Opencast production expected at Anglo Platinum’s Middelaagte mine by year-end

Anglo American Platinum CEO Natascha Viljoen's half-year presentation covered by Mining Weekly's Martin Creamer. Video: Darlene Creamer.

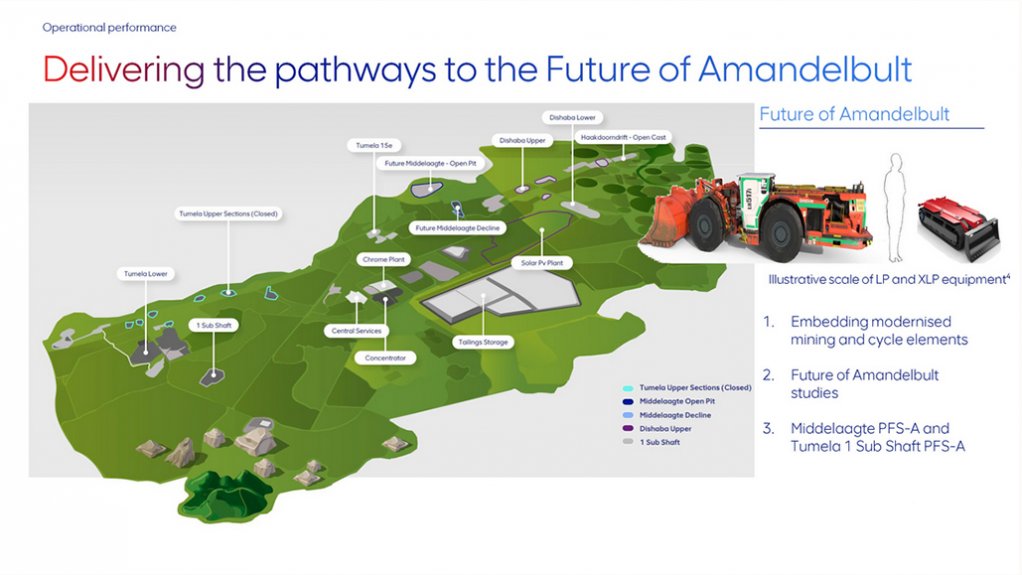

Extra low-profile fleet being trialed.

Platinum group metals (PGMs) mining and marketing company Anglo American Platinum (Amplats)is finalising the permitting process for the future opencast Middelaagte mine, one of three areas of the company’s Amandelbult complex.

Located in Limpopo, within the municipality of Thabazimbi, the Amandelbult mine will consist of three main areas. Firstly, the modernisation of the existing mining areas that have started to deliver safety and efficiency. Secondly, the start of the Middelaagte through the opencast operation, and, thirdly, mining studies to shape the future of Middelaagte and Tumela 1 Sub Shaft.

“We are focusing on continuing the roll-out of modernisation cycle elements. We are staggering implementation to manage change and truly embed the modernised mining cycle,” outgoing Amplats CEO Natascha Viljoen said during the company's half-year presentation on July 24, covered by Engineering News & Mining Weekly.

“This has enabled us to start capturing value through a safer and higher productivity mining cycle and lowering cost.

We are finalising the permitting process and expect to start production at Middelaagte with an opencast mine at the end of this year,” Viljoen added.

Production will ramp up to a maximum expected rate of between 110 000 t and 180 000 t a month.

Further, three studies are currently under way that will provide optionality for either life extension or growth of the Amandelbult complex.

The objectives of the Amandelbult studies are to find the optimal mining strategy, volume and timing of various new mining areas and applied mining systems that could be both modernised, conventional, mechanised mining and/or hybrid mining opportunities within the portfolio.

The journey Amplats has been undertaking is to try a fully mechanised solution in Tumela 15 East, which has proven valuable in understanding the successes and current limitations of mechanisation for Amandelbult.

“These learnings form part of the studies as we map out our optimal pathway for Amandelbult,” said Viljoen.

Depicted on a slide that was displayed during the presentation was an image of the extra-low-profile fleet being trialled, which was shown to be a fraction of the size of conventional mining equipment.

A marked improvement in safety has been seen at Amandelbult, which is a critical success factor for the future of Amandelbult.

The modernisation programme at the mine utilises new technologies to continuously improve safety, mine productivity and simplify operational logistics.

This was described as being a positive journey, with focus continuing on the delivery of the programme to enhance the work and to improve operating conditions.

Second-quarter performance within the Amandelbult complex was lowered by continued poor ground conditions at Dishaba and short-term operational challenges at Tumela, with underground rail maintenance stoppages impacted. The redevelopment impacted development buffers at Dishaba and an additional labour skills mix has been introduced to restore the mining buffers and to provide flexibility to implement the full benefits of cycle mining across the operations.

Half-year capital expenditure (capex) of the JSE-listed Amplats was R8.5-billion, with R4.5-billion on stay-in-business capital and R1-billion on growth capex, the growth capex being predominantly linked to the future of the Mogalakwena mine, where exploration decline work is being undertaken as well as progressing studies associated with the future of Mogalakwena work.

Capital was also spent on the Mototolo/De Brochen life extension project, on which around R3-billion is expected to be spent this year.

Guidance for the year remains unchanged, with between 3.6-million and 4-million PGM ounces, subject to the impact of Eskom load curtailment. Unit cost guidance for 2023 remains between R16 800 and R17 800 per PGM oz and is expected to be at the upper range of guidance. In 2023, total capex is expected to remain within the market guidance of R22-billion.

In terms of market outlook, platinum is expected to remain in deficit over the next few years, as automotive demand gains from ongoing substitution of palladium in gasoline catalysts. Palladium is expected to move into surplus for the opposite reason, though to what extent will depend on what happens to automotive production and battery electric vehicles’ share of it. Rhodium will remain in a small surplus, assuming further disposals from the fibreglass industry.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation