MTN rides out difficult operating environments

Telecommunications giant MTN Group unpacked a resilient set of 2023 financial results, despite elevated inflation in several key markets averaging a blended 16.7%, foreign exchange volatility and ongoing political tensions in some markets, and a sharp devaluation of the naira in Nigeria.

During the year ended December 31, 2023, MTN Group’s earnings before interest, taxes, depreciation and amortisation (Ebitda), before one-off items, decreased 0.5% to R90.5-billion, with the Ebitda margin declining by two percentage points to 40.9%, impacted mostly by the higher inflation and the effects of foreign currency devaluations.

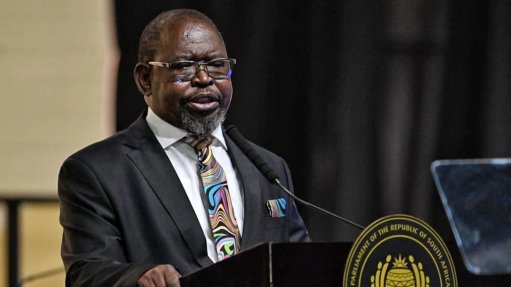

“The extent of these impacts were moderated through delivery of our expense efficiency programme, which realised savings of R2.6-billion for the year, exceeding our 2023 target of R1.5-billion,” said MTN Group president and CEO Ralph Mupita.

In constant currency terms, Ebitda increased 9.8%.

Basic earnings a share for the year under review decreased by 78.5% to 227c, while reported headline earnings per share (HEPS) decreased 72.3% to 315c, with nonoperational impacts decreasing HEPS by 888c.

The pan-African mobile operator, with 295-million customers in 19 markets, reported a 6.9% growth – 13.5% in constant currency terms – in service revenue to R210.1-billion, with data revenue accounting for R84-billion and voice revenue contributing R83-billion. Fintech revenue totalled R21-billion.

In terms of service revenue growth in the group’s larger markets, MTN Nigeria increased by 22.1%, MTN South Africa by 2.5% and MTN Ghana by 35%.

During the year ended December 31, 2023, MTN Group’s total subscribers increased to 295-million across the group’s markets.

Active data subscribers increased 9.3% to 149.7-million – half the total subscriber base – boosting data traffic by 26.3% with use up to an average of more than 6 GB per user a month.

Active Mobile Money (MoMo) users increased by 5% to 72.5-million, impacted by a strategic shift in focus to wallet customers in Nigeria and base clean-ups in Côte d'Ivoire and South Africa.

“The momentum in volume and value of MoMo transactions remained strong and were up by 32.2% and 47.4%, respectively. This underpinned strong advanced service revenue growth of 54.8%,” Mupita commented.

The volume of fintech transactions increased by a third to 17.6-billion during the 2023 financial year, with the value of transactions across the fintech platform increasing to $272-billion, driven by growth of advanced services in payments, banktech and remittance solutions.

To sustain this growth, as well as network coverage and quality, MTN deployed capital expenditure (capex), excluding leases, of R41.1-billion in the year.

MTN South Africa deployed R10-billion of capex to drive network capacity expansion and power resilience, with more than R2.6-billion of this directed to power and security resilience.

“The progress of MTN South Africa's network resilience plan was a key success in the year, which significantly improved network availability and supported commercial initiatives, despite ongoing loadshedding,” he said, noting that by the end of 2023, MTN South Africa had achieved network availability of 95% ahead of schedule, with availability of 98% on the cohort of sites where resilience investment had been completed.

Meanwhile, Mupita pointed to the good strategic progress MTN Group had made in the development of its fintech and fibre businesses.

“A key highlight was concluding an agreement for payment network processor Mastercard to invest up to $200-million for a minority stake in MTN Group Fintech at a valuation of $5.2-billion. We are excited about this partnership, particularly the commercial agreements, which we expect to support the accelerated growth of our fintech business,” he said.

MTN Group also advanced the structural separation of its fibre business Bayobab, with engagements to secure regulatory clearances in key markets being the main priority.

In 2023, Bayobab and Africa50 partnered to develop Project East2West, a terrestrial fibreoptic cable network to help bridge Africa’s connectivity gap by improving broadband access for the continent’s landlocked countries in particular.

Looking ahead, the group maintained its overall medium-term guidance framework.

“We are anticipating that the macro conditions in our trading environment will persist in 2024, with naira volatility and elevated inflation the key challenges we will need to navigate. MTN plans to invest R35-billion to R39-billion in 2024 to position the company to capture the structural demand for data and fintech services across Africa,” Mupita concluded.

MTN Group declared a total dividend of 330c a share for the year ended December 31, 2023.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation