Platinum-enabled green molecules offering inviting green electron value-add – Nedbank

Nedbank CIB's Mike Peo interviewed by Mining Weekly's Martin Creamer. Video: Shadwyn Dickinson.

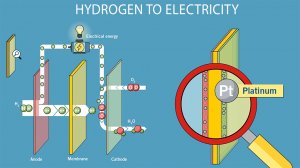

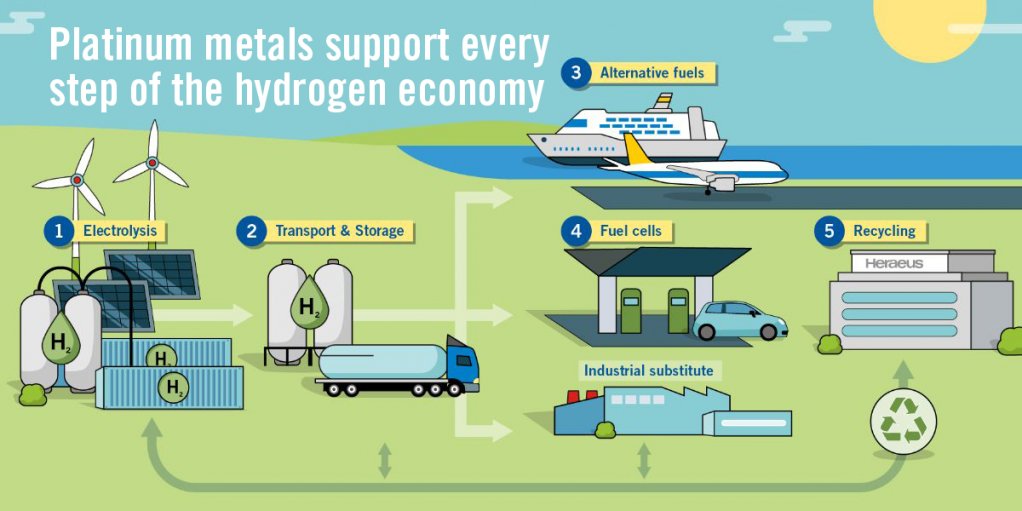

Platinum group metals support every step of the green hydrogen economy from electrolysis to recycling.

Photo by Heraeus

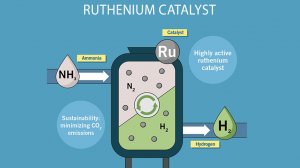

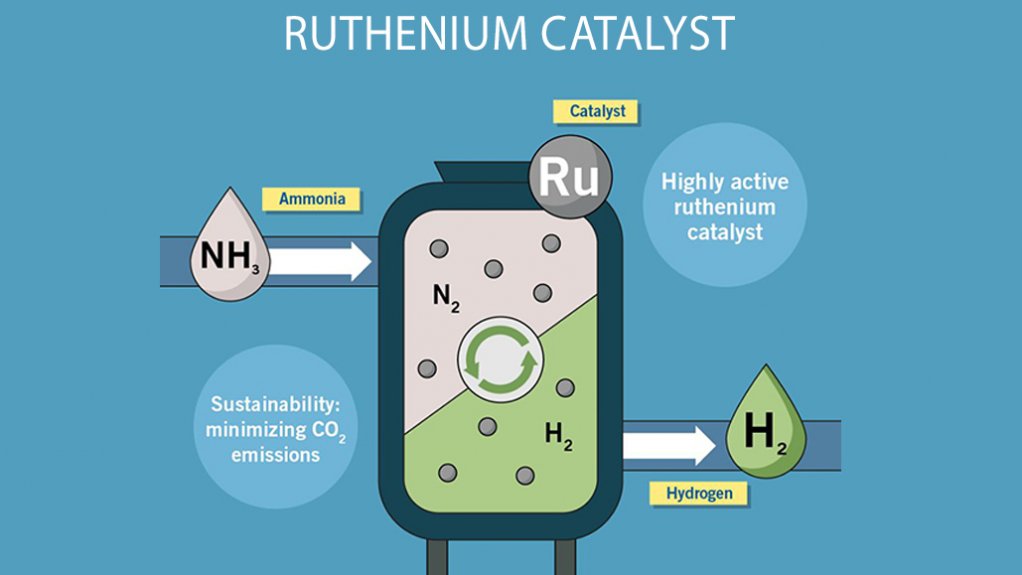

In an ammonia cracking reactor, the hydrogen stored in the ammonia is regained through ruthenium catalysis.

Photo by Heraeus

Nedbank CIB Head of Infrastructure, Energy and Telecommunications Mike Peo.

Photo by Creamer Media

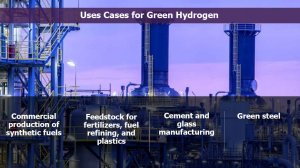

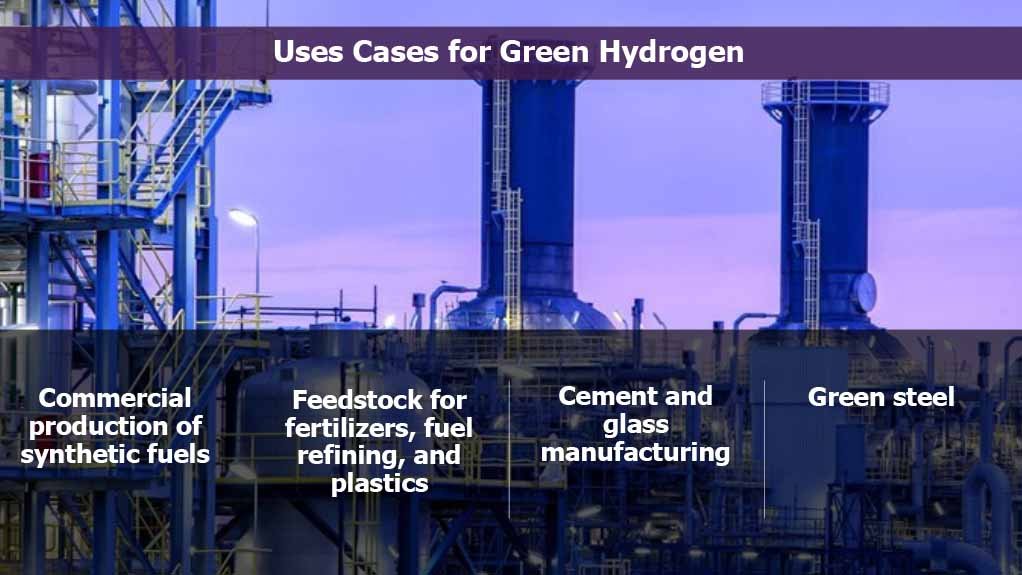

Green hydrogen crosses many industrial paths.

Photo by CHIETA

The 17 future skills needed for green hydrogen economy.

Photo by CHIETA

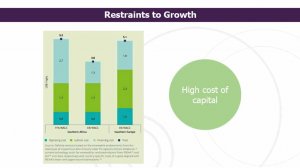

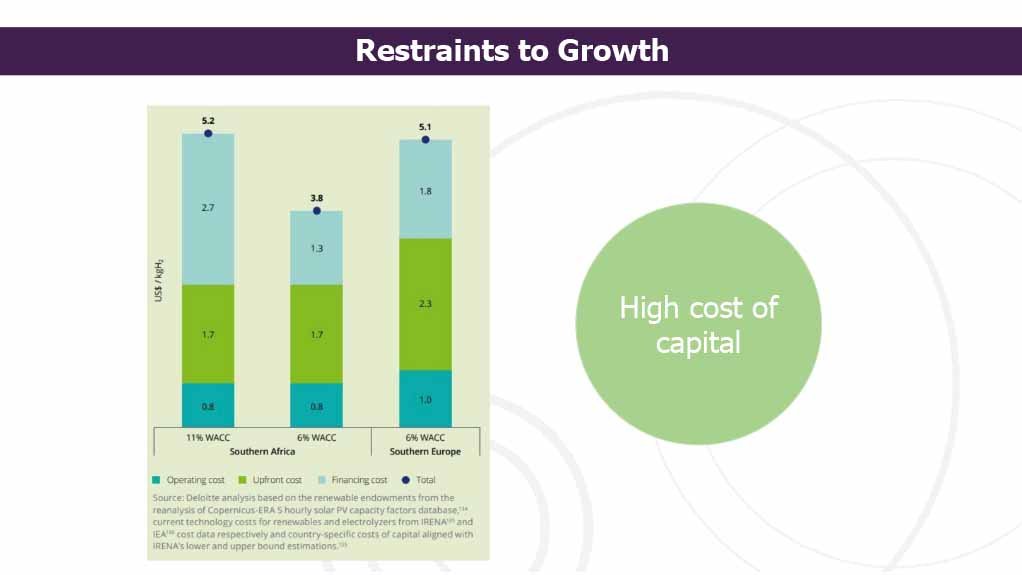

High cost of capital is restraint being challenged.

Photo by CHIETA

South Africa's 13-million tonne green hydrogen potential.

Photo by CHIETA

JOHANNESBURG (miningweekly.com) – It’s no longer good enough to just produce electric vehicles (EVs). You have to produce green EVs, and to do that, you need green steel. To get green steel, you need the green molecules that green hydrogen provides.

To get the green hydrogen, you need green electrons from sun and wind renewable energy to power water electrolysis, and the most efficient way of obtaining green hydrogen from the water is to deploy proton exchange membrane (PEM) electrolysers that are catalysed by platinum group metals (PGMs), which South Africa hosts in overwhelming abundance.

Furthermore, hydrogen fuel cells, which are again catalysed by PGMs, beckon as an inviting value-add to South Africa's essential re-industrialisation to meet its net-zero contribution under the Paris Accord.

To contribute at the level that meets our national obligation, South Africa must build somewhere in the region of 30 GW of renewable energy between now and 2030.

While South Africa is experiencing an exceedingly buoyant market in procuring that renewable energy, the scale at which it is now required to ramp up is fairly massive – but that ramping up to the required level opens the door to the development of inviting new green hydrogen and green ammonia industrialisation channels.

Very fortunate for South Africa is that a world-class green hydrogen and green ammonia project is already at an exceedingly advanced stage of conceptualisation and planning at Coega, in the Eastern Cape – the well-led Hive project – and this presents the opportunity to create a key initial hydrogen valley kickstart, in the same way that the $10-billion Hyphen protect is initiating a green hydrogen advance in Namibia.

“The opportunities are almost limitless,” was the comment of Nedbank Corporate and Investment Banking (CIB) head of infrastructure, energy and telecommunications Mike Peo when he spoke to Mining Weekly in a Zoom interview ahead of Nedbank's far-reaching Green Hydrogen Roundtable, which outlined the 17 skills required for the green hydrogen economy and the steps already being taken by South Africa's Department of Higher Education and Training and sector education and training authorities (Setas) to provide the necessary skills. (Also watch attached Creamer Media video.)

South Africa stands to gain so much if it takes up the hugely rewarding collective green electron and green molecule opportunity – and to lose so much if it fails to do so.

For instance, if it fails to take up the opportunity, even continuing to export local product to particularly Europe will be hit by cross-border tariffs.

Supply chains will thus have to go green not only to keep the country moving forward, but to stop it from sliding dangerously backwards.

Encouragingly, at the green electron end, the private sector is procuring renewable energy on a very substantial scale. But there still needs to be far greater realisation by all stakeholders of the huge re-industrialising potential at the green molecule end – and how this can assist in enabling the creation of more jobs than decarbonisation displaces.

The focus must be on how to decarbonise in a just and fair way, with the just energy transition embedded into the net-zero targets across the broadest of fronts.

HUGE FINANCE CHALLENGE

A huge challenge of the green energy transition is finance. None on the continent of Africa has the ability to match the billions of dollars that, for example, the US is providing to incentivise the generation of green electrons and green molecules.

As a result, Southern Africa's cost of capital is relatively expensive and for this reason, Nedbank CIB in particular is working with global development finance institutions as well as countries intent on importing their climate obligations and in doing so, pay on the buy side by buying green fuels from South Africa.

“We’re hoping that creates the same sort of offsets as the big subsidies being seen in Australia, for example, and the United States,” explained Peo, to whom Mining Weekly put these questions:

Why has Nedbank chosen to focus on green hydrogen, and what role do you see green hydrogen playing in the bank's sustainability goals?

Nedbank has always positioned itself as the green bank and we have been actively involved in the renewable energy sector. Over the past 15 years, we have played a major role in lending money to renewable energy projects, which have gone through ups and downs. By and large, South Africa is procuring a huge amount of renewable energy, but to achieve our obligations and our net-zero targets under various Paris Accords, we’ve got to increase the game very substantially. Just as an example, to meet our national development contributor obligations, South Africa needs to build somewhere in the region of 30 GW of renewable energy between now and 2030 - not a very long time. While we are seeing a very buoyant market procuring that energy, the scale at which it has to ramp up is fairly massive, and green hydrogen and green ammonia present an opportunity to start creating new channels for re-industrialisation. In my personal opinion, we’ll never reach the net-zero target pathways without going through a massive transition. We’ve got to decarbonise old coal-based power stations, transition them through some other fuel, and come out on the end with a cleaner fuel source. Right now, we think green hydrogen, green ammonia and a variety of their byproducts present that opportunity. We have a massive mining sector that can, for example, utilise platinum fuel cell vehicles, and really I think the opportunity is ours to meet these climate obligations and to create jobs while we’re going there.

With Nedbank's investment in green hydrogen, what immediate economic benefits do you foresee for South Africa, especially considering the current economic challenges?

The obvious one is that we’re going to be building new renewable energy. We’re going to slowly but surely be replacing coal-fired power stations, replacing dirty electrons with clean electrons. The rush to building these projects is not super-efficient right now. We are largely procuring wind projects, photovoltaic solar projects. We need batteries in the mix, we need to balance our grid, but then to also use those electrons to promote industries. South Africa has got a great motor manufacturing industry down in the Eastern Cape. Those vehicles are largely exported and to keep exporting them, we are going to need to make green electric vehicles as well. So, the potential uses for these green electrons transcends just purely having more power on the grid and having more power available. Also, if we want to continuously export fruit products into, for example, Europe, the procurement supply chain needs to be green, right through the supply chain. The heating and the cooling needs to be run off green electrons as well.

You've mentioned creating new job opportunities through green hydrogen initiatives. What specific skills is the country looking to develop, and how is Nedbank supporting this?

This is a much more complicated conversation because the amount of training is massive but there are a number of massive initiatives under way. Our webinar featured how some of the industry segments have started creating their own job opportunities. Training and reskilling is absolutely fundamental. We have a couple of really good examples globally where countries have created green hydrogen valleys in which green electrons are brought and all the supply infrastructure is created in one area so that multiple industries can tap into it. Simultaneously, the easiest way to start upskilling is to connect with the universities in those areas and get them developing programmes beyond the electrical, mechanical and chemical engineering skills that are needed for all of the jobs in the supply chain. The Eastern Cape just happens to be doing an incredibly good job and we are seeing people now consciously saying we have to build the skills simultaneously. We have very good technical skills. Many of the companies which have been developing big renewable energy projects over the last 15 years have set up training centres to train electrical engineers et cetera. Now we’re seeing that broadening very dramatically and we’re seeing the public sector, the Department of Higher Education and the Setas getting involved in deciding on the type of training that is needed to deliver this new opportunity from a skillset perspective.

How do you envision the switch to green hydrogen benefiting local communities, particularly those reliant on traditional energy sectors?

This is also a very long journey because one of the unfortunate consequences of our energy transition is that we are going to move away from areas of the Highveld around certain of the coal-mining industries where the natural endowments of sun and wind may not be as good as in the Eastern Cape, Northern Cape and Western Cape. Those communities are going to have to be reskilled for new jobs and possibly be relocated. It is quite a delicate balance now but there is sometimes a naïve belief that we will just kill those jobs. The ability to reindustrialise South Africa should create more jobs than we are going to displace. The issue will be how to do it on a just, fair basis, so the just energy transition is very hard-coded into the net-zero targets and it will not just be a switch-off on one side and a switch-on on the other side. There is going to have to be a fairly long and hard transformation programme to reskill and relocate people into areas so that there is no net job loss.

Green hydrogen is seen as a key player in South Africa's reindustrialisation. Can you elaborate on how this might transform South Africa's industrial landscape and what sectors could benefit the most?

We have a number of very hard-to-abate industries so the blending of things like ammonia into current fuel mixes is where we will lead from. I have a feeling that we will seriously start off by exporting green ammonia, the obvious opportunity to prove up massive-scale, new $5-billion manufacturing plants. Right now, the business case is the export of green ammonia. However, in the agricultural sector we are already seeing people converting ammonia production facilities into green ammonia production facilities to enable them to be able to continuously export whatever they are using the fertiliser for to, in particular, Europe. Greening is also happening across the steel sector, across the motor manufacturing sector. It's not good enough anymore to produce an electric vehicle. It’s got to be a green electric vehicle, so we need green steel. In many of the mining sectors, the use of hydrogen fuel cells in major-scale mining equipment is becoming very relevant. Namibia is now going to run two trainsets using hydrogen fuel cells. The United Kingdom is running bus systems using hydrogen fuel cells, so the opportunities are almost limitless. As it becomes more mainstream, those costs are going to come down and become more generally efficient and acceptable.

What are the biggest hurdles anticipated in transitioning from fossil fuels to green hydrogen, and how is the sector planning to scale these hurdles?

The two biggest hurdles we face as a country are the transformation of Eskom’s coal-fired power stations and Sasol’s synfuels business where coal is burnt. The various hydrogen-related products and byproducts present that opportunity right now. There is work that is going to have to happen. As we build more renewables, we need to do a huge amount of work on electricity transmission grid strengthening. Much has been published on the efforts being made to allow the private sector to finance grid and the work that Eskom is doing to enhance grid. The big challenge is that we need the right grid to be able to manage these new electron pools. The other very big challenge is our cost of capital. We compete with countries that are providing huge amounts of subsidies to their green industries. They have billions of dollars that are being paid to subsidise renewables. Nobody else on the continent of Africa has the ability to provide those kinds of subsidies, and our cost of capital is relatively expensive. So, we're working fairly extensively with global development finance institutions et cetera. where countries like Germany and Japan are going to import their climate obligations. They will pay on the buy side by buying fuels from South Africa. We’re hoping that creates the same sort of offset to the big subsidies that we're seeing in Australia, for example, and the United States.

Considering the global shift towards cleaner energy solutions, where does South Africa stand internationally in the hydrogen economy, and what can we learn from other countries' experiences?

We have joined the race fairly early. The government, through the Department of Trade, Industry and Competition (dtic) and institutions like the Industrial Development Corporation (IDC), has formulated plans. Often we’ve been very bad at getting plans out. Our White Papers on telecommunications and mining have tended to be a bit slow. Here, we are at the forefront. We do need to see more commitment from government to say we have an industrial plan, what are we doing about it. My criticisms would be that we’ve seen countries like Namibia, virtually on a monthly basis, promoting as a country what is happening. The Hyphen project, for example, is moving well. We see the President of Namibia standing outside with wind masts and so on, they are doing a very good job of marketing the fact that Namibia is open for business in the green hydrogen, green ammonia world. We, again, are facing the challenges of dealing with the energy transition but we’ve got to ensure that the green hydrogen transformation is at the forefront of that particular agenda as well, and that we don’t just focus on building more renewables and transmission networks. This pathway of green hydrogen production and green ammonia production creates an amazing opportunity to say we're getting things right while building. There's also a bit of a fallacy sometimes saying it’s not really great to be exporting electrons during the energy crisis we’re in. I think that’s a little bit of a naïve view. The two happen in parallel. For example, if the Eastern Cape becomes a hub, it’s very easy for us to unlock gigawatts of electrons into the Eastern Cape. Many of those gigawatts may go to running one single plant, but the remaining gigawatts then go out to the motor industry, the cities, hospitals, and schools in those areas as well. It’s a very symbiotic relationship to be building things like hydrogen valleys, which will support the re-industrialisation opportunity.

Looking towards the future, how does Nedbank plan to expand its support for green hydrogen initiatives? Are there any specific projects or partnerships that you can share with us?

Thankfully, it’s a very natural extension of the work we’ve already been doing. We have a really brilliant sector specialist team that has been at the forefront of financing renewable energy for the last 20 years. We know how to finance wind. We know how to finance PV. We know how to finance batteries, so the natural extension is just the industrial piece that has to be built. But, again, ironically, the industrial piece is not that complicated. Electrolysers have been around forever, people have produced ammonia forever. We’re just taking it up to a different scale now. What we're doing is planning to scale up. The big difference is that the size and the cost of these big investments is going to be in scales of billions of US dollars, so increasingly we're forming clubs with international development institutions such as the World Bank, the big German and European development finance banks, and putting together clubs that will be capable of financing these very big-scale projects. On top of that, we're building the team so that they have the technical skills and knowledge and people understand the risks and the structuring of these new projects.

Finally, what, in your view, should be the biggest takeaway from this interview?

The principles are very similar to building toll roads and everything else. We need policy certainty. We then need regulatory frameworks and we need bankable projects. By and large, we’re now seeing the private sector bringing those bankable projects. The regulatory piece is not too bad but we need the policy support. The dtic and IDC are developing frameworks, but we really need to see that being publicised much more. We need the government to be doing the right marketing job of creating the attractive environment for people to come and develop projects in South Africa.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation