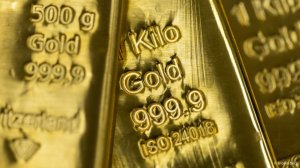

South African gold producers see bright future amid soaring prices

With the gold price having surged above $4 000/oz for the first time ever on October 8, South African gold producers are becoming bullish about their prospects in a sector that has been described as being in decline by critics over the last few years.

“We see incredible possibility. We don’t see a sunset industry. And what better point to be in today, with the gold price at $4 000/oz? We should be able to make money at nearly R2.5-million a kilogram. We do see a declining grade profile, but the current gold price is helping out incredibly,” Sibanye-Stillwater Southern African region chief regional officer Richard Cox said on October 9 at the Joburg Indaba, in Sandton.

He noted that when he started in the mining industry years ago, a big gold mine in South Africa was producing about 3 t a month of gold.

“One of our biggest gold mines today is doing 300 kg a month. So at the slower speed, we are still seeing incredible possibilities, where history has maybe left [those assets] behind, and so we're moving into those spaces. We are actually really positive about gold. It sparks a dream and we're going to pursue that.

“We are very happy to be in gold, and more especially today. I think the stars are aligning. It hasn't always been that way. Gold has offered the opportunity for the company to diversify, and the company has . . . branched out into the platinum group metals (PGMs) industry. We've also had ambition to move outside of South Africa, where we've moved into adjacencies in battery metals and recycling businesses,” Cox said.

Other panel members were just as enthused about gold, given the soaring price.

“We don't believe that gold is a sunset industry. I have worked in gold mining for seven to ten years before, and we believe that there is an opportunity to look at the current assets and rethink them differently.

“We see an elevated gold price as an opportunity. We are imminently acquiring assets in this space, and we will be continuing to grow and extend the lives of those assets,” Bokamoso Gold CEO Billy Mawasha said.

When challenged on whether the bright future of gold mining in South Africa was a just a dream or a workable reality, he doubled down.

“It is being implemented. We have taken steps, so we are not just dreaming. We have actually engaged in processes to acquire some of these assets, because we do believe the gold price environment [is sustainable], and it's important that we invest in this industry if we want it to continue.

“We believe that gold was the bedrock of this country and, for as long as the gold price remains elevated, we need to take that advantage,” he said.

He pointed out that his confidence in a sustained elevated gold price came from his interactions with peers and reports that indicated increased global economic risk and a growing appetite for gold as a hedge.

For Gold Fields, meanwhile, maintaining profitability in a sector with declining grades comes down to investing in enhanced efficiencies, such as mechanisation and automation.

“The more you invest in that and the accompanying skillsets, the more you'll be able to lower the costs. And if you can lower the costs, you'll be able to sustain the business for various ranges of the gold price. So this is the right time to actually do that,” Gold Fields executive VP Benford Mokoatle said.

When asked for their forecasts of the gold price in the coming year, Mawasha expected it would continue to rise to between $4 500/oz and $5 000/oz.

Mokoatle was reluctant to make a specific price forecast, but he said he was certain that the price would continue to rise over the next one to three years.

“We believe there are gold resources to make this industry a sunrise industry instead of a sunset industry. We believe the future is here for long life assets in the gold space.

“What it will take is risk-based capital to invest in these assets. It will take innovation to rethink these assets to be able to take them to the next level and it will take partnerships. I think we will have to work together as a country – as communities, as investors, and as operators of these assets – to make sure that this future is there,” Mawasha asserted.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation