South Africa will continue to remove barriers to growth and investment, Ramaphosa tells investors

Having already announced a key reform for the electricity sector, President Cyril Ramaphosa told international investors on Thursday that the country will continue to remove barriers to growth and investment through the Operation Vulindlela delivery mechanism.

In an address to the SA Tomorrow virtual conference hosted by the JSE, and banking groups Citi and Absa, Ramaphosa reiterated that Operation Vulindlela was “focusing on key reforms that we need to implement in energy, water, telecommunications, as well as in our ports and on our rail”.

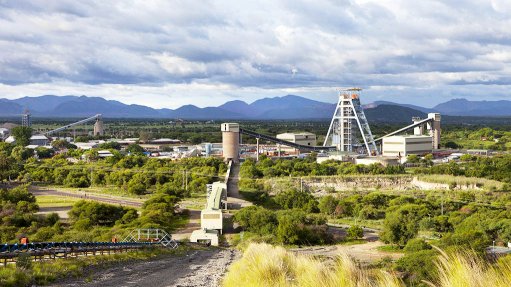

The President has been widely praised for his June 10 announcement that the current 1 MW licence-exemption cap on embedded electricity generation facilities at mines, factories and farms would be lifted to 100 MW and that these plants would also be allowed to wheel electricity through Eskom and municipal networks and sell to unrelated third parties.

The electricity reform signalled the growing influence of Operation Vulindlela, established jointly by The Presidency and the National Treasury, in clearing the way for the implementation of those growth-enhancing reforms that had either stalled or were facing legal or policy hurdles.

Speaking on the same platform, Finance Minister Tito Mboweni described the action taken to facilitate investment in new power generation by large consumers as a “very, very important” structural reform in support of government’s Economic Reconstruction and Recovery Programme (ERRP).

The ERRP, which was announced in October, is government’s response to the economic fallout from the Covid-19 pandemic, which triggered a 7% contraction of the economy and the loss of more than 1.3-million jobs, as well as ten years of economic drift, which saw South Africa descend into a recession even before the Covid lockdowns.

“The power constraint is something that we have to pay particular attention to, because this can be a major threat to the economic recovery.”

Mboweni said that Operation Vulindlela’s main focus was on addressing problems in South Africa’s network industries that, if addressed, would have a large impact in fuelling economic growth.

Besides electricity, it was focusing on removing bottlenecks in the country’s poorly performing ports, which ranked near the bottom of a recent global ports benchmarking report produced by the World Bank, as well as on rail and road constraints, water infrastructure backlogs and the high cost of digital services.

He described delays to auctioning spectrum as “nauseating”, adding that the key issue that Operation Vulindlela was working on in this area was “to make sure that there is movement – we must move, there are too many vested interests here, both private and public”.

“Therefore, we have to drive this thing, almost with a sledgehammer.”

Outside of the network industries, Mboweni expressed an openness to other reforms, including a willingness to consider labour market reforms and some form of basic income grant (BIG).

As Labour Minister in the Nelson Mandela administration, Mboweni had played a central role in the establishment of the 1995 Presidential Labour Market Commission, and said it was possible that a new commission should be convened to assess whether South Africa’s current labour market framework was hampering the development of small businesses.

South Africa, he added, should debate the appropriateness of a BIG as part of the development of a comprehensive social security system.

POSITIVE SHOCK

South African Reserve Bank governor Lesetja Kganyago said that, while the bank had no direct role in influencing supply-side reforms, it was highly supportive of the action government was taking in this regard, as the prevailing structural constraints to growth could not be influenced by monetary policy.

Nevertheless, he said the bank stood ready to continue to offer support to the economic recovery, as it had done in 2020 when it reduced interest rates to historically low levels.

The bank, he said, was alive to the fact that inflation was starting to rise, as well as the prospect that developed economies were considering “normalising” their monetary policy positions.

“The question for South Africa is, when that normalisation takes place, how will South Africa be affected?” Kganyago mused.

The main channels, he said, would be through the real economy, including the impact on commodity prices, through the repricing of global financial assets and a realignment of global exchange rates.

To date, the rise in commodity prices had been positive for South Africa, but there was risk that the realignment of exchange rates could seep through into domestic inflation, which is when “the central bank would have to act”.

“So, our response will not be to the normalisation per se, but it would be a response to the change in the inflation outlook.”

However, he stressed that South Africa was less vulnerable to any normalisation than it would have been in 2020, when it had a current account deficit and a strongly rising Budget deficit.

“Today, as things stand, South Africa is less vulnerable than it was last year.”

The country had a current account surplus, a Budget balance that has recovered faster than was initially expected, which is helping National Treasury stabilise the debt, and the economy was experiencing a positive recovery ‘shock’ driven by commodity prices.

“The big issue for us is whether the policymakers will use that space to continue to stabilise public finance and the behaviour, so far, is that is exactly what the Treasury has done.

“So we will be going into this normalisation from a fairly solid basis,” Kganyago said.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation