Mali mine set for fast-tracked development

HIGH VALUE Since the completion of a definitive feasibility study, Cora has updated Sanankoro’s estimates, with the latest figures showing over one-million ounces of gold in resources

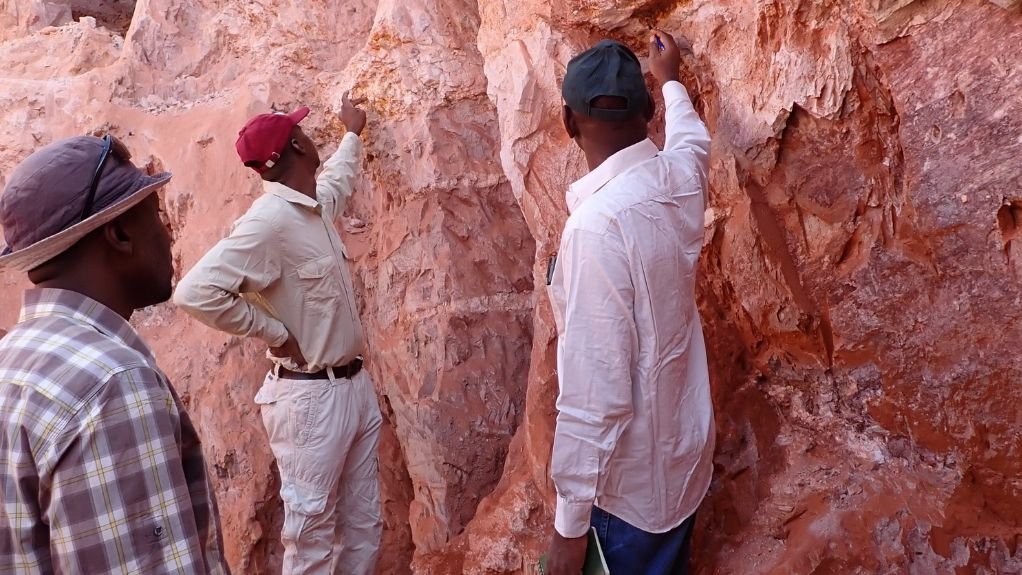

GOLD REGION West Africa is a well-known gold region, and Mali in particular, has a strong mining sector

Emerging West African gold developer Cora Gold is focusing on fast-tracking the construction of its flagship Sanankoro mine with the permitting, financing and technical updating of key works so that the mine can start construction as soon as possible.

Sanankoro, located in southern Mali’s Yanfolila gold belt, is central to Cora’s growth plans, with the company expediting the project as the gold price remains high, boosting the project’s financial potential.

Cora completed a definitive feasibility study (DFS) in 2022, which indicated that Sanankoro could deliver strong returns, even if the gold price contracts to $1 750/oz.

It also confirmed that Sanankoro holds at least 422 000 oz of mineable gold in its oxide reserve.

The company is in talks with the Malian government to finalise the necessary mining permits. “Our primary focus is now on completing the DFS, finalising permitting and locking in financing to begin construction,” says Cora Gold CEO Bert Monro.

Since the completion of the DFS, Cora has updated Sanankoro’s estimates, with the latest figures showing over one-million ounces of gold in resources – a 26% increase in the amount of gold-bearing rock and a 13% rise in total gold content.

Additional testwork has also been completed to explore lower-cost processing options. These findings, along with the updated resource data and operational improvements, are being incorporated into an updated DFS, which is due for completion in the third quarter of 2025.

With a current gold price around the $3 300/oz mark, Monro believes that the project’s future looks even better than before.

“Sanankoro is on the cusp of its transition into mine construction and then production,” he says, adding that, as an established low-cost, high-value gold project, with strong investor support and a clear path to early cash flow, Sanankoro is set to be a new responsible gold source in West Africa.

To support the next phase of development, Cora raised £1.5-million in March through its shareholder base, which includes several high-profile resource investors. It has also secured a $70-million debt financing agreement with Atlantique Finance to help pay for mine construction once permitting is in place.

Beyond Sanankoro

Cora’s exploration portfolio also includes over 600 km2 across two prolific gold belts, in Mali and Senegal.

In eastern Senegal’s Kenieba area, early-stage drilling at the Madina Foulbé permit has confirmed widespread gold mineralisation and the potential for a large-scale discovery, says Monro.

Cora is aiming to develop projects responsibly, with care for local communities and the environment.

“Cora Gold plays a crucial role in identifying, advancing and derisking high-potential gold targets. We are committed to operating to the highest standards while making a positive impact on the communities in which we work and minimising environmental impact.”

West Africa is a well-known gold region, and Mali in particular, has a strong mining sector, Monro points out.

Monro confirms that Cora has always experienced positive engagement with local authorities, and while all junior miners face common challenges, such as access to funding, managing political risk, building community relationships and reducing environmental impacts, he is confident in Cora’s ability to deliver.

The recent investments secured by Allied Gold and Toubani Resources for their respective Mali gold projects, together with the current gold price, show there is strong investor appetite and that this is an “opportune” time to bring a high-value, low-cost oxide gold project, such as Sanankoro, into production, he says.

“With the gold price strengthening and continued operational progress, we believe we’re unlocking substantial long-term value,” concludes Monro.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation