Aerospace group Embraer reports a smaller loss for the third quarter, in year-on-year terms

Brazil-based global major aerospace group Embraer reported its results for the third quarter of this year (3Q22) in São Paulo, Brazil, on Monday. The group reported a net loss (attributable to Embraer shareholders) for the quarter of $30.2-million. This, however, represented a significant year-on-year (y-o-y) improvement: during the third quarter of last year (3Q21), it had recorded a net loss of $45-million.

At the end of 3Q22 the group had a net debt of $1.3-billion. Again, this was a significant y-o-y improvement, the net debt at the end of 3Q21 having been $1.8-billion. “The decrease in the company’s net debt position is a result of cash generation during the last four quarters and also Embraer’s liability management strategy to reduce the gross debt and the interest expenses,” said the company.

Adjusted earnings before interest and tax in 3Q22 came to $50-million, up from the $36-million recorded in 3Q21. Consolidated revenues in 3Q22 were $929-million, a 3% decrease y-o-y, as a result of lower revenues in the Defence & Security business (partially offset by higher revenues in the Commercial, Executive and Services & Support businesses). “Free cash flow in 3Q22 was negative $109.4-million, mainly explained by working capital increase due to higher deliveries in 4Q22 which will reverse to a positive trend,” reported Embraer.

In 3Q22 the group spent $13.8-million on capital expenditure and $28.2-million on product development. The research budget came to $12.8-million.

The Commercial Aviation business reported a 5% y-o-y increase in revenues, which totalled $253.3-million. However, the consolidated gross margin, 5.4%, was lower than the 6.5% recorded in 3Q21. Executive Aviation had 3Q22 revenues of $271.1-million, a 6% increase, y-o-y; gross margin was 19.7%, compared with the 21% achieved in 3Q21.

In 3Q22, the Defence & Security business saw its revenues drop by 42% y-o-y, to $101.7-million. This was largely the consequence of less ‘percentage of completion’ revenue recognition from the A-29 Super Tucano programme. Gross margin in 3Q22 was 17.2%, whereas in 3Q21 it had been 23.7%.

The Services & Support business saw its revenues increase 7%, y-o-y, during 3Q22, reaching $295-million. Its gross margin (31%) was also up from 3Q21’s 25.9%.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

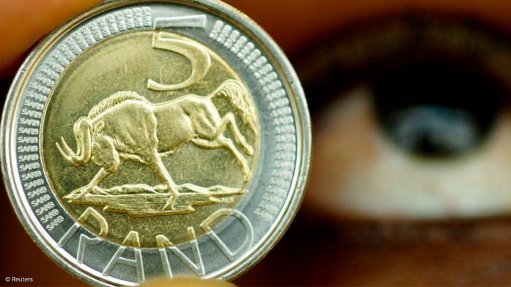

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation