New analysis points to dramatic reshaping of trade lanes amid tariffs and geopolitical tensions

A new scenario analysis of global trade points to ongoing trade growth over the coming decade despite the imposition of tariffs and rising geopolitical fragmentation. However, it also suggests that the shape of trade could change considerably over the period, including for South Africa.

Published by the Boston Consulting Group (BCG), the analysis incorporates four scenarios, including a so-called ‘patchwork’ scenario that BCG says is gaining momentum.

BCG Global Advantage Practice global leader Aparna Bharadwaj, who co-authored the report, argues that the future of global trade won’t be defined by a single set of rules but by a patchwork of relationships and regional priorities.

“For businesses, this isn’t just a policy shift. It’s a strategic inflection point. Our modelling shows that even amid rising fragmentation, trade remains on a clear growth trajectory, and the advantage will go to those who move early to adapt and lead in this evolving landscape,” she adds.

Under the patchwork scenario goods trade is more resilient than many would anticipate given mounting frictions, epitomised by the tariffs imposed by President Donald Trump; actions that have expanded the share of US imports covered by tariffs from 13% to 61% since January 2025.

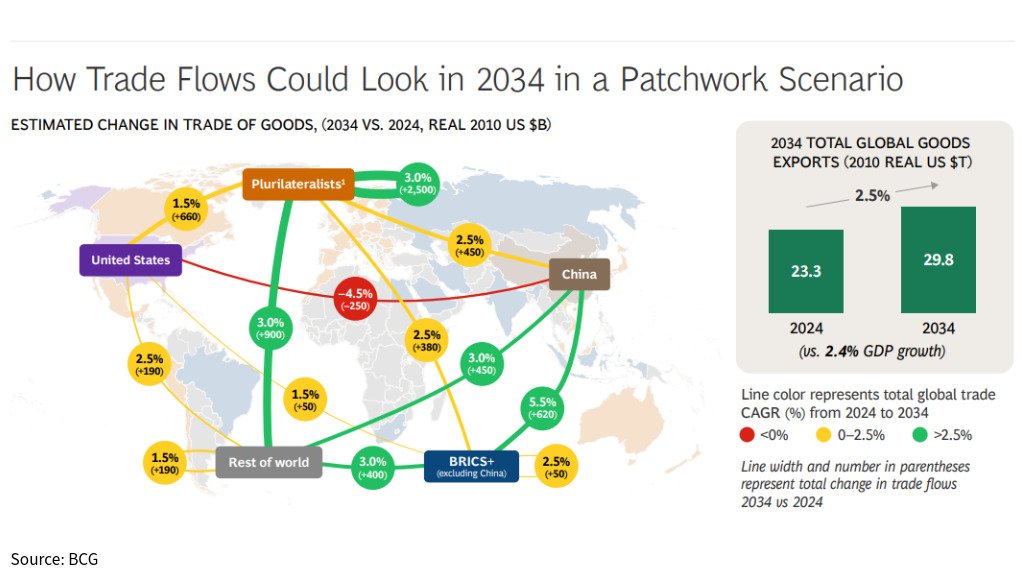

Trade grows under the scenario by 2.5% yearly from around $23-trillion in 2024 to nearly $30-trillion in 2034 and slightly fastener than global GDP.

However, the trade lanes those goods travel are “dramatically reshaped”, with trade flows gravitating around what the BCG describes as four main nodes, namely the US, China, and two informal groupings labelled the ‘Plurilateralists’ and the ‘BRICS+ excluding China’.

The BRICS+ grouping includes South Africa, alongside Brazil, Russia, India, and nations that joined later, such as Egypt, Ethiopia, Indonesia, Iran, and the United Arab Emirates.

Trade relationships involving this grouping is shown to expand with the Global South as well as China, facilitated by the steps being taken by BRICS+ to collaborate with each other on trade.

The approach to trade differs from country to country, with some negotiating deals with other groupings and some not. However, most typically prioritise sovereignty and retaining policy flexibility rather than entering deeper integration frameworks.

BRICS+ nations excluding China face significant trade winds as they navigate steeper US tariffs of 27.5% while deepening commercial ties with China and the broader Global South, the reports states.

Nevertheless, the findings project 3.3% annual growth through to 2034, with trade linked to China accounting for 40% of this increase.

“What makes this trajectory particularly compelling is the infrastructure being built to accelerate intra-BRICS+ commerce,” the BCG states.

“Institutions like the BRICS New Development Bank and expanding non-USD local-currency payment rails are reducing financing and settlement frictions that have historically constrained South-South trade.

“Enhanced logistics connectivity, customs simplification and harmonisation, and digital trade processes are providing practical enablers, while business-led initiatives such as the BRICS Business Council are gaining traction.

“As the bloc works to narrow its current $93-billion trade deficit with China, these mechanisms will be critical to unlocking comparative advantages in energy, metals, mining, and agribusiness, while India and Brazil continue scaling their manufacturing and higher-value production capabilities.”

Meanwhile, the analysis points to the US’s share of global goods trade declining as it maintains its ‘America First’ focus, while China’s trade growth is projected to grow.

“China’s trade growth with the Global South would be driven by its growing need for energy, foods, and industrial inputs, as well as new markets for its finished goods.

The BCG model outlines particularly strong 5.5% CAGR for China over the next decade with other BRICS+ nations and 3% CAGR with the rest of the world.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation