South African budget eyed by investors for further reform steps

The new South African coalition government’s resolve to control debt and expedite reforms to fire up the lackluster economy will be put to the test when it unveils its first budget on Wednesday.

Finance Minister Enoch Godongwana’s mid-term policy statement will provide an early glimpse at the priorities of the alliance forged between the African National Congress, the business-friendly Democratic Alliance and eight smaller rivals after elections in May failed to produce an outright winner.

The new administration’s pledge to prioritize growing the economy has driven a 4% gain in the rand, helped local-currency bonds outpace all peers in an emerging-market index and fueled successive record highs on the Johannesburg Stock Exchange over the past four months.

Investors now want to see the government take real action, such as fixing logistical bottlenecks and boosting local government capacity, before they consider sinking significant amounts of capital into the country, said Casey Sprake, investment analyst for fixed income at Anchor Capital.

“We’ve got the sentiment; it’s been priced in within the markets and we reached a point we never thought we would get within our political space,” she said. “We need to see tangible reforms. We need to see this over a period of time and not just this flash in the pan.”

Gross domestic product has averaged less than 1% over the past decade, insufficient to keep pace with population growth, and the central bank says a recovery needs to be underpinned by a sustained increase in real net investment following years of decline.

The National Treasury is expected to revise its growth forecasts to 1.8% next year and 2% in 2026, compared with its February estimates of 1.6% and 1.8%, the median estimate of 15 economists polled by Bloomberg shows.

The country has had an uninterrupted power supply for the past seven months following years of rolling blackouts, the main contributor to the improved outlook. Pension reforms have also been introduced that allow individuals early access to part of their retirement savings, which along with lower interest rates should boost spending.

“It’s certainly not unreasonable to assume that growth is going to look healthier going forward because of the electricity situation,” said Razia Khan, chief economist for Africa and the Middle East at Standard Chartered Bank. This and a lift in consumption, will provide needed “wiggle room” for the minister, she said.

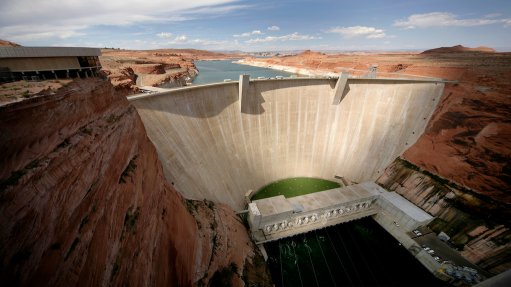

The government is also looking to bolster output by modernizing and expanding the energy, rail, port and water supply networks, with President Cyril Ramaphosa vowing to turn the country into a construction site.

Godongwana will shed some light on how that ambition will be financed as he will have little room to maneuver if he is to meet his commitment to curtail debt and the budget deficit. The government has said it will launch a credit-guarantee facility to boost private-sector involvement and more details are expected to be revealed in the budget.

“Ultimately, the bottom line for infrastructure spend is that a lot of it has to come from the private sector,” said Sanisha Packirisamy, an economist at Momentum Investments. “There’s not really all that much space in the fiscus” to build these massive infrastructure projects, she said.

The ratio of debt to GDP is expected to peak in 2025-26 and the consolidated budget deficit is likely to reach 4.5% of GDP in the year through March 2025 — in line with Treasury’s targets, the economists’ survey showed.

Godongwana tapped R100-billion from the country’s contingency reserves this fiscal year to pay back borrowing, helping keep debt and new loans in check.

Without the drawdown, this year’s deficit would have most likely widened and the “government would have had to increase its bond financing,” said Investec Bank Treasury Economist Tertia Jacobs. “It actually helped to stabilize the fiscal position in the context of fiscal consolidation.”

In February, the Treasury said it planned to introduce a binding fiscal anchor to provide a sustainable long-term path for public finances, without providing details or a time frame. The ANC, the largest party in the ruling coalition, opposes the idea, Johannesburg’s Business Day newspaper reported on Monday.

Still, with state finances under pressure as cash-strapped state companies seek further bailouts and civil servants demanding inflation-beating pay increases, Godongwana needs to show the nation is on a “corrective fiscal path,” Khan said. “The easiest way to do that might be the adoption of a fiscal rule.”

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation