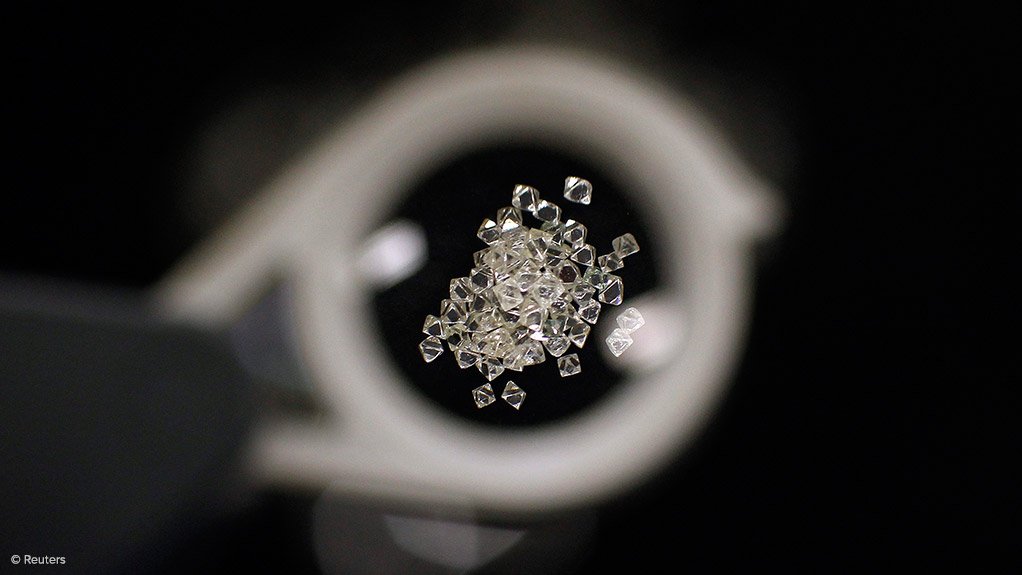

Botswana's ODC seeks $300m in loans for diamond purchases

Botswana's State-owned Okavango Diamond Company (ODC) seeks a $300-million credit facility from local banks to support larger volumes of diamond purchases, Finance Minister Peggy Serame said on Thursday.

ODC, established in 2012 as an independent window for the government to sell diamonds outside of the De Beers channel, currently gets 25% of its production from Debswana, a joint venture between Botswana and Anglo American's De Beers.

In June last year Botswana and De Beers agreed a new TEN-year diamond sales agreement, which will see ODC’s share of Debswana output rise to 30% initially and then increase gradually to 50% by the end of the deal, as the country seeks to get more revenue from its resources.

Following the maturity of a $140-million working capital facility in 2023, Serame said ODC has appointed Standard Chartered Bank to structure and coordinate a new $300-million syndicated revolving working capital facility.

ODC is currently only able to afford purchases up to $70-million using its own cash reserves, Serame told lawmakers as she sought approval for a $175-million government guarantee for the new credit facility.

"The $175-million government guarantee will crucially support ODC's increased entitlement of 30% to Debswana's rough supply, as well as assist the company in negotiating favourable rates in the local market on a new working capital facility,” Serame said.

The diamond industry is currently going through a market downturn which has seen sales at Debswana fall 49% in the first half of the year.

In October last year, ODC temporarily halted its rough sales as part of an industry wide drive to reduce the glut of inventory in the cutting and polishing industry caused by weaker global demand for jewellery.

The diamond industry is expected to start recovering from the impact of weak global demand during the fourth quarter of 2024, Serame said, and availability of the credit facility would put ODC in position to benefit from the recovery.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation