Energy transition needs investment of a further $304-trillion, Glencore calculates

Mining Weekly's video coverage of Glencore Capital Day by Darlene Creamer.

Clean energy investment.

Clean energy metals.

Mutanda Mining in Africa's Democratic Republic of Congo.

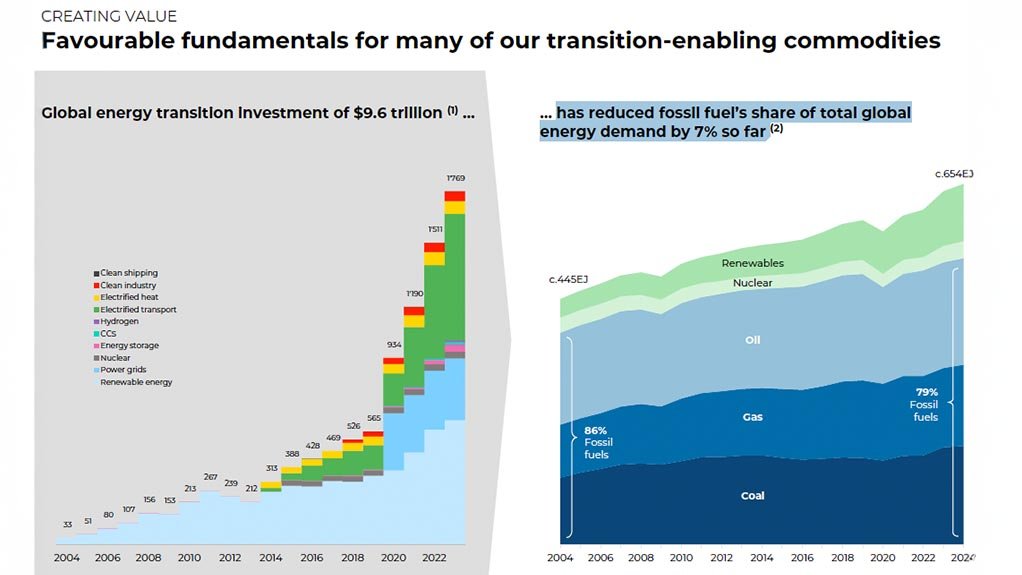

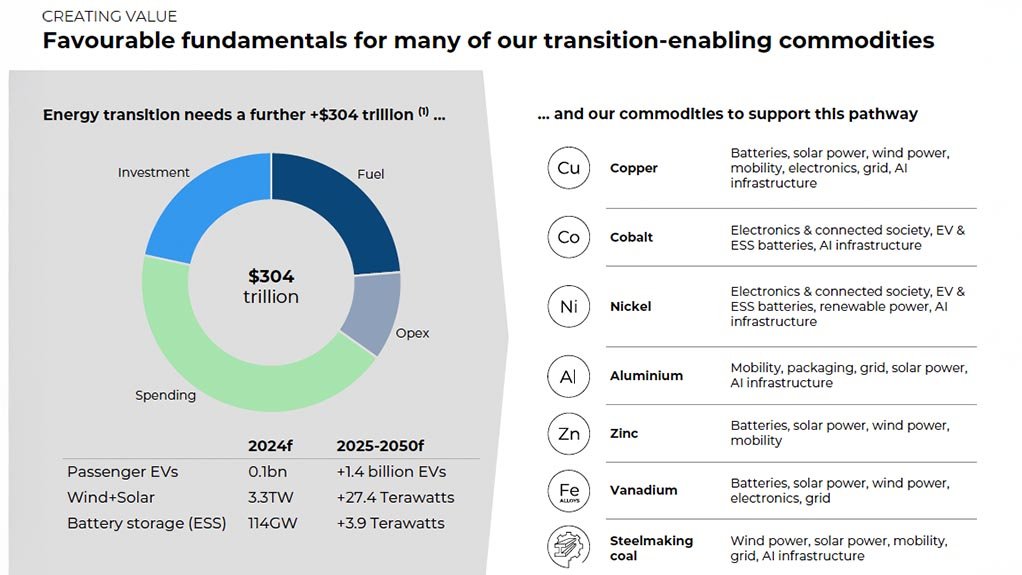

JOHANNESBURG (miningweekly.com) – The global energy transition needs investment of a further $304-trillion, Glencore CEO Gary Nagle pointed out during the Johannesburg Stock Exchange-listed diversified mining and marketing company’s Capital Markets Day 2025.

The global energy transition investment of $9.6-trillion made so far has reduced fossil fuel’s share of global demand by 7%, Nagle reported. (Also watch attached Creamer Media video.)

The Glencore commodities to support the pathway requiring that further $304-trillion investment were displayed on a slide that listed copper, cobalt, nickel, aluminium, zinc, vanadium and steelmaking coal – metals used in items including batteries, solar power, wind power, electric vehicle mobility, electronics, grid, AI infrastructure and packaging.

The big focus of the day was on copper, with Glencore emphasising the global need for significant supply growth and investment.

“Now today, in copper, we’re producing about 850 000 t of copper this year, rebasing back up to a million tons of base copper production, as we were few years ago. And then the growth beyond that is really going to be big,” Nagle pointed out during the event covered by Mining Weekly.

Highlighted was a portfolio of ten copper growth options capable of increasing Glencore copper production to a level of 1.4-million tonnes of copper a year from mines including Mutanda Mining in the Democratic Republic of Congo, Coroccohuayco and Antapaccay in Peru, and Collahuasi in Chile, to name a few.

Its base copper portfolio is sufficient to return Glencore to one-million tons a year by 2028 and a growth pipeline targeting 1.6-million tonnes a year by 2035.

Nine of the ten growth options in the pipeline are brownfield, capital efficient opportunities.

A slide displayed showed Glencore as a big-five copper producer by 2029 and potentially the world’s biggest by 2035 with a projected first-quartile total cash cost position.

Then, moving to fossil fuel, Nagle described coal as continuing to be “a key part of our business”.

On why it retains coal and why Glencore needs coal, Nagle explained that it was not only because shareholders said the company should retain coal. “We believe we should keep coal. It makes a lot of sense to keep coal.

“Look, if shareholders change their minds and don't want to keep coal, we can always relook at it. But as we sit today, we believe there's a strong case for particularly high-quality energy coal for many decades to come,” Nagle said, while pointing out that coal was a major generator to cashflow even in low coal price environments.

Overall, Glencore has delivered more than $25-billion over the last five years to shareholders and believes with the market and the business set up like it is, it will be able to continue to provide good returns.

While Glencore is feeding the global energy transition with the copper, cobalt, nickel, zinc, and lithium, which it mines and trade, this is taking place amid fossil fuels losing 7% of the market share over 20 years, since 2004.

“That's true, but the world has spent nearly $10-trillion on the energy transition, and the use of fossil fuels has gone down from 85% to 79%. That's all that $10-trillion has managed to achieve, and when you look at it in absolute terms, the pie has grown.

“In fact, the use of absolute units of fossil fuels has gone up from 2004 to 2024 and thinking forward, you want to go build a nuclear power station today, we know Hinkley Point, here in the UK, is 20 years away, at least.

“If you want to build a gas-fired power station, you’ve got a five-year waiting time for a gas turbine.

“So, the need for fossil fuels, in particular high-quality steam coal in today's world is absolutely required, and that's where our strong conviction is that the demand for fossil fuels, in particular coal, will remain for a period to come.

“Going forward, that $10-trillion to be able to achieve what the world says they need to achieve, is, all of a sudden, $300-trillion, which is how much needs to be spent on the energy transition.

“We've all been seeing the numbers, the number of passenger vehicles, the number of solar panels, the number of wind turbines, whatever it may be, these need the commodities that we have.

“It cannot happen without the copper, the cobalt, the nickel, the aluminium, zinc, vanadium, and even steel-making coal and when you see that kind of spend to come, the need for these is absolutely critical,” Nagle emphasised.

On the copper demand outlook, Glencore intends feeding tons into a growing deficit to allow the company to maximise value from its existing business base and from projects.

What has given comfort is that the copper price is beginning to reflect the oncoming copper deficit. Since the middle of 2024, copper prices have risen higher every year. Price spikes, which might be unnatural, are disliked but continual rises to the likes of $12 000/t, $13 000/t, $14 000/t are winning project response, "because you don't turn on a copper mine in five minutes. It does take time".

“Since April 24, we've started seeing a trend change and a step change in copper pricing, and over that period, we've seen buyers getting used to it. We don’t see much demand destruction, we don’t see buyer strikes.

“That's giving us the comfort to say that now is the time to sanction these projects. The copper from these projects can come into the market and not cannibalize our existing projects and continue to feed into the deficit,” Nagle explained as the company proceeded on a pathway to produce one-million tonnes of copper by 2028 and targeted the production of 1.6-million tons of copper by 2035

Expected is a 4% overall annual compound growth rate in copper equivalent production from 2026 level to 2029, with copper production itself expected to grow at 9.4% over this period.

Its copper projects are mostly brownfield and expected to be highly capital efficient. "We have a clear pathway for our base copper business to exceed one-million tonnes of annual production by the end of 2028, with a target to produce 1.6-million tonnes by 2035, which would make Glencore one of the largest copper producers in the world."

While steps on this journey have already been taken, coal is supporting the energy and infrastructure needs of today and tomorrow, while the distinctive marketing business continues to perform.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation