Cluster mining model promising steady-state advantage for Copper 360

JOHANNESBURG (miningweekly.com) – Conventional mining typically focuses on a single large operation. In contrast, what is unfolding on South Africa’s Northern Cape Copper Belt is the deployment of a cluster mining model, which embraces 12 opencast and underground mines that are being developed in a manner akin to artisanal mining.

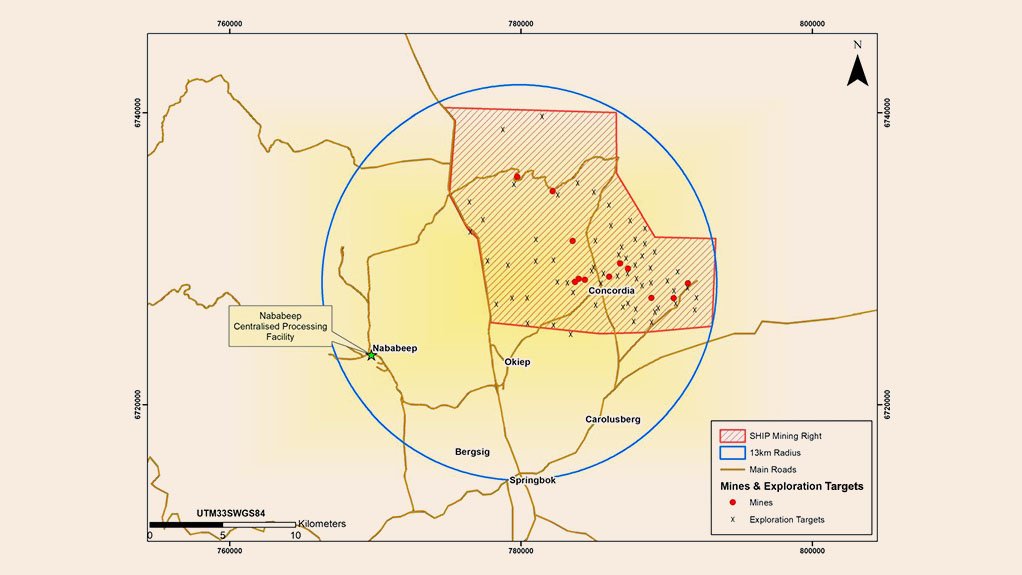

The dozen mines – and in time there will likely be many more as the cluster area hosts another 50 exploration sites – will all make use of the same copper processing infrastructure. (Also see attached infographic.)

Interestingly, the cluster mining model being implemented by Johannesburg Stock Exchange (JSE) AltX-listed Copper 360 – AltX CPR – allows for the simultaneous development and operation of multiple mines within a single region.

Importantly, this provides an opportunity to sidestep mining’s usual downtime, grade fluctuation, development and depletion challenges, in a way that single large-scale operations cannot.

Put more clearly, when one mine experiences production issues, the other mines are made to lift their game to keep output on an even keel.

The 12 opencast and underground mines in question are within 13 km of one another, across more than 19 000 ha.

All will process their ore in Nababeep, the Namaqualand copper town 19 km north-west of the town of Springbok.

The orebodies include Rietberg – which is already in production – Jubilee and Homeep – which are next in line to do so – as well as Klondike, Wheal Julia North, Whyte’s West, Koeëlkop, Hoogkraal and Waaihoek.

While the mines are geographically close, they differ in size, ore grade, stage of development, and operational status, reflecting a form of risk-lowering that diversification normally provides.

If one site within the cluster experiences a drop in ore grade, focus will be shifted to a site that hosts higher grade ore, or the rate of higher grade extraction will be stepped up to ensure steady-state production.

This dynamic approach makes the best of high-, medium- and low-grade orebodies, hedging grade fluctuation and geological surprise through grade mix.

Very importantly, too, the cluster mining model being deployed reduces environmental impact by eliminating the need for multiple waste dumps, with the process area hosting a single tailings facility.

In addition, the processing is scalable and adaptable. Ore from new mines can be added, or material from existing mines scaled down, based on demand, resource availability and technology advancement.

Besides this flexibility, proximity adds logistical efficiency and rapid response.

Development phases will be staggered to ensure that while some mines are being prepared for future production, others are well into revenue generation, which smooths the production curve and fights shy of peaks and throughs.

The producing Rietberg is a mine of appreciable size, with its three adits giving access to three different levels, which in themselves provide a semblance of mine diversification.

“It's like the key that unlocks all the other orebodies,” Copper 360 chairperson Shirley Hayes enthused to Mining Weekly in an online interview that reflected her keenness to unlock the opencast Jubilee, followed by Homeep East.

Not being at the mercy of a single mine makes it more likely for cash flow to remain steady.

Moreover, by leveraging the strength of each mine type, the cluster model has the potential to achieve consistent production and profitability.

“Never underestimate the power of having various eggs in one basket,” quipped Hayes, in pointing out a cluster model of the kind being deployed can only be duplicated in an area similar to the Northern Cape Copper Belt, with its different orebodies.

“We've been busy for quite a long time. We’ve built our solvent extraction-electrowinning plant, we’ve generated cash flow through the rehabilitation of historic dumps, and we’ve bought Nama Copper, our first concentrator plant, which is in production."

Copper 360's second concentrator plant, which is bigger, is on its way to completion, which will leave the company with two concentrator plants – "which, in a way, is also a form of diversification", Hayes added.

Mining Weekly: Is it correct to suggest that, in many ways, cluster mining resembles artisanal mining?

Hayes: Yes, it can be compared with artisanal mining in that you often find a cluster of artisanal miners surrounding a central process area. The key benefit is the shared infrastructure. Having these mines within 13 km of one another allows us to share transportation routes, infrastructure and services. With the mines located near one another, equipment, personnel, maintenance services can be shared. For example, machinery and skilled workers can easily be relocated between sites as needed, optimising utilisation and reducing downtime. Having mines at different development stages is crucial for balancing downtime and maintaining steady supply. By managing these stages, we can ensure continuous production and minimise the impact of disruption. Within such a process, we can stagger our development phases. Within this is exploration, development and operation, ensuring that there's always a mix of mines contributing to overall output. As some mines are ramping up, others may be ramping down or undergoing maintenance. That creates a balance of flow and can ensure a seamless end-of-life transition. Very important is the continuous supply chain that cluster mining supports and also maybe a continuous average grade that you can control by mixing grades from the different mines, ensuring that the process facility is able to operate at optimal capacity. There's also a consistent flow of product to send to market, avoiding supply shortfalls that could lead to loss of income.

How does the cluster mining model help to lower operational downtime?

Having multiple mines allows for the strategic scheduling of maintenance activities, and the avoidance of production disruption. This planned approach limits unplanned outages and extends the life of equipment and infrastructure. It provides the ability to balance production output across the multiple sites. If one mine faces an operational challenge, the production focus is placed on the next mine with higher grade or fewer issues. The model allows mines to scale up or down depending on operational, downtime and maintenance needs. Even if some mines are underperforming or facing challenges, others can increase production to maintain output. It helps to stabilise supply and protect revenue streams.

CASH COW

The revived Rietberg copper mine is seen as being well on its way to becoming Copper 360's cash cow. Its commissioning has set the company on the way to producing 45 000 t of copper a month at a grade of 1.6% copper, which brings to an end four decades of copper dormancy in this well-endowed district. It is the first copper ore to be produced in the O’Kiep Copper District since 1983.

The acquired Nama Copper Modular Flotation Plant is the processor of the ore and in the near future, the second plant, now under construction, will also treat Reitberg ore.

Plant recoveries of 75% to 85% are being targeted during startup, with previous testwork reporting recoveries of 92%.

Rietberg has a measured and indicated resource of 4 782 000 t at 1.27% copper, representing 60 800 t of copper metal.

The mining licence was one of many consolidated in 2008 by Hayes, who has been working for 16 years to get to this point.

HISTORICAL TAILINGS BUILD-UP

The O’Kiep, Carolusberg, Lower NamaCopper and Upper NamaCopper tailings dams were brought into the Copper 360 fold by the reverse listing that Hayes' SHiP Copper did with Nelson’s Big Tree Copper ahead of Copper 360’s listing on the JSE’s AltX in April last year.

The tailings emerged from the O’Kiep copper company of 1937 and were deposited by the Nababeep, O’Kiep and Carolusberg mines from about 1940 all the way up to the 1990s.

In March, a memorandum of understanding was signed with DRDGOLD’s Far West Gold Recoveries tailings retreatment subsidiary to conduct a due diligence on its copper tailings dams to assess their economic copper recovery viability.

During the due diligence period, which is drawing to completion, Far West Gold Recoveries will, through an independent expert, determine the total tonnage of tailings material by Lidar survey applying a density of 1.4 tonnes per cubic metre.

It is estimated that there are about 50-million to 60-million tonnes of material with grades varying between 0.18% and 1.5% copper in the dumps, with the potential to contain 450 000 t of copper metal in situ.

If the due diligence is viable, a partnership with Far West Gold Recoveries would turn more copper to account in the region.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation