Metals Acquisition dual lists on ASX following A$325m IPO

Copper miner Metals Acquisition Limited (MAC) on Tuesday started trading on the ASX, following completion of its oversubscribed initial public offering (IPO) in Australia.

MAC raised A$325-million through the issue of 19.12-million chess depository interests (CDIs) at the top of its indicative price range, being A$17 a CDI.

At listing, MAC has an implied total market capitalisation of about A$1.18-billion, which the company said cemented the IPO as the biggest ASX mining listing based on market cap in more than five years.

Also listed on the NYSE, MAC’s goal is to acquire and operate metals and mining assets in high-quality, stable jurisdictions around the world that are critical in the electrification and decarbonisation of the global economy.

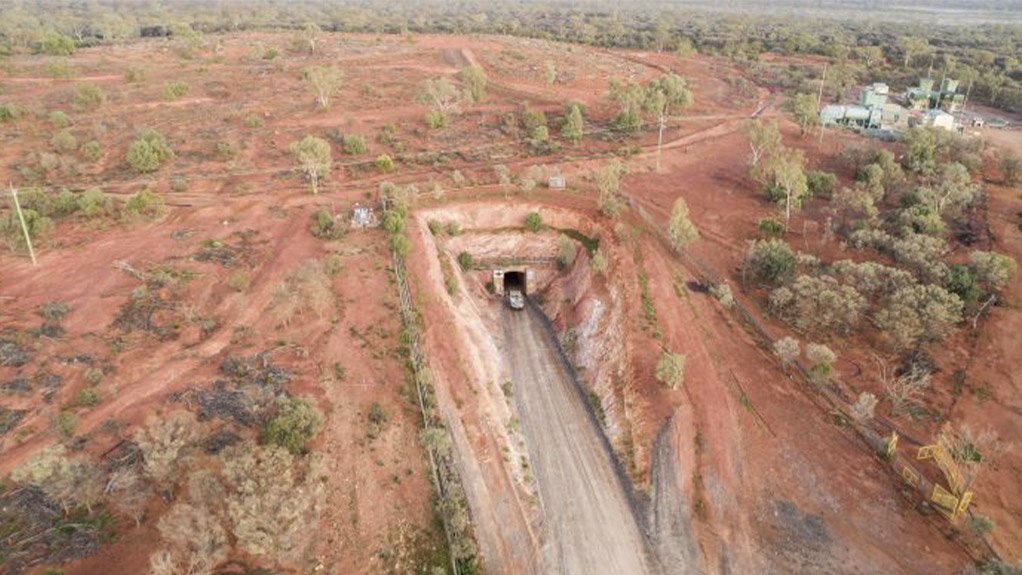

The company’s foundational asset is the CSA copper mine near Cobar, western New South Wales, which MAC acquired from Glencore last year. CSA is the highest-grade copper mine in Australia.

MAC will use the IPO proceeds to repay a A$127-million deferred consideration facility to Glencore in connection with the A$1.64-billion acquisition of CSA. It will also commit further working capital to improve the mine’s production, development opportunities and undertake in-mine, near-mine and regional exploration.

Backed by a board and management team, MAC is led by CEO Mick McMullen, who has more than 30 years of senior leadership experience in the exploration, financing, development and operations of mining companies globally.

McMullen grew up in western New South Wales and was previously CEO and president of Canadian gold producer Detour Gold, where he increased Detour’s market capitalisation from C$2.1-billion to C$4.9-billion over seven months leading to the C$4.9-billion acquisition of Detour by Kirkland Lake Gold. He was CEO at US palladium and platinum producer, Stillwater Mining, increasing its market capitalisation from $1.3-billion to $2.2-billion, and its eventual $2.7-billion sale to Sibanye Gold.

“An Australian IPO and listing will allow us to pursue a range of organic and inorganic growth opportunities in Australia and globally to continue building shareholder value,” said McMullen.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation