South Africa set to alter course on rates until ‘dust settles’: Day Guide

The South African Reserve Bank (SARB) is set to look past a smaller-than-expected rise in prices last month and keep borrowing costs unchanged while it assesses the impact that US President Donald Trump’s trade policies will have on inflation.

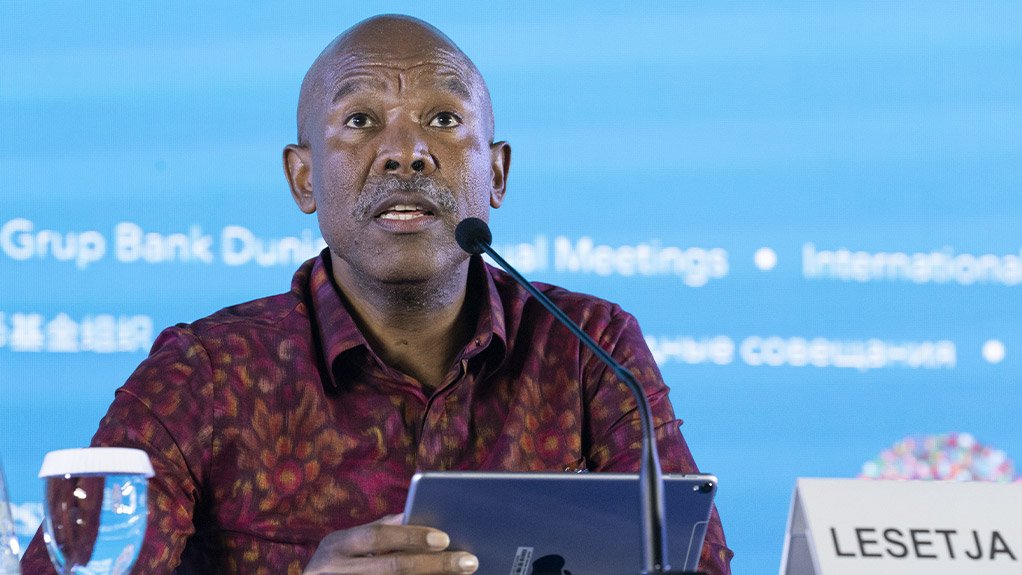

Most economists polled by Bloomberg foresee Governor Lesetja Kganyago holding the benchmark interest rate at 7.5%, after three consecutive quarter-point cuts, when he delivers the monetary policy committee’s decision at a briefing north of Johannesburg shortly after 3 pm on Thursday. They expect the decision to be a close call, with four MPC members backing a hold and two a cut, according to a separate survey.

While there are strong reasons for the MPC to reduce borrowing costs, including a struggling economy and the inflation rate remaining steady at 3.2% in February — and coming in slightly lower than the 3.4% economists expected — “global factors will weigh more” and cause policymakers to wait for the “dust to settle,” said Patrick Buthelezi, economist at Sanlam Investment.

“I think they’ll probably pause for now,” he said. He expects policymakers to be concerned that the US Federal Reserve, which stood pat on Wednesday, may alter course and raise interest rates because of the impact tariffs could have on inflation.

Since Trump’s re-ascension to the White House in January, he has been steadfast in imposing tariffs on neighbours, allies and competitors alike. He has also warned that he will institute reciprocal charges on trading partners on April 2.

His policies have led long-term inflation expectations to jump by the most since 1993.

A Fed hike to mitigate against the effect of the tariffs may trigger the South African Reserve Bank to follow suit, Buthelezi cautioned. “The SARB, unfortunately, will have to respond, because the currency would weaken in that environment.”

The central bank will likely argue that the balance of risks remain tilted to the upside, “in the context of a trade war, volatility risk,” said Investec Bank Ltd. Treasury Economist and Fixed Income Analyst Tertia Jacobs.

This will be despite the MPC being able to reason that there are new disinflationary forces emerging, given the rand’s performance, and softer oil prices, she said.

Another factor that may persuade the MPC to pause is South Africa’s souring relations with the US. Some fear it could cause it to lose its preferential status under the African Growth and Opportunity Act, a trade accord covering about $3.6-billion of its exports to America.

Such concerns have led institutional investors including Franklin Resources Inc., JPMorgan Chase & Co. and Wells Fargo & Co. to dump South African bonds this quarter, fuelling outflows at a rate not seen since before elections in May.

The central bank may also prefer to do nothing for now because of the uncertainty regarding the budget tabled on March 12, said Andrew Matheny, economist at Goldman Sachs Group Inc. “While we see a strong case for further monetary easing on the basis of doveish cyclical dynamics, we expect that budget uncertainty will prompt the SARB to keep rates unchanged.”

The budget proposed a 0.5 percentage point increase in the value-added-tax rate in both of the next two fiscal years, but failed to get buy-in from the Democratic Alliance and other parties, and it’s unclear if it will be passed in parliament. The DA is the second-largest member of a collation government formed by the African National Congress after it lost its outright majority in the legislature last year.

The parties are holding a series of talks to resolve the impasse.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation