Jindalee sells stake in Dynamic Metals for A$2.75m

Lithium-focused Jindalee Lithium has sold its shareholding in ASX-listed Dynamic Metals raising A$2.75-million before costs. The transaction aligns with Jindalee’s strategy to advance its McDermitt lithium project in the US while maintaining shareholder value.

Dynamic, previously a subsidiary of Jindalee, held the company’s Australian exploration assets before being spun out in January 2023 through a A$7-million initial public offering (IPO). The divestment leaves Jindalee as a pure-play US lithium company, solely focused on the McDermitt project in Oregon, one of the largest lithium deposits in the country.

The sale of Jindalee’s stake in Dynamic was facilitated by Argonaut Securities and involved multiple sophisticated and high-net-worth investors. Among them, Dynamic chairperson Justin Mannolini and nonexecutive director Lindsay Dudfield acquired 500 000 and 700 000 shares, respectively.

Jindalee CEO Ian Rodger said on Tuesday that the transaction supported the company’s goal of advancing McDermitt without excessive shareholder dilution. “At a time when many lithium companies are struggling to raise capital, Jindalee’s ability to unlock funding from a noncore asset enables us to accelerate project development in a less dilutive way,” he stated. “History shows that projects advanced during downturns are best positioned to capture the upswing, and with lithium prices at unsustainable levels, a supply crunch is inevitable.”

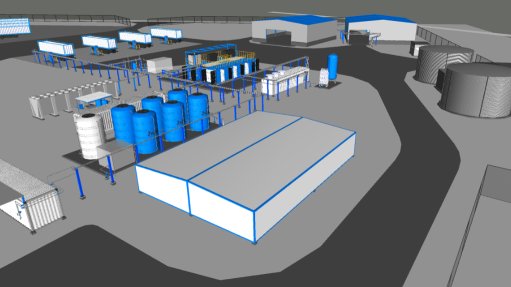

Proceeds from the sale will be directed toward engagement with potential funding partners and US government agencies, as well as project optimization, permitting, and community engagement efforts. Jindalee recently released a prefeasibility study on McDermitt, confirming a 63-year project life, projected production of 1.8-million tonnes of lithium carbonate, and a five-year payback period. The study also highlighted opportunities to reduce capital and operating costs while increasing production.

Meanwhile, Dynamic Metals remains focused on exploration in Western Australia, with immediate plans to drill-test the highly prospective Cognac West target. The company retains a strong financial position, with approximately A$5-million in cash and liquid investments.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation