Weekly Commodities Market Wrap

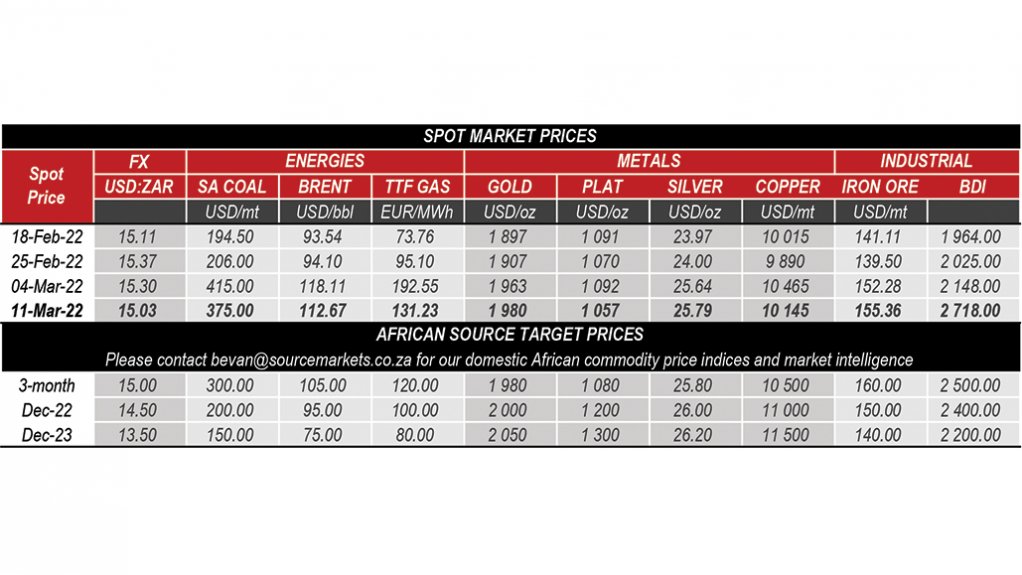

ENERGIES - Coal markets had a wild ride last week, with Richards Bay Coal Terminal physical prices reaching a high of around $450/mt, before coming back down to around $380.

As we said previously, this was likely to be the high water mark with the most desperate utilities covering in the spot market. However, the back end of the curve still remains well bid, even as paper traders rolled their time spreads further out, contributing to the steeper backwardation.

Both oil and gas have also retreated from their panic-induced highs. We are likely to see prices stabilise around the classic 50% retracement of the recent spike move. For South African coal this implies a still incredible price of some $300 for now.

METALS - The big news was obviously the halting of trading in the London Metal Exchange's nickel contract, thanks to a short consumer-based squeeze. The question remains whether the banks (JP Morgan and China Construction Bank) are going to take the hit if their Chinese client defaults, or whether Xiang Guangda will be able to post the margin and retain his shorts, which he has indicated he would like to do.

Meanwhile, most three-month base metal contracts are trading at a small premium to cash, highlighting the expectation of further supply chain constraints to come. Silver, lithium and cobalt continue to outperform most other metals.

Gold and platinum remain in contango with spot prices having come off substantially as the shock effect of the Ukraine invasion wears off.

INDUSTRIALS - Both iron-ore and steel prices have retreated from their highs as consumers take pause and re-assess demand. Scrap prices are better bid across the curve as spot retreats. European steel remains most constrained with three-month pricing trading at a premium, whilst Asian markets appear less perturbed.

Freight indices are up in general, with the Atlantic continuing to see strong demand versus Pacific cargoes. A rewiring of available front and back-hauls is underway which will impact on available ships that can meet European Union standards.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation