New-vehicle market on the mend; exports continue to plummet

New-vehicle sales in November continued the positive momentum seen in October increasing by 8.1%, to 48 585 units, compared with the same month last year.

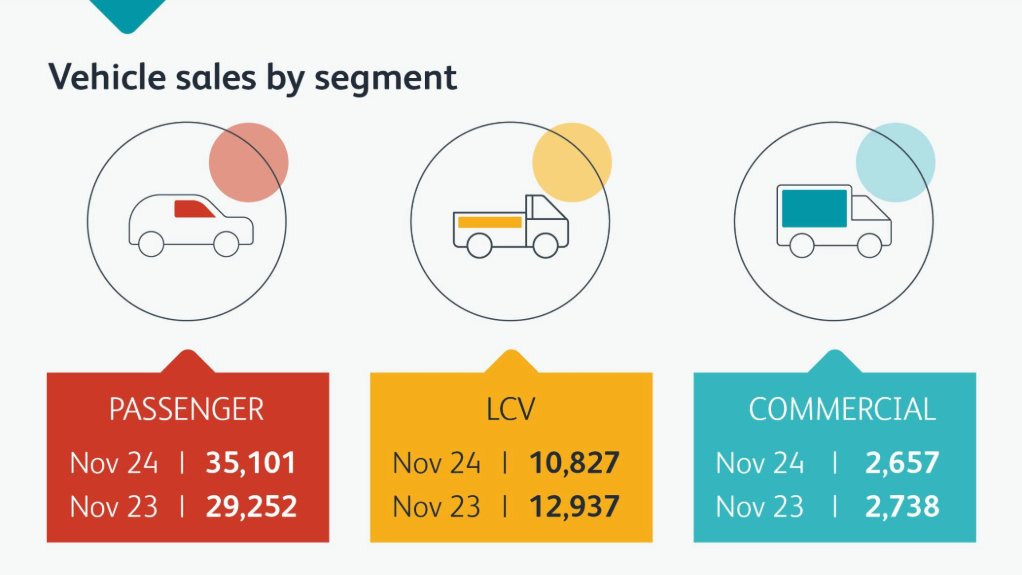

naamsa | The Automotive Business Council reports that the new-passenger-car market jumped by 20%, to 35 101 units during November, with car-rental sales accounting for 19.5% of this number.

The new-commercial-vehicle market failed, however, to mimic this performance.

Sales of new bakkies, vans, small trucks and minibus taxis – light commercial vehicles – dropped by 16.3%, to 10 827 units.

Medium-truck sales declined by 9.2%, reaching 699 units, while heavy-truck and bus sales dipped by 0.5%, to 1 958 units.

New-vehicle export sales also continued its dismal performance in November, dropping by 28.6%, to 30 431 units.

For the first 11 months of the year, vehicle exports were now 23.9% below the corresponding period last year, driven mainly by poor economic conditions in South Africa’s major export markets.

Naamsa believes that November’s sales numbers could signal the start of a long-awaited upward trend in the new-vehicle market.

“In view of the stronger year-end performance, new-vehicle sales were now only 3.5% below the corresponding period in 2023.

“Further interest rate cuts in the new year would support vehicle affordability across all the various segments.”

National Automobile Dealers’ Association (NADA) chairperson Brandon Cohen notes that November is traditionally challenging for the motor industry, as many consumers postpone purchases until January to benefit from new-year registrations, or await year-end bonuses, typically paid in December.

“Despite these factors, dealers have navigated the month with careful strategies, considering the competitive environment.”

He adds that the commercial vehicle market continues to reflect the economic challenges facing SA Inc.

As year-end approaches, there is hope within NADA for a strong end to the year.

“With some stock available in key segments and marketing support from manufacturers expected, there is potential for a positive finish to the year,” says Cohen.

“The strong rental industry sales signal a promising festive season, which we hope will set the stage for a better trading year in 2025.”

Consumer Budgets Still Strained

According to WesBank, November sales delivered the best performance for the new-vehicle market since March last year.

“But, there is a lot more momentum to create before the country’s automotive industry can rest easier,” warns marketing and communication head Lebo Gaoaketse.

“Consumers remain under severe household budget constraints, displayed in two key pieces of WesBank data.

“The average deal size financed by the bank is 6% lower year-on-year for new vehicles, indicating affordability concerns amid new-car-price inflation.

“In addition, despite sales being significantly higher than a year ago, demand as measured by [credit] applications has softened substantially.”

“Consumers have welcomed the second interest rate cut and will be hoping for the trend to continue,” says Gaoaketse.

“In addition, the energy crisis is seemingly under control, inflation has been lower for five consecutive months, the currency is performing better, and fuel prices are contributing to budget savings – but all this positive impetus will take time to filter through to overall market performance and general consumer affordability.

“We continue to be on the slow path of recovery, and while positive market growth for two months should be celebrated, cyclically softer December sales should be expected as consumers delay purchase decisions into the new year.

“However, the market remains primed for some stability during 2025 if October and November performances can be sustained.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation