HVACR industry at a turning point

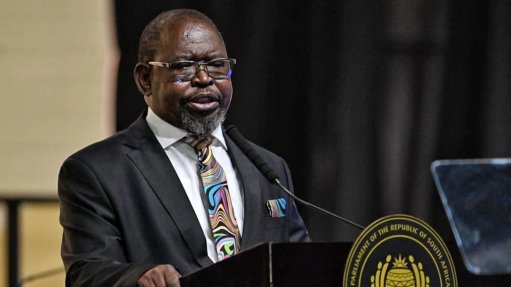

KOEN VAN WYNENDAELE Before the Covid-19 outbreak, the industry in general was under pressure owing to a sluggish economy with limited to no growth, a difficult political climate and a tough investment climate

The heating, ventilation, air-conditioning and refrigeration (HVACR) industry is at a turning point and it is up to all the innovators in the industry to take the lead and set a new standard for South Africa, multinational air-conditioning manufacturing company Daikin South Africa MD Koen Van Wynendaele tells Engineering News.

“Before the Covid-19 outbreak, the industry in general was under pressure owing to a sluggish economy with limited to no growth, a difficult political climate and a tough investment climate.”

In addition to this, he points out that the Covid-19 pandemic has further added to the industry’s pressures, in the form of price fighting, bankruptcy, problematic money collection, but worst of all, a short-sighted market predominantly focused on capital investment and less on energy efficiency or quality.

Van Wynendaele highlights that, owing to this, the innovators in the industry should take the lead and set a new standard for South Africa.

He believes that Daikin South Africa is in a good position to exploit the opportunities in the current downturn.

“Indoor air-quality awareness, whereby ventilation is seen as key to reduce contamination by the virus, is one opportunity that we are well positioned to grasp. This has already gained momentum, and we expect this trend to continue. Now is the moment to act as an innovator, rather than a follower, especially in terms of refrigerants and energy efficiencies,” he tells Engineering News.

The company has always been at the forefront in developing energy efficient solutions, he enthuses, adding that Daikin South Africa was the “first-to-market” in providing solutions based on the new R32 refrigerant – which is more efficient and better for the environment.

Daikin South Africa also plans to expand the scope of its business by entering into spheres such as refrigeration.

The company is transforming into a fully applied solutions provider and product developer, “with a clear focus on reducing our carbon footprint through different refrigerants and a particular focus on high energy efficiency”, Van Wynendaele points out.

In the longer term, he stresses that four factors need to be addressed to move the HVACR industry forward.

Firstly, although government’s stimulus plan is a step in the right direction, Van Wynendaele points out that it will not compensate for the economic damage caused by the lockdown; therefore, air quality must be prioritised now more than ever.

“As the virus will be around for the foreseeable future, governments should direct their stimulus packages to recovery plans that focus on green and sustainable transition for parts of the industry. Therefore, I believe the industry is in a transition phase. Daikin has been at the forefront in providing energy efficient and green solutions.”

Secondly, the industry has been focusing mainly on capital investment and less on energy efficiency and the durability and/or the quality of installations, he points out.

“In a crisis like this, our behaviour becomes illogical, and we tend to focus even more on the short term. We have a global commitment to reduce our overall carbon emissions and that should be a key priority.

“Knowing that we are operating in a country with electricity shortages, this is surely a missed opportunity, especially with regards to improving energy efficiency.”

Van Wynendaele notes that going forward, a different approach from government, with more stringent requirements towards minimum efficiencies, is required. This includes improved building standards as well as advisers and consultants in the industry paying more attention to these legalities to create awareness and insight into how the various technologies available in the market will support changes in the industry.

“I expect that the focus on operational excellence will increase by itself – driven by the strong recent increases in electricity prices and more predicted increases. This is particularly applicable to those applications with long running times such as process cooling, food retail and commercial air conditioning.”

Thirdly, Van Wynendaele advances that it has been confirmed by various independent organisations – such as the Federation of European Heating, Ventilation and Air Conditioning Associations – that the use or no use of conventional air-conditioning systems (recirculating room air units) does not pose a problem in terms of spreading Covid-19, as long as it is combined with sufficient ventilation.

In addition to ventilation, extra measures can be taken by using air cleaners or by implementing additional measures (such as ultraviolet lighting and filters) into the existing centralized ventilation systems.

Ventilation is, therefore, a key component in reducing transmission risks in indoor environments. As such, he underlines that better standards in terms of ventilation in buildings could support not only the industry in terms of business but also reduce transmission risks in terms of Covid-19 or any future similar virus.

The fourth aspect is that HVACR contractors, who are traditionally the direct customers for the company, often find themselves working with rock-bottom prices and under risky contracts.

Consequently, the contractors are facing a dilemma of either accepting work with difficult terms and consequently risking late or no payments or going out of business.

“Better understanding of the standard contracts used in the industry and a better relation between main contractor and subcontractor will be key in mitigating this. Organisations such as the Master Builders South Africa play a crucial role in ensuring that these situations improve.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation