EOH posts loss a share, as Operational Technologies division offsets Digital Enablement growth

JSE-listed information and communications technology services firm EOH reported a 2% year-on-year decrease in revenue to R3.1-billion for the six months ended January 31.

Group operating profit also decreased, to R9-million, from R142-million in the six months ended January 31, 2023.

Adjusted earnings before interest, taxes, depreciation and amortisation (Ebitda) of R97-million was down from R171-million in the prior comparable period.

The group posted a total loss a share of 15c, compared with a loss a share of 3c in prior comparable period, but its headline loss a share of 11c was an improvement on the headline loss a share of 17c reported in the prior period.

Total cash generated from operations increased to R201-million for first half of the 2024 financial year, up from R5-million.

"The core Digital Enablement business, including International, has seen good revenue growth. However, this has been offset by reductions in other areas, particularly in the Operational Technologies division, which has been negatively impacted by delays in closing Public Sector contracts and contracting delays with large mining customers," the company said in its interim results statement on March 26.

EOH experienced a challenging second half of its 2023 financial year, and this trend continued through the first three months of the 2024 financial year.

Despite an improvement in trading and tendering activity in the second three-month period of the half-year, the challenging environment led to a reduction in revenue, it said.

Further, operating costs continued to be a core focus, and EOH was on track to eliminate at least R50-million from the 2023 financial year cost base, on an annualised basis, as part of the efficiency strategy. Operating costs declined by 3% year-on-year, said outgoing EOH Group CEO Stephen van Coller.

Despite these savings, the pressure on gross margins and the reduced gross profit had fallen through to the adjusted Ebitda performance for first half of the 2024 financial year. Gross profit margin fell to 27% from 29%, said EOH Group CFO Marialet Greeff.

The Digital Enablement business had maintained a stable gross profit margin year-on-year, but there was a decrease in gross profit margins across the other lines of business, she added.

While group revenue decreased, the Digital Enablement business showed good revenue growth at 9% and the International business continued strong growth at 11%. Further, EOH should be able to fully complete the restructuring of iOCO operations during the current financial year, she added.

Meanwhile, EOH reached a settlement with the South African Revenue Service in terms of a legacy pay-as-you-earn tax matter.

This was a milestone and meant the group could focus 100% of its efforts on moving forward, Van Coller said during the company's results presentation.

"With an improved capital structure in place and significantly lower interest payments to our lenders, EOH is now able to make proper long-term decisions, including investments in growth opportunities," he said.

Additionally, the asset sale process that is aimed at reducing legacy debt is largely complete. The group is in the process of disposing of various other businesses as part of a strategic portfolio clean-up to further streamline its operations and aligning its business portfolio with its core objectives. The proceeds will further be used to deleverage the group.

EOH was now well positioned to execute its growth strategy and execute its business consolidation in iOCO and EasyHQ, which would enable the business to right-size its cost structure and capitalise on the growing demand for digital transformation across its client base, Van Coller said.

"The large legacy issues were the final piece of the very complicated puzzle that needed to be solved to allow the group to operate as a normal business," he noted.

"While the final set of results I am presiding over may be disappointing, there is a hidden promise because, for the first time, we were able to make long-term business decisions. ICT is a people business and one of these decisions we made saw us retaining highly skilled people despite delays in deploying them to contracts. We couldn't do this in the past, as we had to keep our heads above water.

"We have navigated many challenges over the past years, including Covid-19 and bribery and corruption, alongside international and local challenges, but have managed to keep our gross profit margin stable and the normalised results have remained flat from the first half of the year into the second half," he said.

He praised the team for doing a good job in building a sustainable business and said the group would deliver on its commitment to deliver the true EOH in 2025.

"We are well positioned, for once, and when the world economy turns, and we hope South Africa follows, we can ride the wave up. Going forward, the group's ability to realise cost and administrative savings will be critical in getting the underlying structure in place to move ahead.

"I am confident that the team will create EOH 3.0," said Van Coller.

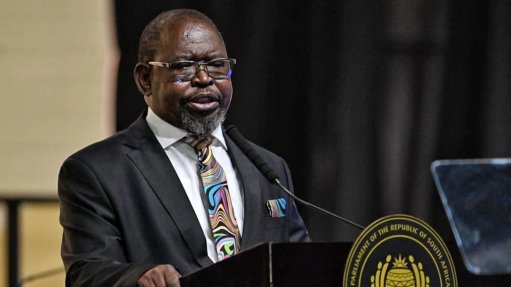

EOH chairperson Andrew Mthembu thanked Van Coller and praised the leadership he demonstrated by helping to rescue the business from the brink of collapse and saving thousands of jobs while it continued to deliver services to clients.

Additionally, the board would look at potential CEO candidates over the next four months and the company should be in a position to identify a new CEO within six months, Mthembu noted.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation