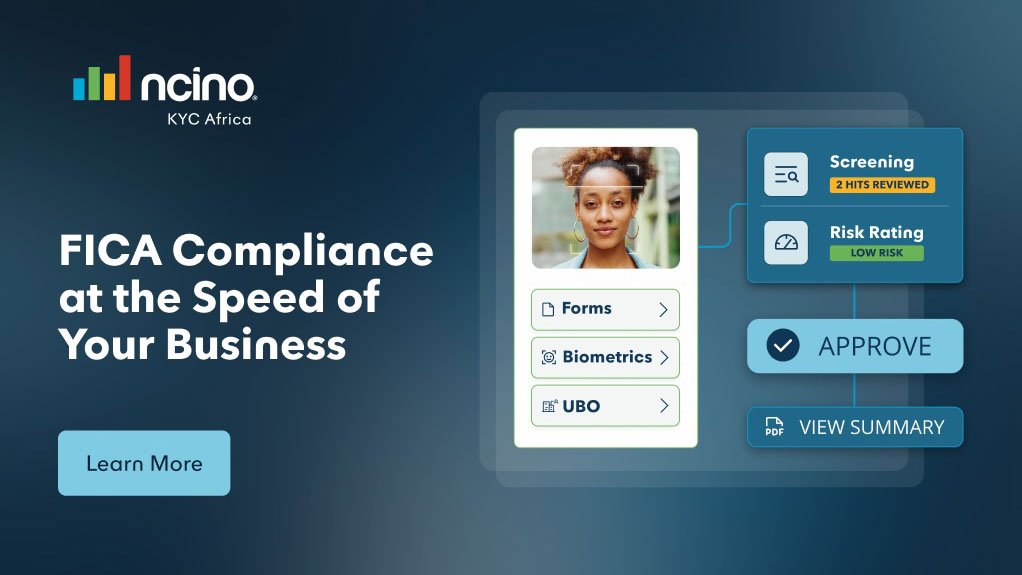

FICA compliance at the speed of your business

High-value goods dealers (HVGDs) in South Africa are increasingly vulnerable to money laundering, with the Financial Intelligence Centre (FIC) identifying them as a key area for concern.

If you sell high-value goods, such as machinery, vehicles, heavy equipment, or medical devices, Financial Intelligence Centre Act (FICA) compliance is not optional. It is a legal requirement that protects your business from criminal exploitation.

The Greylist Delisting

South Africa’s removal from the Financial Action Task Force (FATF) greylist is a milestone, but it is only the beginning. The real risk over the next 12 months is compliance fatigue.

It is tempting to think, “Mission accomplished,” but that would be a critical mistake. Financial crime is a perpetual game of cat and mouse. As criminals grow more sophisticated, FATF standards will continue to evolve. Compliance is not a project with an end date; it is the new normal.

Why HVGD Are Prime Targets

High-value goods are prime targets because they can be easily converted into cash and used to move value anonymously. Without robust compliance processes, your business could inadvertently facilitate money laundering or terrorist financing, risking severe penalties and reputational damage.

Many businesses assume existing processes are enough, or that banks that conduct FICA checks could cover them. This would be a costly misconception.

As a HVGD, you are legally required to perform full customer due diligence for every qualifying transaction, whether they are an individual, a foreign national, or a juristic entity.

To name a few, the list of obligations include:

- Registering with the FIC (consider a dual registration if you are also a credit provider)

- Verifying the identity of individuals or legal entities, including addresses or locations

- Reporting any suspicious activity or transactions to the FIC

A full list of FICA obligations can be found here.

How do You Protect Your Business?

Collecting comprehensive customer information at onboarding is essential, but the bigger risk is failing to reassess clients over time. Risk is not static.

A client who was low-risk at onboarding might become high-risk after a change in ownership, adverse media exposure, sanctions hits, political exposure or relocation to a high-risk jurisdiction. As criminals adopt more sophisticated methods, your business must employ equally advanced technologies to detect and prevent illicit activities.

What if FICA compliance did not have to consume hours of your team's time or drain your resources?

FICA compliance software provider nCino KYC removes the complexity, equipping your team to work faster, smarter and with complete confidence.

Our solution does the heavy lifting:

- Streamlined, secure client onboarding

- Access to South Africa’s most comprehensive Domestic Politically Exposed Person and Prominent Influential Person database, with continuous screening to flag emerging risks

- Automated risk ratings tailored to your business, accelerating assessments without compromising accuracy

Don't let FICA compliance slow your business down or expose you to regulatory penalties.

nCino KYC can help you FICA at the speed of your business. Partner with us to streamline your compliance processes while maintaining the highest standards of due diligence.

Are you ready to see how we can transform your FICA compliance? Reach out today to schedule a consultation with our team.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation