Merafe loss decreases, electricity risk remains, logistics challenge intensifies

Merafe Resources results presentation covered by Mining Weekly’s Martin Creamer. Video: Darlene Creamer.

Japie Fullard

Merafe ferrochrome output down.

Photo by Creamer Media

JOHANNESBURG (miningweekly.com) – Although the loss suffered by ferrochrome company Merafe Resources decreased in 2020, its electricity risk remains and its logistics challenges are intensifying.

Merafe’s revenue and operating income is primarily generated from the Glencore Merafe Chrome Venture, which has a total capacity of 2.3-million tonnes of ferrochrome a year. Merafe shares in 20.5% of the Ventures’ earnings. Overall revenue was 11% down at R4 780-million. (Also watch attached Creamer Media video.)

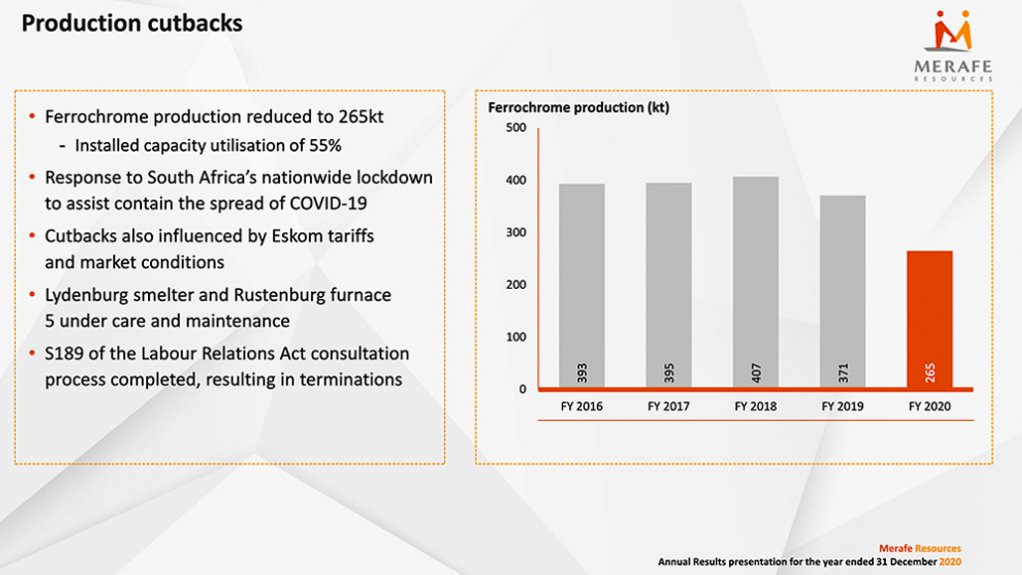

In presenting a 26% decrease in loss and total comprehensive loss for 2020 of R1 003-million, compared with R1 362-million in 2019, Merafe Resources CEO Zanele Matlala reported reduced ferrochrome production and 55% capacity utilisation. There were also cutbacks influenced by Eskom electricity tariffs, weaker market conditions, the Lydenburg smelter and Rustenburg furnace being under care and maintenance and consultation under Section 189 of the Labour Relations Act resulting in terminations

Matlala told a media conference covered by Mining Weekly that, in line with weaker demand, global ferrochrome production decreased by 11.2% to 12.4-million tonnes. However, South African ferrochrome production was 25% lower at 265 000 t on Covid-19, winter shutdowns and weaker demand. Fifteen employees succumbed to Covid, ten of them during the second wave of the pandemic, and Magareng chrome mine also suffered an occupational fatality.

Ferrochrome revenue decreased by 10% to R4-billion and chrome ore revenue by 15% to R777-million.

CHINA'S MAJOR ROLE CONTINUES

China accounted for 61% of global stainless steel production and 57% of global ferrochrome demand, further entrenching its dominance, whilst all other regions decreased.

Chrome exports into China declined by 11% to 14.3-million tonnes, with 82% of the chrome exports from South Africa.

Ferrochrome and chrome ore prices remained under pressure on weaker demand, with ferrochrome prices declining by 8% and chrome ore prices by 15%.

“We are encouraged, though by the notable increase in early 2021 market prices, due to ferrochrome supply restrictions in China and an increase in demand,” Matlala said.

In response to Mining Weekly during question time, Matlala said Eskom’s latest electricity tariff increase of 15.6% was unsustainable and from what the company understand there are indications that Eskom may need increases at that level again in the next year before the tariff increases normalised to the level of inflation.

“That is a concern for us,” she said, adding that electricity costs represented just over 20% of Merafe’s total costs and a process was under way requesting proposals for self-generation.

Glencore ferroalloys head Japie Fullard said the high electricity tariff was one of the major reasons why Lydenburg had been put under care and maintenance, with the latest Eskom increases reinforcing that the correct decision had been taken.

Fullard said that Eskom and the National Energy Regulator of South Africa had authorised applications for a negotiated price agreement, or NPA, and the company’s NPA had been lodged a couple of weeks ago.

“I must say that we had some quick feedback from Eskom; we can see that there’s definitely a need to get the special pricing. If we do not get special pricing, it will just add to our already stressed environment,” said Fullard.

Electricity intensive users, including representatives of the ferromanganese industry, had also been in discussion on how the cross subsidisation penalty suffered by energy intensive users could be eliminated.

“The cross subsidy is definitely what we’re pushing very hard, along with the NPA and the on-site generation via carbon monoxide processes, the Swedish Stirling project at the Lion smelter and also on top of that we’re evaluating a virtual power purchase agreement, which will involve off-site generation, via wind and solar - let’s say in the Northern Cape, and then it will be wheeled on to the grid and used in some of our space. That’s the concept of that and we are at quite an advanced stage in terms of evaluating whether this will make sense. Obviously, it’s important for us to ensure that we take the correct decisions seeing that it’s quite capital intensive and we will be liable in terms of the agreements,” said Fullard.

LOGISTICS CHALLENGE BECOMING FOCUS AREA

During the Covid lockdown last year, the venture’s excellent logistical team was able to move most of its product but post-lockdown the coming back into operation of all the ferrochrome smelters is putting considerable pressure on the company’s logistical supply chain.

“This is happening to such an extent now that we’re really battling now to get our product out, and I’m talking throughout the whole chain, to the ports and from trains. Definitely a big challenge. It’s actually moved to, I would say, one of our top focus areas. On a daily basis, we actually relook at logistical challenges.

“I also believe that a part of this issue that we’ve got with this is unfortunately there are also huge problems on the logistical networks. I’m sure that you will have seen the many challenges caused by cable theft. We’ve got ongoing discussions with the chief executive of Transnet and it’s continuing almost on a weekly basis and we want to join hands to see how we can assist in getting our logistical challenges sorted.

“One of the biggest constraints, definitely, is the availability of the rail capacity. We’ve seen utilisation being as low as 40%. So, really a huge concern for us,” Fullard said in response to Mining Weekly.

RECOVERY OUTLOOK

Merafe said in a release that global stainless steel production is expected to recover with growth of 12.5% projected in 2021, with the supply restrictions in China, as well as the expected increase in demand potentially having a positive impact on ferrochrome prices.

“We will continue to manage factors within our control by continuing to focus on cost management, efficient and safe operations, cash preservation and efficient capital allocation. Our balance sheet remains strong and ungeared which positions us to withstand the challenging times ahead,” the JSE-listed company stated.

The company’s net cash on hand is R278-million, compared with R354-million in 2019.

BOARD CHANGES

Independent nonexecutive director Belese Majova and nonexecutive director Mpho Mosweu will be retiring as members of the board at the Merafe annual general meeting to be held on May 18 and shareholders will be advised once the new appointments have been made.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation