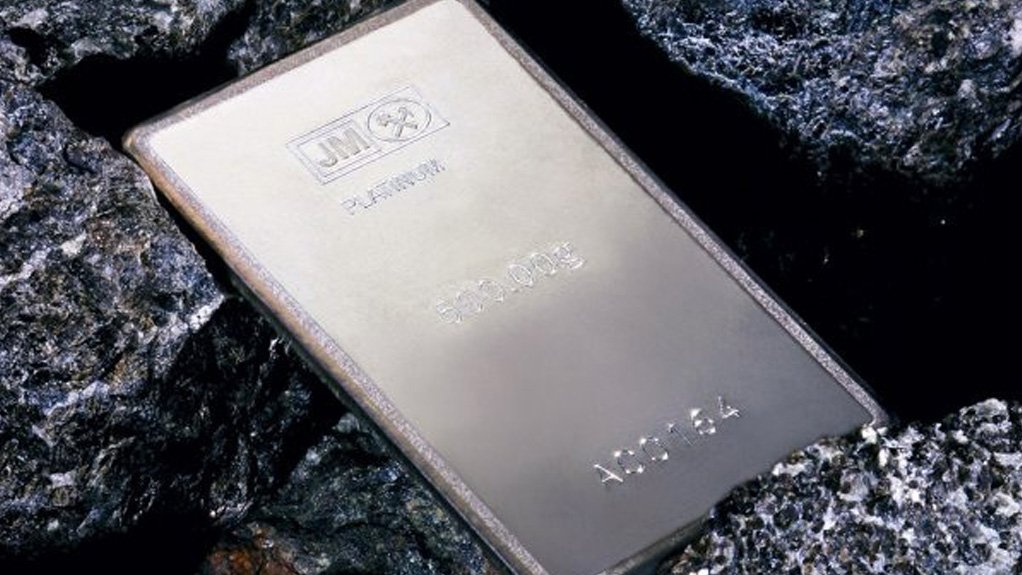

Johnson Matthey forecasts lower palladium, rhodium deficits, but larger platinum deficit

Chemicals and sustainable technologies provider Johnson Matthey says the palladium and rhodium markets are likely to record smaller deficits this year, while platinum is likely to record a deficit of 600 000 oz on the back of lower primary supplies.

It states in its latest yearly ‘PGM Market Report’ that an anticipated recovery in primary and secondary platinum group metal (PGM) production fell short of expectations in 2023.

“Plant maintenance and electricity shortages hampered efforts to reduce work-in-progress at South African smelters and refineries, while the number of end-of-life vehicles entering scrapyards continued to decline, reducing PGM recoveries from automotive scrap by about 14%.

“Despite heavy selling of Russian PGM into the Chinese market, combined primary and secondary supply of platinum and palladium rose only slightly, while rhodium supply declined,” Johnson Matthey states in the report.

Automotive demand, however, exceeded expectations, with global light vehicle production having surged by nearly 10% to 88.9-million units.

Johnson Matthey says industrial demand was relatively robust, with glass demand having significantly exceeded expectations.

Chemicals demand for platinum and palladium fell short of recent highs, but remained elevated by historical standards, but the consumption of PGMs in the electronics sector was weak.

The company reports that investment demand for platinum and palladium moved back into positive territory in 2023, while jewellery demand recorded only a modest decrease.

Johnson Matthey does not expect significant changes in combined primary and secondary PGM supply this year, with a modest reduction in Russian sales and flat South African shipments forecast. Small gains in North American output are also expected this year, although the constrained price environment is impacting on miners’ profitability.

Combined primary and secondary platinum supply is expected to reach 7.02-million ounces this year, while demand is forecast to reach 7.61-million ounces. This would result in a deficit of just under 600 000 oz, compared with a deficit of 518 000 oz in 2023.

Palladium supply is estimated to reach 9.37-million ounces this year, while demand is forecast at 9.73-million ounces, resulting in a deficit of 358 000 oz. This compares with a deficit of 1.02-million ounces in 2023.

The rhodium market is expected to record a deficit of 65 000 oz this year, compared with a deficit of 125 000 oz in 2023. Supply is forecast to reach 999 000 oz and demand 1.06-million ounces.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation