Petra remains confident of one-million-carat increase in production in 2025

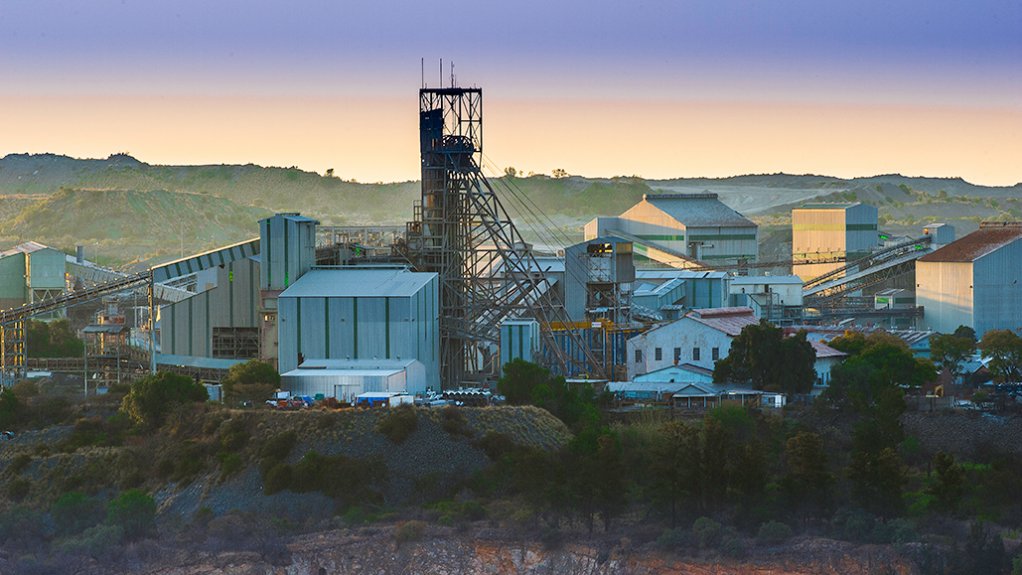

With an operational turnaround under way at diamond miner Petra Diamond’s Finsch mine, in South Africa, the restart of its Williamson mine, in Tanzania, running ahead of schedule and the company’s capital projects remaining on track to ensure incremental growth, CEO Richard Duffy has reiterated guidance for yearly group production to increase by up to one-million carats in the 2025 financial year.

An additional 300 000 ct increase in output is also expected for the 2026 financial year.

“Operations at both Cullinan and Finsch are now largely stabilised, enabling us to focus on reducing waste dilution and improving grades. These advancements have been supported by a much improved safety performance in the fourth quarter,” Duffy said in an operating update for the company’s 2023 financial year, which ended on June 30.

He explained that the operational turnaround at Finch was a reflection of the introduction of new underground equipment, the recruitment of several senior technical personnel to fill vacancies and the resolution of ground handling issues that impacted production in the third quarter. At Cullinan mine, he said the improvement was a result of increased plant availability largely on the back of the completion of a mill relining.

During the fourth quarter, the number of lost time injuries decreased to two, while the lost-time injury frequency rate reduced to 0.12. These improvements were a result of Petra’s renewed focus on safety, aimed at addressing the regression that was observed in previous quarters.

“We’re striving for a zero-harm environment as we continue to ensure that we maintain our focus on remedial actions and behaviour-based intervention programmes across operations,” Duffy said.

In terms of diamond production, there was a 5% decline in total diamond production, amounting to 620 018 ct compared with the previous quarter. This decrease was primarily owing to lower grades at both the South Africa-based Cullinan and Finsch mines.

However, Petra has taken remedial measures at both mines to rectify the situation.

As a result, Petra’s diamond production for the financial year reached 2.67-million carats, which was slightly below Petra’s earlier guidance range of 2.75-million to 2.85-million carats.

“Mitigating steps have been successfully implemented to address grade issues experienced at Cullinan and Finsch in the final quarter that resulted in 2023 production coming in marginally below guidance. Grades at both operations have now reverted to planned levels,” Duffy said on July 18.

In June, Petra concluded sales amounting to $7.8-million to fulfil regulatory requirements for selling to South African cutters and polishers. This brought the total rough diamond sales for the fourth quarter to $49.9-million, a decrease from $179.8-million in the fourth quarter of 2022.

Additionally, Petra’s sales for the year amounted to $328.4-million, down from $584.1-million last year. It is worth noting that like-for-like prices increased by about 2% year-on-year, and revenue from profit share agreements increased to $1.4-million compared with $1.1-million a year ago.

The reduction in revenues compared with the previous year was mainly owing to a lower contribution from exceptional diamonds, which totalled $12.6-million this year compared with $89.1-million last year, as well as a 34% reduction in rough diamonds sold.

This reduction was owing to a 20% decrease in diamonds recovered, along with the deferral of Tender 6 sales, as well as of 75 900 ct of predominantly higher-value stones from Tender 5 from this year to next year.

As a result of the deferred sales, Petra’s diamond inventory increased to 715 200 ct, valued at $65.9-million, at the end of the period. This compares with the inventory of 381 700 ct, valued at $40.2-million, as at June 30, 2022. These figures exclude the 71 600 ct from Williamson’s blocked parcel.

After the end of the reporting period, Williamson received the final regulatory approvals and consents necessary to commission the newly constructed tailings storage facility (TSF).

As a result, the commissioning of the TSF and treatment plant began in July, and production resumed ahead of schedule.

At Koffiefontein, in South Africa, ongoing care-and- maintenance activities are being carried out as part of Petra’s preparations for a responsible closure.

Throughout the quarter, the company benefited from the support of a weaker rand. The exchange rate closed at R18.83 to the dollar on June 30, compared with R16.27 a dollar a year earlier.

The average exchange rate for the financial year under review was R17.77 to the dollar, compared with R15.22 to the dollar in the prior financial year.

Petra’s gross debt decreased to $247.3-million as of June 30, reflecting the repurchase of a portion of the 2 026 loan notes.

However, Petra’s consolidated net debt increased to $176.7-million compared with $40.6-million a year ago. This increase was primarily owing to the deferral of diamond sales to the 2024 financial year, coupled with planned higher capital expenditure (capex) associated with the mine plan extension projects.

Over the past few years, Petra has taken strategic actions to strengthen its business, improve cash flow generation and maintain capital discipline. These efforts have positioned the company well to capitalise on the favourable diamond market fundamentals expected in the medium to longer term.

Currently, Petra’s capital projects are progressing as planned and are expected to result in a significant increase in production over the next three years.

At Cullinan, work is ongoing on the CC1-E and C-Cut extension projects, which are on track to deliver incremental production growth. Similarly, at Finsch, the Lower Block 5 3-level 90L sub-level cave extension project is progressing as scheduled.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation