New African owners of Ibhubesi gas prospect aim to settle Ankerlig supply deal in 2017

The new African owners of the Ibhubesi Gas Project (IGP), off South Africa’s West Coast, report that negotiations with Eskom for the supply of gas to the Ankerlig power station are ongoing, with the conclusion of a gas supply agreement (GSA) targeted for the second quarter of 2017.

The project was previously held by ASX-listed Sunbird Energy, which has since been delisted, following a deal consummated on July 28. The value of the transaction has not been disclosed, but the deal was reportedly priced at a discount to the IGP’s independent report valuation of R364-million.

The deal has resulted in Sunbird being “Africanised”, with the new owners being Umbono, led by Sunbird executive chairperson Kerwin Rana, Vandasia, a South African-Nigerian consortium, Musa Capital, an Africa-focused private-equity firm and PetroSA, which has retained its 24% stake.

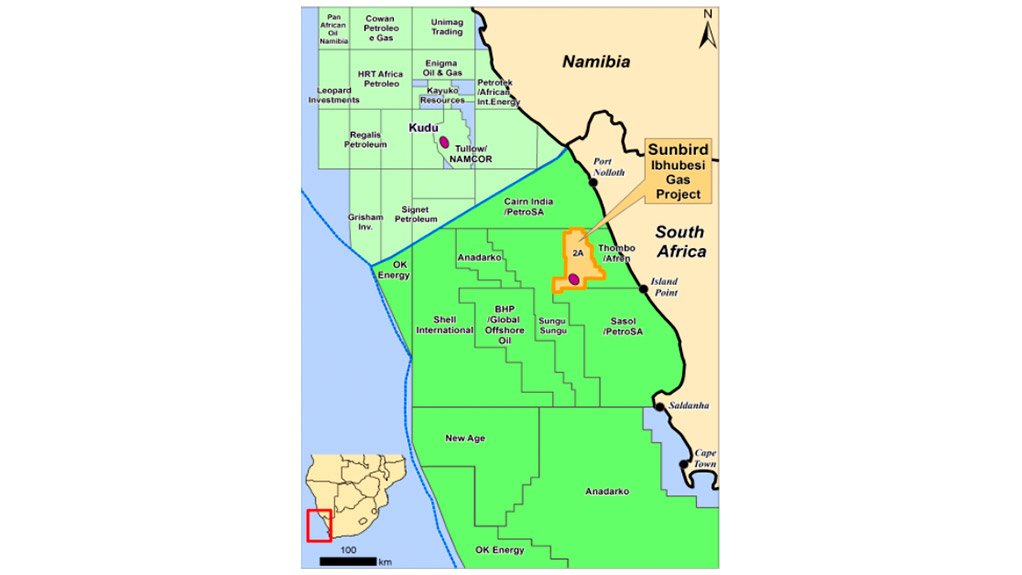

Rana says IGP, which is situated 80 km off of the Northern Cape coast, is currently over 50% black-owned and he reports that Sunbird is hoping to attract additional local investors to a project of “strategic and national importance to South Africa”.

To date, eleven wells have been drilled at the field, which was initially discovered by PetroSA predecessor, Soekor, in the mid-1980s. A combined R1.6-billion has been invested in this exploration effort, through which half-a-trillion cubic feet (Tcf) of gas has been proved. Sunbird stresses, though, that only a portion of the 5 000 km2 Ibhubesi production licence area has been explored and is, therefore, confident that the reserves can be expanded to 8 Tcf with further resource development work.

However, current reserves are said to be sufficient for commercialisation. “All that would be required would be the finalisation of a GSA, which would then allow for the detailed front-end engineering design (FEED) to be conducted.”

Progress, therefore, hinges on the Eskom GSA, where “a few critical commercial issues still need to be agreed”.

Should a deal be concluded, a 9- to 12-month FEED phase would be undertaken, followed by a 30- to 36-month construction period. The company is hoping to supply first gas to Ankerlig, which is being converted to operate on either diesel or gas, in 2020 or 2021.

“Sunbird is in discussions with funders and technical partners to fund the FEED phase of the project, but the timing is currently aligned to the GSA conclusion. Once the FEED is completed, Sunbird will look to more conventional project financing for the overall project development.”

Musa Group CEO William Jimerson believes the restructuring of the company has improved prospects for the development of the IGP. “Sunbird was not benefiting from being listed on the Australian Stock Exchange. There was limited appetite in the Australian market for early-stage energy companies. In addition, the Australian public market, in our view, was not the appropriate platform to raise development capital for African projects.”

Jimerson believes the privatisation and localisation makes the investment more attractive for African-based funders, especially in light of Sunbird’s status as a majority black-owned company. “In the South African context, it is assisting with the securing of a market for the gas,” he adds, noting that Eskom is keen to contract with black-owned primary-energy suppliers.

Rana reveals that Eskom would like to participate in gas directly, in addition to its role as an offtaker. “Currently our discussions are centred around finding solutions to an appropriate load and pricing profile which is mutually beneficial over the long-term.”

The recently published draft Integrated Resource Plan (IRP) base case is also viewed as supportive, with gas-fired electricity production allocated a larger share in the future mix than is the case in the current IRP. The base case outlines the introduction of 35 292 MW of open-cycle and combined-cycle gas turbine capacity by 2050.

While Sunbird has limited its current GSA focus to Eskom, it is nevertheless investigating additional markets, including heavy industrial users on the West Coast. It also remains open to supplying new gas-fired independent power producers.

The company is also not concerned about the decision of the Department of Energy to exclude Saldanha Bay from the initial phase of the proposed gas-to-power programme, nor the programme focus on liquefied natural gas imports. “We view this as positive for the IGP; this now creates space for the project to be the first gas development on the West Coast of South Africa,” Rana says.

He adds that the benefit of domestic gas developments is the opportunity for rand-based pricing. “However, the IGP does not intend to compete with imports into the East Coast of South Africa. The IGP is focused on providing gas to Ankerlig and other ancillary opportunities on the West Coast of South Africa.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation