New report outlines strategy for ending load-shedding by early 2024, but delivery hinges on ‘substantial political will’

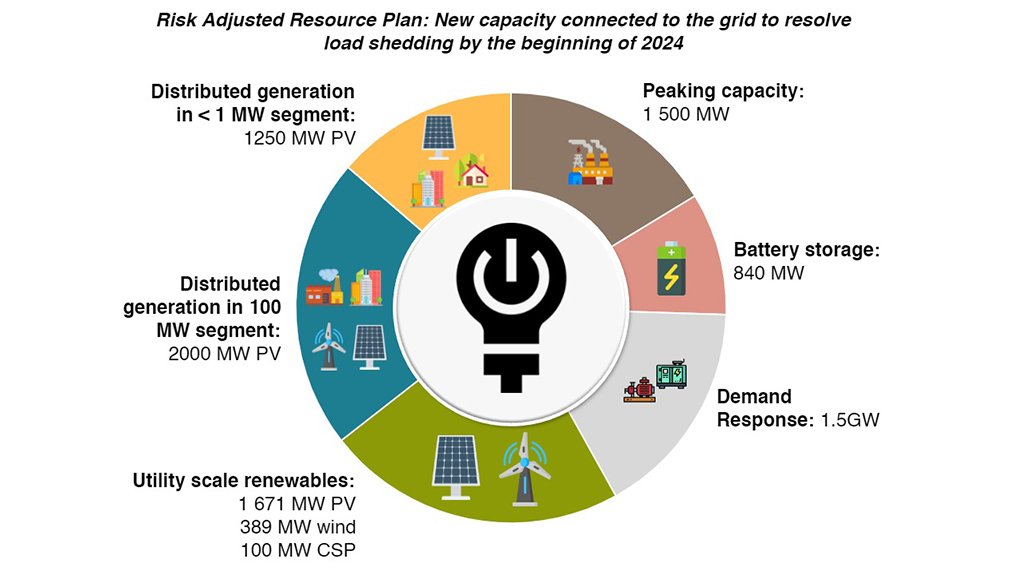

Graphical summary of Solution Case to early 2024, as developed by Meridian Economics

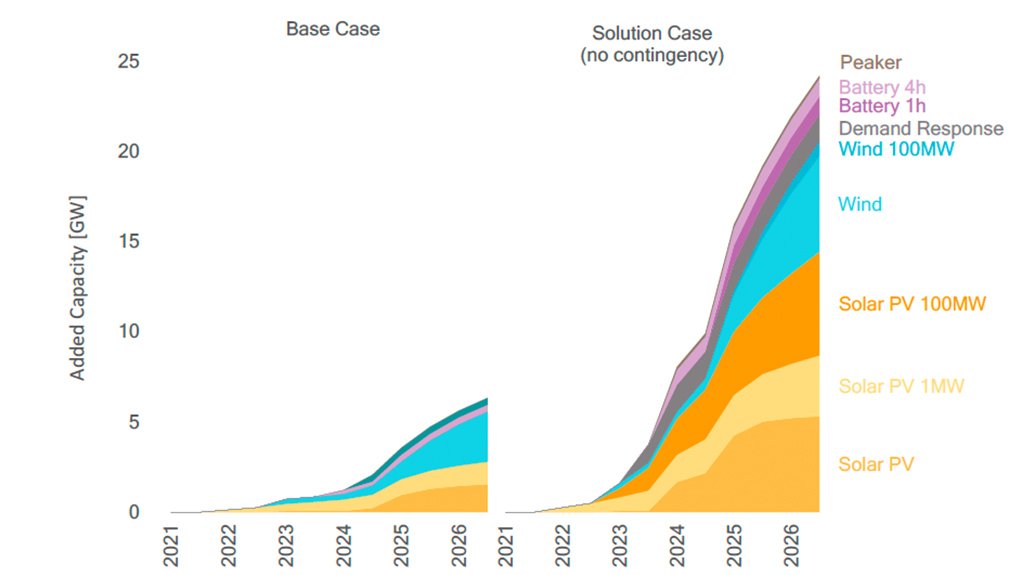

Comparison of the added capacity in the Base Case and the Solution Case (excludes additional peaking plant contingency)

Photo by Meridian Economics

Graphical summary of Solution Case as developed by Meridian Economics

Photo by Meridian Economics

A comprehensive strategy for drastically reducing, or even eliminating, the scourge of rotational power cuts in South Africa by early 2024 has been outlined in a new public-interest report published by Meridian Economics.

The authors warn, however, that load-shedding is poised to rise to extreme levels unless unprecedented interventions, underpinned by “substantial political will”, are taken urgently to introduce about 10 GW of mostly wind and solar photovoltaic (PV) generators into the energy-starved system by that date.

The detailed two-part report includes a model showing that 96.5% of the load-shedding implemented by Eskom in 2021 (officially the country’s worst-ever year for power cuts) could have been averted had there been 5 GW more variable renewable-energy generation available – a scenario that could well have prevailed had it not been for the seven-year disruption to the country’s renewables procurement programme.

Besides reducing the deleterious economic impact of load-shedding on the economy as a whole, the additional 5 GW of wind and solar would have also created a net annual saving of R2.5-billion for Eskom, as a result of lower diesel and coal consumption.

The model also shows that there is likely to be a four-fold increase in load-shedding next year when compared with the 1.8 TWh of unserved energy in 2021, which affected 1 165 hours, rising to a ten-fold increase in 2026, under a business-as-usual approach, which the report terms as its ‘Base Case’.

To avert such an outcome the authors have crafted a plan, dubbed the ‘Solution Case’, that includes a suite of interventions to be pursued simultaneously and by multiple participants to resolve the crisis.

PRESIDENTIAL UNIT

Given the scale of the implementation challenge, however, the authors argue strongly for the creation of a dedicated and well-resourced power crisis implementation unit inside The Presidency to drive and monitor the programme and reduce the potential for bureaucrats and politicians to frustrate progress.

“Implementing these reforms will require political will at a scale that has not yet been demonstrated in dealing with South Africa’s power crisis,” Meridian Economics MD Dr Grové Steyn, who co-authored the report together with Adam Roff, Peter Klein, Rian Brand, Celeste Renaud and Lonwabo Mgoduso, avers.

“It will therefore be critical that a single, neutral overarching entity in government takes the lead in setting out the elements of the game plan that must be implemented, and drives its implementation.

“In our view, the natural place for this role is in The Presidency,” Steyn says.

Most of the resource components of the Solution Case outlined in the second part of the report, titled ‘Resolving the Power Crisis Part B: An Achievable Game Plan to End Load-Shedding’, are drawn from interventions already under way to either add new generation or to reduce demand.

“We think the fastest way of doing this is to take what we've got on the table – what is currently being procured and being pursued as a result of the recent deregulation allowing projects below 100 MW to proceed without a licence – and make that work more effectively and a bit faster,” Steyn explains.

Therefore, the main resource components of the plan draw on the current and upcoming bidding rounds of the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP), the embedded generation projects being pursued by energy-intensive companies and -miners, as well as from a reconfigured Risk Mitigation Independent Power Producer Procurement Programme (RMIPPPP), but excluding the controversial power ships, which face legal and environmental obstacles that are unlikely to be resolved in the timeframe envisaged in the report.

In addition, the authors argue that efforts should be made to obtain additional energy from the multitude of existing and new projects that are distributed throughout the grid, while leveraging and incentivising demand response through aggregators to secure 1.5 GW and introducing additional battery storage of about 2 GW.

To add further resilience to the strategy, and to cater for likely procurement delays, the report also suggests the urgent installation of additional thermal peaking capacity of 1.35 GW and expanding diesel storage at the existing peaker plants.

In total, under a risk-adjusted version of the Solution Case, which caters for delays or even some project failures, the report proposes that 27 GW of new capacity be added by the end of 2026, with about 10 GW of that added by early 2024 to end load-shedding.

The bulk of the new energy would be derived from utility and distributed solar PV (15 GW), with the report assuming that 80% of the capacity bid under bid window 5 (BW5) achieves financial close and that BW6 is expanded to 3 GW.

The report also assumes that 5.7 GW of wind is added, again based on the assumption that 80% of the wind projects under BW5 achieve financial close and that BW6 is expanded to 4 GW. The Kusile coal power station is also assumed to add 2.1 GW by 2024, which will result in a 108 MW net rise in coal capacity after unit decommissioning during the period.

The report does not anticipate any recovery in the energy availability factor (EAF) for the Eskom coal fleet, stating that it appears unlikely that the EAF decline can be contained to less than 2% a year as long as there is inadequate space to take plant out for maintenance.

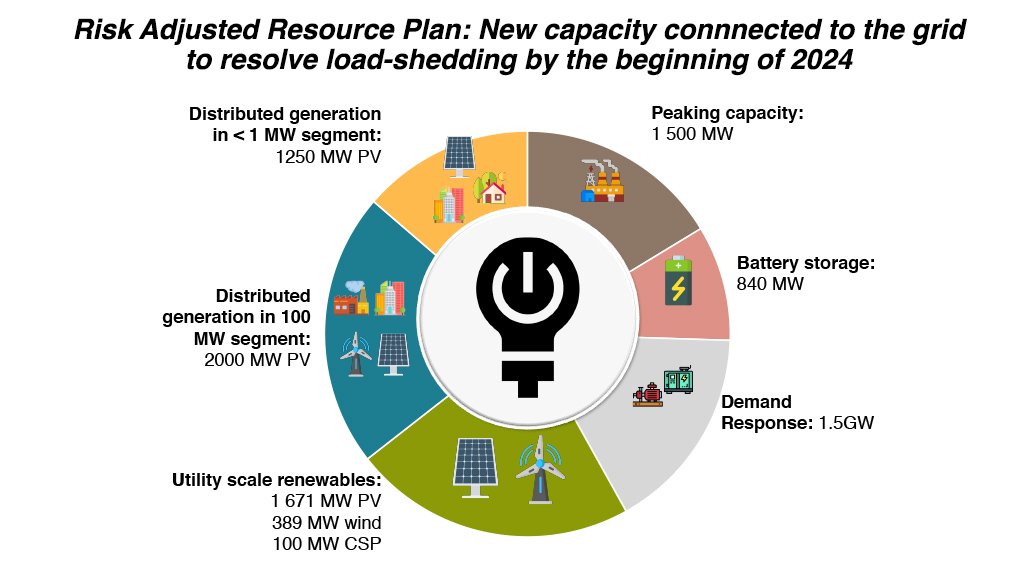

For the period to early 2024, Meridian's risk-adjusted plan for resolving load-shedding includes: 2 000 MW of distributed solar PV; 1 671 MW of utility-scale solar PV; 389 MW of new wind; 100 MW of concentrated solar power; 1 500 MW of diesel peaking capacity; 840 MW of battery storage and 1 500 MW of demand response.

“Together, this suite of resource increases can practically eliminate load-shedding by 2024 with full security of supply reached by 2025,” the report states.

ON-TIME DELIVERY?

Ensuring these large-scale additions are delivered on time, however, is regarded as a “substantial challenge” and, besides a dedicated unit in The Presidency, the report suggests the following measures be introduced to support implementation:

- eliminate or drastically reduce local-content requirements on solar PV modules, as these are posing a critical risk to the closure of RMIPPPP and REIPPPP projects;

- fix design flaws in the RMIPPPP to enable all the projects with PV, wind and storage to proceed and for the entire energy capacity to be made available to the system, including by allowing surplus variable electricity to be sold to Eskom or other offtakers, allowing battery charging from the grid at the applicable time-of-use tariffs and scrapping the 15-hour qualification test;

- implement across-the-board price increases for BW5 REIPPPP projects to compensate for large cost escalations that have arisen subsequent to bidding as a result of supply-chain bottlenecks;

- accelerate uptake in the distributed generation market by implementing further licence exemptions, raising the licence threshold from 100 MW to 1 000 MW and providing for net feed-in tariffs and further tax incentives;

- expand the REIPPPP BW6 allocation to 3 GW of solar PV and 4 GW of wind and launch it in time with stronger incentives for early energy;

- expedite the procurement of additional peaking capacity, as well as demand response capacity and storage;

- implement Eskom’s Just Energy Transition renewable-energy projects as public-private partnerships;

- clarify and unlock the opportunity for municipalities to rapidly procure new capacity;

- bolster the Eskom grid-connection process;

- fix and establish key institutions, including ironing out issues and skills constraints at the Independent Power Producer Office and at the National Energy Regulator of South Africa; and

- expedite additional amendments to Schedule 2 of the Electricity Regulation Act, exempting all storage facilities from licensing and raising the licence threshold to 1 000 MW, while issuing new Ministerial determinations to facilitate larger-scale procurement.

The authors acknowledge that some of their solutions may appear objectionable, including the proposed increase in prices for projects bid under the RMIPPPP and BW 5, as well as the suggestion that the local content thresholds be abandoned initially and reworked for later rounds.

“However, when considering these proposals, it is critical to consider the correct counterfactual: more and longer load-shedding with its economic and social consequences.”

The report comes as Eskom canvasses the views of international and local experts on a comprehensive package to end load-shedding as quickly as possible, as well as to position South Africa’s electricity supply industry for technical, financial and environmental sustainability by 2035.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation