Rate chokehold on African economies is set to loosen slowly

Over the course of the next month, African nations representing almost three-quarters of the continent’s gross domestic product are set to stake out different approaches to interest rates, as they weigh the risks of protectionist US policies on their economies and inflation.

South Africa, Kenya and Egypt’s central banks are among the eight likely to cut interest rates. Nigeria, Ghana and Mozambique are among seven anticipated to stand pat.

Their divergent stances means the aggressive monetary tightening unleashed since the inflation surge of 2021-22 is unlikely to get markedly looser any time soon. While domestic conditions will ultimately dictate their decisions, it’ll be hard for them to ignore global factors.

“The potential policies and focus of the Trump administration and the impact it will have on commodity prices and imported inflation will be at the back of the minds of almost all central banks,” said Ayodeji Dawodu, director of fixed income at BancTrust & Co. Investment Bank. “In line with this will be exchange-rate stability, given the possibility of the dollar strengthening.”

Here’s why African monetary policy committees will diverge:

Muddied Waters

Unlike Nigeria and Zambia, South Africa and Kenya’s real rates are among the highest in the world and inflation is forecast to remain below the midpoint of their central banks’ target ranges — where they prefer to anchor expectations — for the next couple of months, providing scope for them to cut rates.

South Africa is forecast to reduce its benchmark gauge by 25 basis points to 7.5% on Thursday and then pause; Kenya will likely slow the pace of rate cuts after a 75 basis-point reduction last month, said Tatonga Rusike, sub-Saharan Africa economist at Bank of America.

Their policymakers will be concerned by global risks and the direction that the Federal Reserve’s rate path may take, Rusike said. Fewer Fed cuts would mean African countries may have to confront a stronger dollar and higher interest rates when borrowing in international markets.

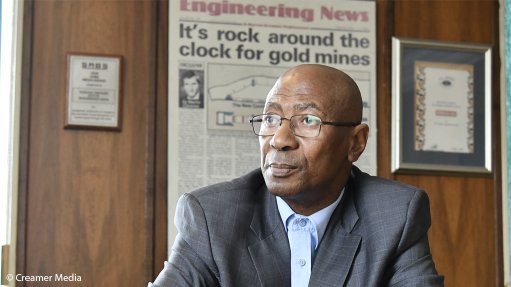

South African Reserve Bank Governor Lesetja Kganyago cautioned last week that policies enacted by US President Donald Trump may be inflationary and threaten to derail future rate cuts.

Central bankers in Mauritius, Eswatini, Lesotho and Namibia are also anticipated to reduce their benchmark rates as inflation remains within their target ranges.

Double-Digit Inflation

Nigeria, Malawi, Ghana and Zambia’s MPCs are all forecast to maintain high interest rates to support their currencies and contain double-digit inflation that’s only expected to let up in coming months. That’s as steep currency drops fall out of their annual price comparisons and their agriculture sectors recover from adverse weather conditions.

The expected slowdown in inflation may see Nigeria loosen interest rates in the fourth quarter and Ghana in the second, said Yvonne Mhango, Africa economist at Bloomberg Economics.

In the Democratic Republic of Congo and Egypt, where double-digit inflation has already started to ease and is expected to continue because of the relative stability in their currencies, policymakers are poised to cut interest rates for the first time in years on Thursday and February 20 respectively.

Domestic Factors

After cutting interest rates at six meetings in a row, Mozambique’s MPC will probably keep borrowing costs at 12.75% to control inflation that accelerated to an 11-month high in December and is expected to edge up further because of election-related disruptions.

The gas-rich nation has dealt with sporadic unrest since opposition leader Venâncio Mondlane rejected the outcome of last year’s presidential elections and repeatedly called for protests that have often turned violent.

Botswana and Uganda’s monetary authorities are also expected to leave their policy rates on hold as inflation is forecast to inch up.

An economic recovery from a prolonged slump in diamond prices is likely to drive up inflation in Botswana and a weakening shilling in Uganda.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation