Sustainable aviation fuels output growing but long journey ahead to meet agreed goals

Sustainable aviation fuels (SAF) generate much lower carbon dioxide (CO2) emissions, across their entire lifecycle, than conventional jet fuels. SAF can reduce life-cycle CO2 emissions by up to 80% compared with fossil fuels. Moreover, SAF contain far fewer impurities than fossil fuels, resulting in reductions in sulphur dioxide and particulate matter emissions that are even higher than 80%.

“[SAF] is the main term used by the aviation industry to describe a non-conventional [that is, not fossil derived] aviation fuel,” explains the International Air Transport Association (IATA) – the global representative body for the airline industry. “The chemical and physical characteristics of SAF are almost identical to those of conventional jet fuel and they can safely be mixed with the latter to varying degrees, use the same supply infrastructure and do not require the adaptation of aircraft or engines.”

Between 2021 and the first half of this year, use of SAF in the US alone grew tenfold, the US Department of Energy reported in September. Use of SAF in US aviation went from 5-million gallons (18.93-million litres) in 2021 to 52-million gallons (196.84-million litres) during 2024’s first semester, with the SAF being sourced locally and through imports. In June, IATA forecast that global SAF production for the whole of this year would be triple that for last year, reaching 1.9-billion litres, or 1.5-million tons.

This is a fast ramp-up. And this production ramp-up is continuing. IATA also reported that about 140 renewable-energy projects, capable of producing SAF, have been announced, which could take total (not just SAF) renewable fuels production capacity to 51-million tons by 2030.

But the hard truth is that total SAF production this year will amount to just 0.53% of total aviation fuel requirements. There is a very long way to go, and time is tight: it has been internationally agreed that international aviation carbon emissions have to be reduced by 5% by 2030. And it has also been internationally agreed that commercial aviation achieve net-zero carbon emissions by 2050. SAF is expected to be responsible for nearly 100% of the carbon emissions reduction target for 2030, and for 65% of the reductions required to reach net-zero by 2050 (the other 35% would be composed of new technologies, such as electric power and hydrogen (13%); infrastructure and operational efficiencies (3%); and offsets and carbon capture (19%)).

To cut carbon emissions by 65% by 2050, IATA points out that SAF will have to provide 80% to 90% of total aviation fuels by that year. Production of such quantities of SAF will require from 5 000 to 7 000 biorefineries. As most SAF production pathways need to use hydrogen, the production of SAF could require nearly 100-million tons of hydrogen by 2050 – a total similar to total global hydrogen production last year.

However, SAF currently have lower energy densities than conventional jet fuels, resulting in a reduced range for the same quantity of fuel. Further, although jet airliners have successfully flown using 100% SAF, regulators currently don’t allow commercial flights to be flown purely with SAF, but required SAF to be blended with jet fuel, to a maximum level of 50% SAF. (It is hoped that 100% SAF will be authorised by 2030.) And SAF are expensive – up to four times more expensive than jet fuel, in part because of the low scale of production. Even so, every drop of SAF that has so far been produced has been bought by airlines, so eager are they to have it.

Feedstocks & Pathways

There is not one type of SAF, and there is not one pathway to produce SAF. The current feedstocks for SAF are agricultural wastes and residues, algae oils, forestry wastes and residues, gaseous (captured) CO2, invasive alien plants, regenerative or cover crops, waste fats, and waste gases.

Oils, fats and greases can be converted into bio-oil, which can be treated to become hydro-processed esters and fatty acids (better known as HEFA) SAF. Any form or source of sugar can be turned into bioethanol or iso-butanol, and then converted, through a process called Alcohol-to-Jet (AtJ), into SAF. Solid biomass, including biogenic municipal waste, bioplastics, and forestry residues, can be turned into an intermediary synthetic gas (syn-gas), which is then processed into SAF using Fischer-Tropsch technology. Hydrogen can be extracted from water, using renewable energy, to allow carbon capture (either from a point emission source or from the atmosphere), and then by employing syn-gases as intermediaries, Fischer-Tropsch or AtJ technologies can be used to produce Power-to-Liquid (PtL) SAF.

There are also different generations of SAF feedstocks. Regarding biofuel SAFs, there are three such generations.

The first-generation feedstocks were food-grade fats and oils, such as canola or rapeseed oil, palm oil and its derivatives, corn, soybean oil, and sunflower oil. However, use of these feedstocks affects the global food supply.

The second-generation feedstocks are waste fats, oils and greases – for example, used cooking oils, inedible animal fats and tallow, fatty acid distillates, and “trap” (or yellow) grease. These are, however, the most expensive SAF feedstocks and, as they are the results of industrial processes, their supply is likely to be constrained.

The third-generation feedstocks are bio/ agricultural in origin. They include wet wastes, algae oils, food waste, agricultural and forestry residues, and municipal solid waste. These are abundant, and so cheap, but there are not yet robust supply chains for them.

Biofuel SAF that use second- or third- generation feedstocks are known as Advanced Biofuels. The use of these feedstocks has wider environmental benefits, as well as making very-low-carbon emissions fuel. If not used to produce SAF, waste fats, oils and greases have to be incinerated or interred in landfills; agricultural waste must be incinerated, or, if left, could damage soil productivity or toxify waterways; and, if not incinerated, forestry waste can become the catalyst for forest fires.

PtL SAF, also known as E-fuels, is the non-biofuel SAF option. “PtL SAF will likely play a pivotal role in aviation’s decarbonisation strategy,” states IATA in its online May 2024 SAF Handbook. “However, it will have to contend with multiple challenges, technologies, and over longer timelines than advanced biofuels. E-fuels might only begin to scale and complement advanced biofuels from the mid-2030s.”

Also, the production of PtL fuel will require a great increase in the supply of green energy, including renewable energy, to power the processes, otherwise it will not be sustainable. And the number of carbon capture facilities would also have to be greatly increased. “Despite the considerable challenges, PtL SAF lends itself to becoming one of the strongest contributors to airlines’ energy transition in the long-term,” points out the IATA handbook.

South Africa

South African petrochemicals multinational group Sasol is renowned for its expertise in Fischer-Tropsch technology. It is thus unsurprising that the group is a key player in the HyshiFT PtL project to produce E-Kerosene SAF. The project was launched in October last year and will be based at Secunda, home of Sasol’s biggest petrochemicals complex, in Mpumalanga province. It is being developed by a consortium of four companies. In addition to Sasol, there is Germany-based hydrogen production, processing, storage and transport group Linde, green hydrogen production (using renewable energy) company Enertrag, also based in Germany, and 80%-black-owned South African green hydrogen infrastructure investment and development company Hydregen Energy.

The project will see Enertrag provide renewable energy in the form of both solar and wind power, while Linde will produce the green hydrogen, and then Sasol will convert this into E-Kerosene using a Fischer-Tropsch reactor. The project will involve the creation of 450 MW of renewable-energy capacity and the construction of a 200 MW electrolyser, and the target is to produce 50 000 t/d of SAF. That amount of SAF could power two flights between South Africa and Germany every day.

Although the country’s first biofuel SAF demonstration project (involving national flag carrier South African Airways (SAA), US global major airframer Boeing, Netherlands-based SAF producer SkyNRG, and Netherlands- based sustainable biofuel feedstocks producer Sunchem, and which focused on using the solaris strain of tobacco as a feedstock) proved abortive, that had nothing to do with the country’s biofuels potential, and everything to do with the deep crisis into which SAA fell. In fact, South Africa has great Advanced Biofuels SAF potential. IATA cites five factors that create this potential.

The first of these is the country’s feedstock potential, which is wide ranging, from low-carbon by-products of sugarcane production, to using the biomass provided by the systematic clearance of alien invasive plants (an option that also brings wider environmental benefits). Not noted explicitly by IATA, but already proven as a viable option, are the above-mentioned solaris tobacco plants.

Second, the country has significant SAF production capacity. The Worldwide Fund for Nature has found that South Africa could produce between 3.2-billion litres and 4.5-billion litres of SAF every year. As domestic SAF demand would be 1.8-billion litres, this would create a new export product for the country.

Third, there is the country’s existing refinery infrastructure. This creates opportunities for brownfield investments and plant conversions.

Fourth, South Africa has lots of expertise in the relevant fields, but especially (as noted above) in Fischer-Tropsch technologies. It also has strong research institutions and universities.

Finally, South African airports, especially Johannesburg’s OR Tambo International and Cape Town International, are important hubs connecting a large part of Africa to the other continents.

Ramp-Up

There are zero technological obstacles to producing, storing, transporting and using SAF. Yet, worldwide, production remains, in comparison to demand, miniscule. What is needed to turn SAF into, first, a mainstream fuel, and then, THE mainstream fuel, for aircraft?

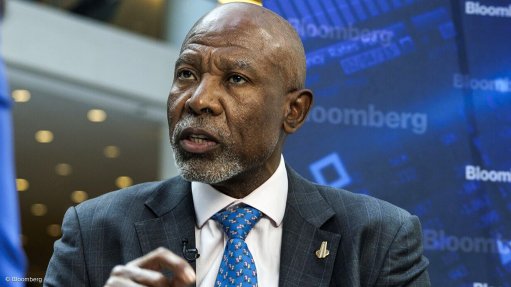

“The interest in SAF is growing and there is plenty of potential. But the concrete plans that we have seen so far are far from sufficient,” highlighted IATA director-general Willie Walsh in June. “Governments have set clear expectations for aviation to achieve a 5% CO2 emissions reduction through SAF by 2030 and to be net zero carbon emissions by 2050. They now need to implement policies to ensure that airlines can actually purchase SAF in the required quantities. Incentives to build more renewable energy facilities, strengthen the feedstock supply chain, and to allocate a greater portion of renewable fuel output to aviation would help decarbonising aviation. Governments can also facilitate technical solutions with accelerated approvals for diverse feedstocks and production methodologies as well as co-processing renewable feedstocks in crude oil plants. No one policy or strategy will get us to the needed levels. But by using a combination of all potential policy measures, producing sufficient quantities of SAF is absolutely possible.”

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation