RH Managers to raise R2bn to boost social, energy infrastructure in South Africa

Johannesburg-based private equity and infrastructure investment firm RH Managers (RHM) is on a fundraising drive for a R2-billion social impact fund to boost South Africa’s healthcare and energy infrastructure.

Although far more developed than many of its African peers, latest statistics indicate that South Africa will have an infrastructure investment gap of R4.8-trillion by 2030 unless it increases investment in infrastructure to meet the targets set under the National Development Plan, the country’s development blueprint, the firm points out.

RHM says that, through its array of infrastructure funds, it intends to fill the chasm, off the back of increasing quality healthcare, affordable housing and reliable energy demand.

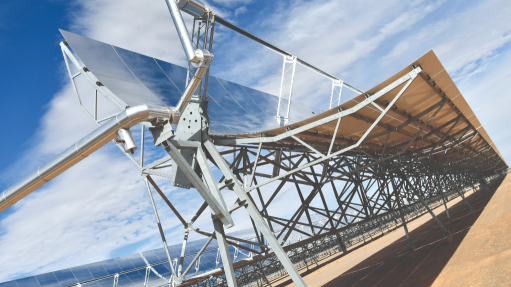

The fund’s mandate is to invest in social infrastructure encompassing healthcare, housing and renewable energy, thereby making them more accessible and affordable to the greater population of South Africa.

RHM, with a pool of investors from both local and international limited partners, is the second largest black private equity firm by assets under management (roughly R5-billion) in South Africa.

The firm plans to have the fund’s first close in December this year and the second close of the fund is earmarked for June 2025.

The launch of Fund 3 follows RHM having previously launched and achieved success in three healthcare funds that raised over R5-billion in debt and equity capital to date.

RHM says it seeks to incorporate sustainable finance and environmental, social and governance considerations in its investment decisions to enable improved outcomes for society and returns for investors.

The RHM team is said to have amassed extensive experience in identifying and structuring acquisition opportunities, in both the green, brown, and later stage investment areas. These investments have involved sourcing investment capital (leverage and equity), construction and commissioning processes.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation