Multifaceted approach required for sector resilience

SUSTAINABILITY FOCUS As South Africa navigates changing socioeconomic dynamics, it must embrace a forward-looking approach that prioritises long-term community well-being and resilience

Building long-term resilience in South Africa’s mining sector requires a multifaceted approach that includes the integration of new technologies, enhanced safety standards, adequate fit-for-purpose infrastructure and a strong commitment to environmental, social and governance (ESG) principles, as well as business and human rights (BHR) principles, highlights law firm Webber Wentzel.

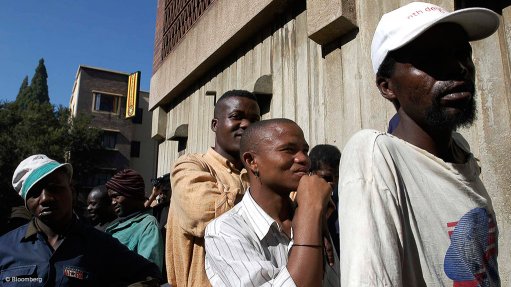

Subject matter professionals from the firm explain that the mining sector cannot thrive amid disruptions and other adverse impacts such as protests, extortion rackets, illegal mining and a challenging regulatory environment.

They outline that the legacy of mining in South Africa is inextricably tied to the country’s socioeconomic development and that as the sector navigates these changing dynamics, it must embrace a forward-looking approach that prioritises long-term community well-being and resilience.

To foster such resilience and sustainability, an investment-friendly landscape is also essential, where responsibilities are allocated fairly, rather than placing a disproportionate burden on mining companies, thereby facilitating shared value creation.

Key to creating such an investor-friendly environment are favourable fiscal regimes, proactive and reliable policing, streamlined permitting processes and clear regulatory frameworks.

“We take a sector and client-focused approach, proactively addressing our clients’ needs rather than merely executing instructions. This distinction is critical, as challenges in the mining sector do not exist in isolation and often trigger widespread ripple effects,” the firm says.

With an eye on creating “value beyond compliance”, Webber Wentzel says mining companies will increasingly require the support of trusted advisers who understand the complex and multi-dimensional challenges facing the sector.

With this in mind, the firm provides targeted solutions that enable its clients to concentrate on their core priorities – production and operations, alongside leaving a positive legacy of sustainable development.

Seeking advice on issues such as meaningful stakeholder engagement, economic diversification, supply chain alignment, regulatory certainty, fit-for-purpose infrastructure, skills transfer and development and proactive regulatory engagement also assists in fostering trust and confidence among key players in the sector.

Challenges

South Africa’s mining sector faces challenges such as supply chain constraints; infrastructure issues, including operational inefficiencies at Transnet’s rail and port facilities; rising operational costs; and increasing demands from communities for mining companies to provide basic services, which should otherwise be the responsibility of the local municipalities within which certain operations are located.

Further, cybercrime and geopolitical risks are growing concerns, and Webber Wentzel points out that communities are becoming more organised and vocal by leveraging social media, dispute resolution platforms and international advocacy networks to hold companies accountable.

Consequently, addressing these challenges through innovative solutions and enhanced collaboration between the public and private sectors is essential for driving sustainable growth, the firm states.

In this regard, Webber Wentzel notes that ESG, as a risk mitigation strategy, provides a holistic view; but its application is inconsistent across multiple jurisdictions and regions globally.

Meanwhile, to remain profitable, the firm suggests mining companies should seek a better balance between the critical need to remain feasibly productive and focus on profit-generating activities, while at the same time mitigating risk and meeting evolving expectations of stakeholder-inclusive and rights-based decision-making strategies.

“As the world moves towards net-zero goals and targets, the demand for rare earth elements and critical minerals such as lithium, cobalt, nickel and copper is skyrocketing. Southern Africa, with its rich resource base, has an opportunity to position itself as a key player in the global critical minerals value chain,” the firm highlights.

A strategic and sustainable approach to developing these resources could attract billions of dollars in foreign direct investment, catalysing infrastructure development, creating jobs across primary, secondary and tertiary sectors, and fostering socioeconomic upliftment, the firm adds.

The value chain opportunities offer a pathway to economic diversification and long-term economic resilience.

While the emphasis is often on processing critical minerals locally rather than the historical pattern of exporting of raw materials, Webber Wentzel says this approach will require substantial investment and must be economically viable while considering the lifespan of the underlying mineral resource.

Looking ahead, the firm says there are both hurdles and opportunities in South Africa’s mining sector, as the sector lags behind some of its Southern African Development Community neighbours in attracting investment and modernising mining regulatory systems. For example, the firm cites Zambia as an example of a country that has been particularly successful in creating a regulatory framework that appeals to investors and encourages mining.

Given the global push towards critical minerals, Webber Wentzel says South Africa needs to make the most of tools such as the Junior Mining Exploration Fund to explore and develop these resources.

South Africa must prioritise the improvement of its exploration capacity by leveraging this Industrial Development Corporation fund and other available exploration funds to accelerate the exploration of critical minerals, as failing to do so represents a significant missed opportunity to participate in the just transition towards a greener economy.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation