Renergen remains on track to execute Virginia gas project

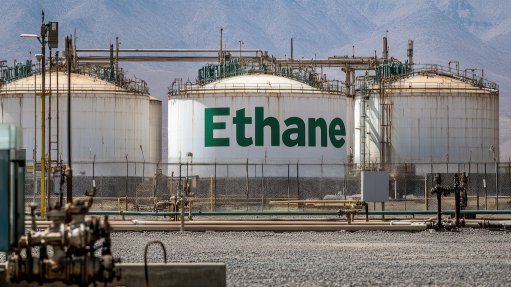

The 2020 reporting period has arguably been emerging liquefied natural gas (LNG) and helium producer Renergen’s busiest to date, with major milestones including a successfully completed initial public offering on the ASX, which raised A$10-million for the company, ensuring that the company remains on track to execute its Virginia gas project, located in the Free State, South Africa.

While not the company’s only milestone in the financial year ended February 29, the global macroeconomic picture is also changing and has seen the helium market remain in tight supply, with a prolonged oil price dip further exacerbating this position, which will likely have an impact on future large-scale LNG and helium prospects from a financing perspective.

This, together with decreasing supply from the US, with Hugoton’s production diminishing and the Bureau of Land Management (BLM) announcing its shutdown, is likely to “put significant pressure” on the supply dynamics of helium for the foreseeable future, Renergen noted in a report, published on June 1.

Considering that demand is, at this stage, not expected to fall in line with the reduced supply shortages, the impact of Covid-19 has been assessed, and according to Renergen management, deemed to “not have a material impact on the group in the new financial year”.

Given, however, that South Africa is a net importer of crude oil and liquid fuels, the impact from the decline of oil prices has been offset by a weakening currency and supply chains will most likely be impacted.

However, the extent of the problem could potentially worsen, should countries and organisations not plan effectively to deal with the global crisis.

As such, Renergen has since opted to implement measures from March 18, post period-end, with non-essential staff placed on special leave and all meetings moved to digital platforms to reduce contact.

While the virus has not yet resulted in any substantial delays to either the fabrication of the liquefaction equipment, nor to the construction of the pipeline, Renergen noted that from a local economic perspective, South Africa’s energy landscape remains constrained and a top priority for many companies in the country.

In this regard, with the announcement of a Carbon Tax during the financial year and the new Integrated Resource Plan (IRP 2019), Renergen noted that this positions the company “front and centre of an “enormous opportunity”, which will play an important role in how it develops Phase 2 of the Virginia project.

FINANCIAL REVIEW

At the end of the financial year, Renergen had a cash balance of R141-million, with the group’s property plant and equipment increasing by 828% to R350.8-million as a result of construction starting on the new LNG and liquefied helium plant in September 2019, as well as the acquisition of the farm on which the plant operates.

Phase 1’s plant will be built on the same farm, where the land was revalued at year-end, subsequently resulting in revaluation reserves being recognised in financial statements.

With Tetra4’s drilling campaign starting in September 2019, it increased the company’s intangible assets by 27% to R89.2-million.

During the period, Tetra4 also concluded a $40-million finance agreement with Overseas Public Investment Corporation (Opic), now known as US International Development Finance Corporation (DFC), during August 2019 to spend towards the LNG and liquefied helium plants.

About $20-million of this facility was drawn down in September 2019, increasing the group’s financial liabilities by 787% to R351.2-million. The loan has a three-year capital repayment grace period, with the first capital repayment in August 2022.

Renergen also listed on the ASX in June 2019, raising A$10-million at the initial public offering (IPO) and raising a further A$5.7-million in January.

As a result, the group’s stated capital increased by 50% to R452.3-million.

On listing on ASX, Renergen granted options with a fair value of R6.3-million to the ASX listing transaction advisers - the options can only be exercised four years from the grant date.

This has been accounted for in the share-based payment reserves.

Overall, Renergen’s revenue decreased by 13% to R2.6-million as a result of the five-month-long Association of Mine Workers and Construction Union (AMCU) strike in Virginia, which saw a decrease in compressed natural gas (CNG) sales volumes in the first quarter of the financial year.

PROJECT UPDATE

Renergen’s Megabus project continues to operate on a stable basis, supplying gas to the ten buses, which have now travelled in excess of two-million kilometres combined and have saved about three-million kilograms of carbon dioxide (CO2).

Renergen subsequently scaled up the operation to include two shifts in preparation to service the Black Knight CNG contract.

The CNG dispenser and additional CNG trailer were commissioned and the operation is to commence shortly as our customer finalises its last remaining processes.

Further, Renergen continues to enjoy good prospects on the Evander field and is proceeding with the necessary steps to bring this field into production.

Overall, the company indicated that it “continues to be an attractive investment to shareholders”, particularly as it participates in two important commodities that are in short supply locally, in the form of natural gas, and globally strategic in the form of helium.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation