South African PGM miners overcoming challenges to build new mines

South African platinum group metal (PGM) miners are overcoming challenges and building new mines locally, albeit in phases, to derisk some of these promising tier-one projects.

PGM mining industry leaders, participating in a panel discussion as part of the PGMs Industry Day conference on April 10, highlighted that costs per ounce were a significant focus, and that these were in addition to challenges including the electricity shortages and logistics bottlenecks, facing all South African real economy companies.

“If costs sit in the lower half of the cost curve, then a project should be able to ride the waves [of commodity cycles]. However, the current environment calls for responsible and disciplined deployment of cash, which is the position we find ourselves in [at the Modikwa, Two Rivers and Nkomati mines],” said diversified miner African Rainbow Minerals (ARM) Platinum CE Thando Mkatshana.

The Two Rivers platinum mine has been the company’s flagship PGMs operation for many years. It is a mechanised operation mining the Upper Group 2 reef (UG2) and sits in a favourable position on the cost curve, he said.

Three years ago, the company saw an opportunity to navigate through challenges, including the declining grade at Two Rivers.

“We are now finishing these projects, but we are taking a responsible approach, including planning to slow down the developments in such a way that they can be ramped up when the market turns.

“We are building a Noah’s Ark so that, when the cycle turns, we are able to bring these operations back to life quickly. In the meantime, they are carrying on and are well positioned until such time,” he said.

ARM Platinum also acquired the Bokoni mine from Anglo American Platinum two years ago. This is a high-quality asset with high-grade potential from UG2, which provides an opportunity to develop a good tier-one operation, Mkatshana said.

However, given the current market, the company is looking to phase it in.

“We did start some of the initial phases last year, and have started to develop a 60 000 t a month operation, albeit mainly to manage the maintenance costs of the mine. At this stage, the project is not sustainable and needs to double production and then ramp up to about 220 000 t a month.

ARM Platinum is focused on spending cash in a disciplined and responsible way, and we are using the existing infrastructure as much as possible. Despite these challenges, the asset has a huge orebody with the potential to ramp up to much higher volumes,” said Mkatshana.

Additionally, Bokoni and the Merensky reef historically have had a lot of geological challenges. ARM Platinum plans to mine the UG2, which is a tabular orebody with a steep dip.

However, the company has developed a mine plan and its team is highly experienced.

“We will deploy a mechanised mining method there. In June, we plan to deploy mechanised mining equipment and start mining. We have given ourselves a year to prove the concept,” Mkatshana said.

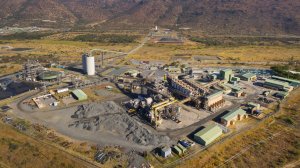

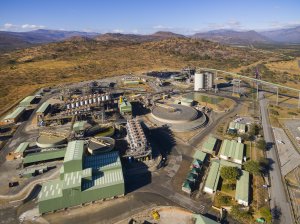

Meanwhile, diversified energy- metals-focused mining company Ivanhoe Mines president Marna Cloete said the company was using its experience from building the Kamoa-Kakula Copper Complex, in the Democratic Republic of Congo, to approach its investment in the Platreef PGMs/nickel mine, in Limpopo, South Africa.

“To derisk the Platreef project, we are developing it in phases. Phase 1 will enter production next year and then ramp up quickly to Phase 2, which will result in production of more than 400 000 oz/y. The third phase is expected to produce close to one-million ounces a year from this one mining complex,” she said.

However, the Platreef project must be mined at scale. Phase 1 was never meant to be the ultimate plan, but a phased approach helps to derisk the project, as the company will get to know the metallurgy, the orebody and the geotechnical details of the project, she noted.

Ivanhoe made the decision to develop the Platreef project in 2011 on the basis that it is a large orebody, can be mined mechanically and would sit in the lower quartile of costs.

“We believe that there is space for every commodity, including PGMs, as the world will not transition [to sustainable energy] overnight . . . There is a bright future for PGMs, and this is why we are building the project. We believe it will be one of our flagship assets that will be producing in South Africa in the next year,” said Cloete.

Meanwhile, neither pricing of commodities nor capital funding is holding back PGM projects, although they do introduce challenges. What is holding back projects is logistics and energy costs, said Canada and South Africa platinum and palladium miner Platinum Group Metals finance executive Schalk Engelbrecht.

“When South Africa built many mines, it was simpler to get money for the project and offtake will be there once the project is on line. This is no longer the case, and we have been working hard since 2019 to secure offtake.

Further, one of the reasons we are pursuing the possibility of building a smelter in Saudi Arabia is because of how the economics work. Electricity costs make up about 30% to 40% of a smelter’s operating costs and, if you are in a region where electricity is significantly cheaper, you immediately get a 20% to 30% reduction in operating costs,” he explained.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation