise South Africa's payments ecosystem and drive digital adoption, with PayShap being a central enabler of accessibility and inclusion.

Ozow's commitment to these values is embedded in its strategic approach, reflecting the collaborative efforts required by various parties within this space. Through these collaborative efforts, Ozow has launched a digital payment product that leverages the PayShap rails and Ozow’s technology and user experience to deliver an intuitive, user-friendly payment experience.

Enhanced customer experience and accessibility

A key differentiator of Ozow’s PayShap Request offering is its unparalleled customer convenience. Customers are not required to have a pre-registered ShapID to complete a payment.

If a customer has not registered a ShapID (a registered phone number linked to their bank account), they can simply use their bank account number to transact, significantly reducing friction and improving accessibility for a wider range of consumers.

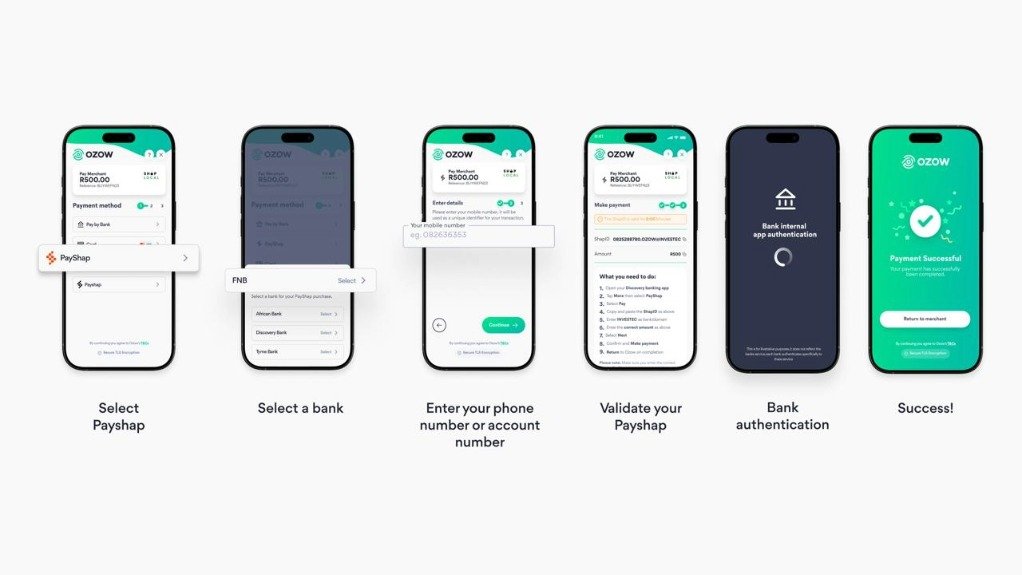

Customers simply select PayShap at checkout, choose their bank, enter their phone number or account number, and follow the prompts to authenticate the payment in their banking app.

This feature is particularly crucial in a market focused on bringing more individuals into the digital economy and aligns with the SARB's drive for greater financial inclusion.

Ecosystem collaboration for seamless rollout.

The successful rollout of PayShap Request is a result of collaborative efforts between Ozow and key ecosystem players. This collaboration has been instrumental in enabling the solution and ensuring a smooth and secure launch, reinforcing the collective commitment to advancing South Africa’s payment infrastructure.

PayShap is powered by BankservAfrica and supported by South Africa's banks under the Rapid Payments Programme, ensuring continued scale, enhanced security, and stability.

Ozow’s history of successful collaborations (including its work with Absa Pay to co-develop a seamless bank API) highlights the company’s ability to deliver best-in-class digital experiences. This partnership has since become a blueprint now accessible to all PSPs, reinforcing Ozow’s role as a leader in ecosystem innovation and user-centric design.

Key benefits for merchants and consumers:

·Instant payments: Merchants can get paid in real-time, significantly improving cash flow and speeding up service delivery.

·Customer convenience: Customers can make instant payments using just their mobile number or bank account number.

·Access to new customers: With over 4.5 million ShapIDs registered, PayShap opens access to digitally hesitant and risk-averse consumers, expanding the potential customer base for merchants.

·Secure and irrevocable: Every PayShap payment is authenticated directly via the customer’s banking app, with built-in fraud prevention mechanisms, ensuring secure and irrevocable transactions.

·Direct refunds: Merchants can easily process refunds directly into a customer’s bank account.

·No extra setup required: Merchants already integrated with Ozow can enable PayShap Request with no additional development needed, ensuring a seamless transition and immediate benefits.

“Account-to-account payments have been central to Ozow’s model from the start, and with PayShap enabling deeper integration between banks and fintechs, we’re one step closer to a more interoperable payment ecosystem,” said Cowan

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation