Anglo American’s capex investment set to continue – Fitch Solutions

Diversified miner Anglo American will continue its capital expenditure to broaden its platinum group metals (PGMs) capabilities, while growing its sustainable capabilities at mines, Fitch Group unit Fitch Solutions Country Risk and Industry Research states in a new report.

Fitch Solutions says Anglo’s focus to expand production on key commodities – particularly copper and PGMs – will ensure strong revenues in 2023.

However, the research unit points out that rising input costs, energy prices and climate issues will put a ceiling on production in the near term.

STRENGTHS

Fitch Solutions outlines that Anglo has limited operational risk exposure owing to considerable geographical diversification.

It also highlights Anglo’s diversified mining portfolio, which leaves the group relatively insulated from fluctuations in the price of one commodity.

Further, among the major diversified mining companies, Anglo is the least exposed to a sharp slowdown in Chinese fixed asset investment given it relies on iron-ore less than its competitors do, Fitch Solutions states.

OPPORTUNITIES

Fitch Solutions says that continued asset sales, combined with strong operating performance in most segments, provides resilience through global macroeconomic headwinds.

It also highlights that multiple partnerships and projects dedicated to hydrogen could position the firm as a mining leader in terms of green hydrogen use.

WEAKNESSES

Fitch Solutions outlines a lack of vertical integration, compared with Rio Tinto and BHP Billiton, as a weakness, noting that Anglo possesses little of its own energy assets.

It also notes that its significant presence in South Africa increases operating risk owing to anticipated industrial unrest and rising costs over the coming quarters.

THREATS

A class action law suit filed against Anglo regarding the alleged mass lead poisoning of children and women of childbearing age in Kabwe, Zambia, will also present reputation risks, Fitch Solutions points out.

COMPANY STRATEGY

Fitch Solutions posits that Anglo’s competitive asset portfolio will support its growth potential.

Anglo boasts a diversified mineral portfolio, maintaining leading positions in diamond and PGMs production. At the same time, the firm’s copper operations continue to demonstrate substantial growth and cost efficiency, which will bode well for the firm in the coming years, the research unit indicates.

Anglo’s Quellaveco project announced the start of commercial operations in September 2022.

Anglo is also bolstering exploration expenditure, primarily within its PGMs and base metal groups. This continued investment pipeline into exploration would help it maintain its competitive portfolio for these critical minerals, Fitch Solutions says.

Anglo’s platinum production growth will benefit in the long term from increasing demand driven by air quality and emissions concerns, the unit notes.

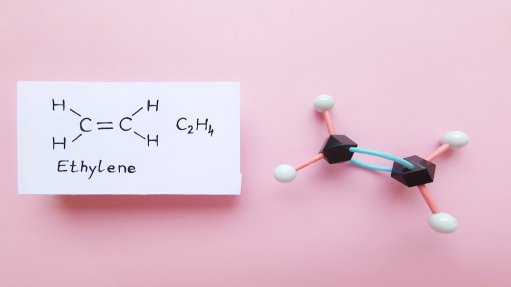

PGMs are used in hydrogen fuel cells in the transportation sector, and an increasing shift towards hydrogen as a clean fuel source will bolster demand for PGMs, benefiting output.

Accordingly, Anglo expects production of platinum and palladium to continue growth this year.

Fitch Solutions says Anglo’s strong margins will further underpin its financial performance in a post-Covid-19 operating environment.

Looking ahead, consensus estimates suggest capital expenditure of $6.5-billion in 2022 and $6.4-billion this year, up considerably on pre-pandemic figures of $3.4-billion and $4.7-billion in 2018 and 2019 and above the $5.7-billion spent in 2021.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation