South Africa's mining sector shifting gears to thrive, PwC highlights

PwC Africa Energy, Utilities and Resources Leader Andries Rossouw and PwC SA Mine Project Leader Vuyiswa Khutlang.

South African mining's performance.

Opening the way for beneficiation.

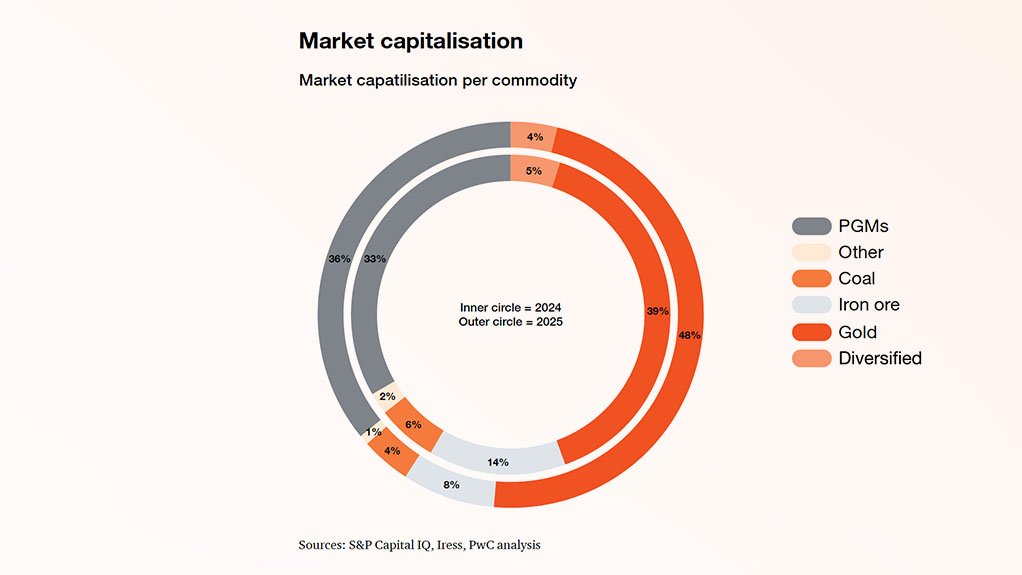

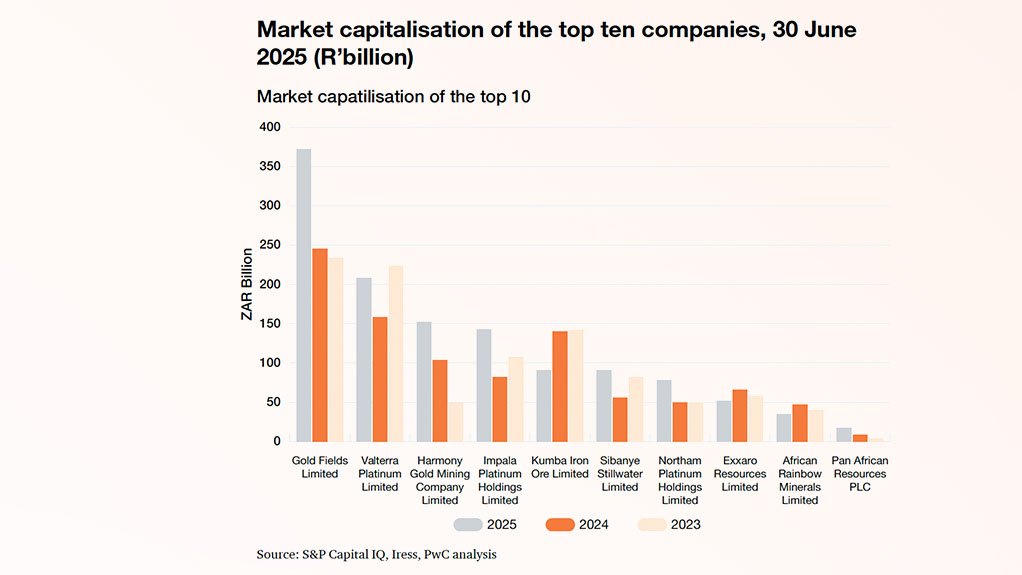

Market capitalisation.

JOHANNESBURG (miningweekly.com) – South Africa's mining sector is shifting gears to thrive following a year of strategic recalibration to position itself for future growth. This was among the many messages of PwC Africa energy, utilities and resources leader Andries Rossouw and PwC SA mine project leader Vuyiswa Khutlang in their presentation on Tuesday of PwC's 50-page 'SA Mine 2025'.

In the 12 months to June 30, gold has reached record highs, platinum group metals (PGMs) have rebounded, and green metals are continuing to rise in strategic importance amid electrification, energy storage and networks all requiring extensive volumes of copper, nickel, lithium, cobalt, manganese, vanadium and rare earth elements.

South Africa's mining sector continues to face structural challenges, including an exploration backlog, slow licensing processes, limited capacity for battery-grade production, and a shortage of skills in hydrometallurgy and chemical processing.

These issues are compounded by intense competition for capital, particularly against jurisdictions with faster permitting regimes.

In response, the government's critical minerals strategy aims to close these gaps by prioritising geoscience investment, streamlining permitting, enhancing local value addition, and enabling infrastructure such as power and logistics. The strategy also focuses on developing skills, supporting research and development and introducing tailored financing mechanisms.

Importantly, it promotes balanced exports and regional value chains – an approach that aligns with the African Union's green minerals strategy.

In the 12 months to June 30, politics steadied, policy showed intent, and boardrooms reshaped portfolios for the next cycle.

Mining output rose 2.4% year-on-year, supported by a higher production of PGMs, coal and chrome.

The mining industry's contribution to South Africa's GDP remained broadly stable at around 6%, underscoring its continued strategic importance despite employment and cost challenges.

Mining’s market capitalisation rose by 8%.

Third-party access to rail moved from concept to early implementation, signalling gradual progress in infrastructure reform.

The integration of renewable energy and decarbonisation is being embraced as part of its electricity consumption strategy, aiming to achieve cost savings and a greener energy mix.

As of June 30, 1 820 MW of renewable energy capacity had been installed of the 3 500 MW pledged.

Also advancing are digitisation and AI, capital allocation, restructuring, maintenance, water management and waste management.

The mining sector's commitment to cost-saving initiatives reflects a strategic advance toward operational resilience, sustainability and long-term competitiveness through control of the controllables.

Net profit in the 12 months to June 30 was up 24%, an increase of R16-billion, and the aggregate tax expense of the mining companies was R26-billion, at an effective tax rate of 25%.

Free cash flows increased by 219% owing to the increase in profits, more specifically those in the gold sector.

Gold's sustained rally has re-priced revenues and cash flows across the industry. For African miners and policymakers, the question is not whether gold is valuable but where that value accrues along the mining chain and how to close the persistent valuation gap with global peers.

However, equity valuations continue to lag. Globally, gold miners' shares have not kept pace with bullion prices during this cycle and for African miners, the discounts are often even wider. This is because of the perceived sovereign and operating risks of the jurisdictions in which they operate. Even some of the continent's top producers continue to trade at a discount to their global counterparts and to the metal itself. This is despite Africa being central to the global gold narrative. The continent has the geology, projects and producers to prove it. The challenge is translating strong commodity prices and macroeconomic shifts into enduring equity value at home. With stable policy, resilient energy and pragmatic beneficiation, Africa can close the value gap and convert today’s gold price windfall into long-term global competitiveness.

And why did chrome increase? Well, chrome prices incentivise production and many of South Africa’s PGM producers are now maximising chrome product revenue and supporting the overall PGM basket price. Platinum prices have rebounded to decade-high levels and rhodium recovered to more than $7 000/oz.

WHAT IT WILL TAKE TO WIN IN 2026

To progress well, South Africa needs to "unblock the arteries", scale third-party rail access, secure corridors, get locomotives moving, and restore predictable slotting for coal, iron-ore and manganese.

It needs to fix energy at source, accelerate private generation and wheeling, lower and stabilise tariffs and prioritise grid access for self-generation.

It must turn policy into projects, convert the critical minerals strategy into faster permits and pilot processing hubs and offtake-anchored financing.

Keep capital disciplined. Buy control where it compresses timelines, back long-cycle barrels of value – copper, high-quality manganese, future-facing ounces – over barrels of volume.

Success in 2026 will hinge on unlocking infrastructure bottlenecks, accelerating private energy solutions, translating policy into investable projects and maintaining capital discipline. In a volatile and fast-evolving landscape, agility, control and execution will separate the leaders from the laggards.

CRACK DOWN ON ILLEGAL MINING

Over the past decade, illegal mining in South Africa has received extensive media coverage aimed at raising awareness, outlining planned interventions and highlighting both public and private sector responses to the growing challenge. Yet, despite these efforts, illegal mining remains a persistent and escalating concern.

Its impact is far-reaching: it affects the well-being of communities near mining operations, compromises environmental integrity, undermines human rights and poses serious risks to the cost and operational safety of legitimate mining activities.

The economic consequences are equally significant. These include increased State spending to manage the issue, the cost of protecting assets, the loss of revenue and disinvestment by mining companies, which in turn leads to retrenchments and rising unemployment. At its core, illegal mining is a symptom of deeper socioeconomic challenges facing South Africa and neighbouring countries: high unemployment, entrenched poverty and sluggish economic growth.

Time and resources have been spent by both the private and public sectors to address the illegal mining concerns.

In January 2025, the Minister of Mineral and Petroleum Resources reported that there were some 6 000 abandoned mines in South Africa and R60-billion in losses owing to illegal mining. This marks an increase of about R53-billion since 2017.

While data sources vary, what is evident is that from 2017 to now, there's been a notable shift in that illegal mining is being tracked more closely, its impacts are better understood, and its footprint has expanded.

As no single stakeholder can address the challenge of illegal mining alone, a collaborative effort between government, communities and the private sector is essential. So, what has been done over the years to respond to this growing issue?

Various initiatives have been introduced – from increased enforcement and legislative amendments to community engagement and private sector-led asset protection strategies. The response has evolved, but the need for coordinated action remains critical.

While the statistics of arrests over the years are not readily available, media reports have covered the various arrests of illegal miners over the years. The government established nationwide operation Vala Umgodi in 2023 to combat illegal mining in seven provinces – the Free State, Gauteng, KwaZulu-Natal, Limpopo, Mpumalanga, North West and the Northern Cape. According to the National Integrated Plan on Illegal Mining Operation Vala Umgodi, since December 2023, 16 645 cases have been opened, and 20 367 arrests have been made. Looking forward, the South African Police Service has been allocated around R1.8-billion to acquire assets and deploy 4 302 personnel over 18 months and there have been four work streams established to address the various aspects of illegal mining.

CLOSING AFRICA'S VALUE GAP

Operators should prioritise power resilience, through independent power producers to de-risk beneficiation, foster an environment of regional collaboration on processing and skills development, and practice disciplined capital allocation by means of strategically deploying capital into the highest-return projects while rigorously managing risks and aligning with the company's long-term goals and factoring in long-term gold prices in analysis and planning of new projects.

Policy makers should ensure that beneficiation is commercially viable through prioritising energy stability, introduce regulatory stability to eliminate uncertainty and remove obstacles in the way of investment growth and create lasting investment environments.

Africa is central to the global gold narrative and has the geology, projects and producers to prove it. The challenge is translating strong commodity prices and macroeconomic shifts into enduring equity value at home. With stable policy, resilient energy and pragmatic beneficiation, Africa can close the value gap and convert today's gold price windfall into long-term global competitiveness, PwC pointed out in 'SA Mine 2025'.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation