Battling threat of sugar tax, excessive imports and low price

DEDICATED TO SUGAR CANE Large parts of KwaZulu-Natal and Mpumalanga, about 360 000 ha, are dedicated to growing sugar cane

Photo by Victor Moolman

DEVELOPMENT PUSH The South African Sugar Association has used over R206-million to develop black growers in the industry

Photo by Victor Moolman

The large amount of sugar being imported into South Africa has caused the country’s sugar industry, which may soon be further compromised by the introduction of a sugar tax, to start exporting sugar at world market prices to offload excess sugar, which it is unable to sell locally.

While opposing the introduction of a 20% tax on sugary beverages, or what has been referred to as sugar tax, South African Sugar Association (SASA) commercial director Judith Wilson says the sugar industry is also tackling a high volume of imports from the residual world market at prices below any producer’s cost of production.

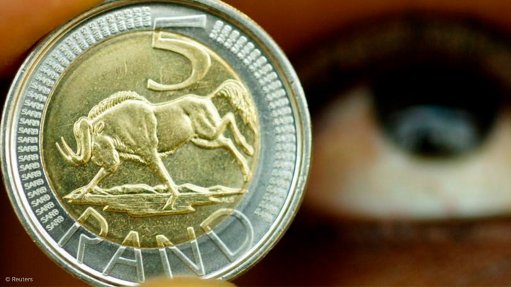

International markets were paying R14.74/lb of sugar at the start of November, however, she highlights that this does not cover the cost of local sugar production.

Compounding the unattractive global sugar price are the free-trade agreements South Africa has with Southern African Development Community (SADC) countries. This agreement enables these countries to export a quota volume of sugar and other commodities into South Africa without having to pay import duties.

“SADC countries can send about 43 000 t of sugar to South Africa duty free. But, we don’t have the reciprocal export opportunities; it’s only one way, coming into South Africa. Further, this year, deep-sea imports have increased from 5% of the total sugar consumed in the Southern African Customs Union to an estimated 29%,” Wilson states.

Deep-sea imports to South Africa are mostly from the United Arab Emirates (UAE) and Brazil – the import of sugar from these countries further increases the challenges for local industries.

“Deep-sea imports are displacing South African sales, which is why we are now exporting massive volumes of sugar. We’ll have exported 500 000 t of sugar by the end of this season as a result, negatively impacting on our economy,” Wilson points out.

She explains further that South Africa required 2.2-million tons of sugar in 2016/17, with the local production of sugar supplying 76% of this amount. Swaziland also supplied a small portion; however, the remainder was imported from countries like Brazil or the UAE.

The import of sugar reduces the price that the local industry can charge per ton, impacting the upstream market and making the sugar industry unprofitable.

When sugar is sold at a loss, this has an effect on the profitability of millers and sugar cane farmers, which lose their incentive to further invest in the industry, as “farmers don’t buy new equipment and millers do not want to employ more workers” when they are short of funds.

South Africa has recently started to export to the European Union (EU) through the UK. Wilson explains that, if this move had been made earlier, exporting sugar would have been an attractive option – in November last year, when trade was officially opened, the price for sugar in the EU fell to only a few cents above that of the international price.

Owing to the Brexit vote that took place in the UK and more exports to the EU, the cost of sugar to the EU has dropped significantly over the last year.

“We have almost delivered our full quota this year to the EU; although, it doesn’t have quite the value we hoped for. South Africa’s remaining sugar surplus will, therefore, need to be sold to the world market at a loss,” she adds.

Local Production

The South Africa sugar industry generates R14-billion a year, with the gross domestic product being exported accounting for 0.6% of this value, SASA executive director Trix Trikam states.

He explains that the 2016/17 sugar season produced 15.5-million tons of sugar cane, with KwaZulu-Natal and Mpumalanga being South Africa’s only producers of sugar cane.

“In total, the area under cane is about 360 000 ha. It’s a big number but there isn’t anything else you can grow in these areas. “The rainfall and irrigation required also effect what can be grown,” he states.

Trikam highlights that, while farms in the northern parts of KwaZulu-Natal and Mpumalanga are irrigated, farms further south rely almost entirely on irrigation systems, owing to less precipitation.

Further, there are 14 mills spread across both provinces that reduce the cost of transporting sugar cane to mill for farmers.

“There are 12 mills in KwaZulu-Natal and two in Mpumalanga, which are owned by sugar producers Illovo Sugar, RCL Sugar & Milling, Tongaat Hulett Sugar, Gledhow Sugar Company, UCL and Umfolozi Sugar Mill.”

Further, he says, there are 21 750 registered cane growers in South Africa, of which 20 500 are small-scale growers. The sugar industry provides 85 000 direct jobs, with a further 350 000 indirect employment opportunities.

He concludes that SASA is helping the industry grow further by helping in the development of black farmers. To date, the association has invested R206-million in the development of black sugar cane growers.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation