Renewable-energy projects Merafe’s 2022 focus, says CEO Zanele Matlala

Merafe Resources presentation covered by Mining Weekly’s Martin Creamer. Video: Darlene Creamer.

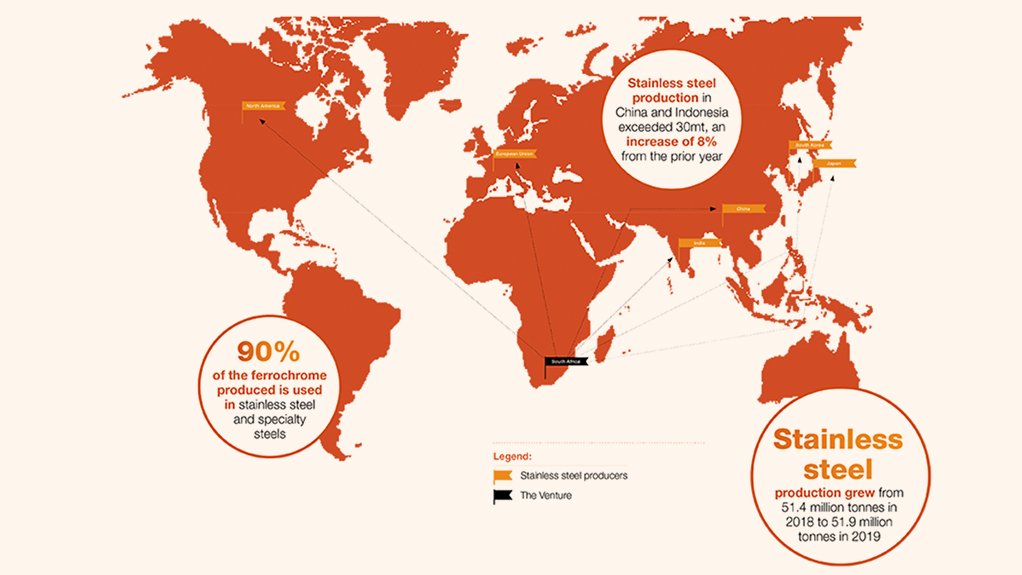

China produces most stainless steel, South Africa supplies most of the ferrochrome required by stainless steel.

Photo by Creamer Media

Meafe constructing plant to recover platinum group metals from chrome talings.

JOHANNESBURG (miningweekly.com) – The focus of ferrochrome company Merafe Resources in 2022 will be on renewable-energy projects, along with efficient operations, cash management and well-ordered capital allocations, CEO Zanele Matlala said on Tuesday.

The year 2021 has been one of spectacular recovery for the Glencore Merafe Pooling and Sharing Venture. (Also watch attached Creamer Media video.)

In announcing its highest profit after tax since the formation of the venture in 2004, the JSE-listed Merafe provided new insight into the PGMs-from-chrome-tailings project at the Kroondal mine, and also outlined three distinct areas of green energy development involving:

- the conversion of on-site offgas from the venture’s smelters into clean electricity;

- on-site 'behind-the-meter' solar and wind projects capable of generating 150 MW of green electricity; and

- the evaluation of quotations for the phased execution of up to 800 MW of virtual wind and solar power purchase agreements.

China continued to dominate stainless steel production, accounting for about 57% of global output. Ferrochrome demand in 2021 mirrored global stainless steel production, with Indonesia slightly decreasing China’s dominant share of global output.

World ferrochrome production increased by 15% to 14.4-million tonnes, with most of the production growth coming from South Africa (32%) and India (30%).

Chrome ore imports into China increased by 5% to 15-million tonnes, with South Africa making up 80% of the chrome ore sold into China.

The average ferrochrome prices received in 2021 were around $1.08/lb compared with $0.72/lb in 2020. Chrome ore prices, on the other hand, only increased modestly, with upper group two prices averaging about $140/t, compared with $129/t in 2020.

Merafe FD Ditabe Chocho reported a 75% year-on-year increase in ferrochrome revenue and a 33% increase in chrome-ore revenue.

“We also accounted for small revenue arising from PGMs concentrate sold from December 2021,” said Chocho.

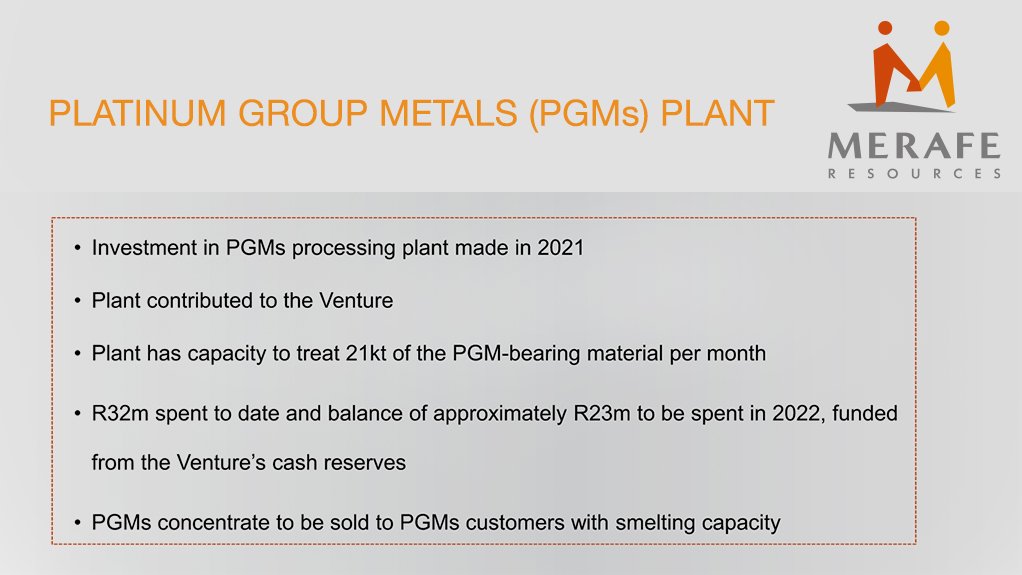

The processing plant being built to recover PGMs from chrome waste has a capacity of 21 000 t a month.

To date, R32-million has been spent on developing it and a further R23-million is due to be spent this year to take the plant to completion.

The PGMs concentrate it produces is being sold to PGMs customers that have smelting capacity.

“We believe the PGMs plant will be fully commissioned in quarter two. We’ve started to treat material and we are seeing benefits from that,” said Glencore Alloys CEO Japie Fullard, who declined to give the grade of PGMs produced.

“We do have an offtake. You will understand that the chrome content in the PGMs concentrate is fairly important and we do have an agreement with a PGMs producer that we are selling that product into the market,” he added.

Chocho reported that the financial return on the PGMs project would be sufficiently higher than Merafe’s weighted average cost of capital of 11.4% after tax, with a four-year payback based on current pricing assumptions.

DECARBONISATION IMPORTANT

Fullard described the reduction of Scope 2 emissions specifically as being “very important”.

Agreements had already been signed with suppliers for the conversion of on-site offgas into electricity, Fullard said in response to Integrated Managed Investments portfolio manager Leo Altini.

With pilot circuits being run, the operation was well on its way to achieving the best efficiencies in the turning of carbon dioxide to electricity.

“That’s the first focus area for us and there’s a lot of work we’re doing there,” said Fullard during the question session covered by Mining Weekly.

Capital investment in the second behind-the-meter solar and wind project greening area would commence within the next year, and quotations were being evaluated for the various virtual power purchase agreement contracts, for which multiple financial instruments were under consideration.

It was reported that Rustenburg smelters Furnace 5 is back in operation while the Lydenburg smelter remained on care and maintenance.

The foreseen benefits of developing the PGMs plant at Kroondal arise from the treating of PGMs-containing chrome tailings. The plant is close to being in the final completion phase.

REDUCTANT PRICE RISK

As a reductant-intensive company, Merafe was experiencing supply constraints owing to the high prices being fetched resulting in a tendency for local companies to want to export.

“For that reason, we had to negotiate with our suppliers. From an anthracite point of view, I think that we’ve secured fairly consistent supply. On the coke side, we’ve also made sure that we do have enough coke. We don’t believe we have a security of supply risk per se, but we definitely have a reductant price increase risk,” said Fullard.

Fullard said that although ferrochrome as such had not been classified as a green metal, stainless steel, in which it featured as a key ingredient, had been singled out as a metal of the future.

LOGISTICS ISSUES

Matlala said in response to Mining Weekly that logistics was an issue for Merafe and the mining industry and that the company was working very closely with Minerals Council South Africa to try and address the matter.

“We’ve had various meetings from an industry point of view with Transnet to address the issues and we’re in the process of trying to develop solutions. But obviously in the meantime we’ve got to move product so we’re relying a lot more on road than on rail and that does cause its own issues around port congestion.

“We’re also relying on the flexibility that we have to use the various ports. So, rail is happening, but not at the levels that we’d like,” said Matlala. Ports being used include Maputo, Richards Bay and even Durban.

CHROME EXPORT TAX

Matlala said in response to a question that Cabinet had approved the imposition of a chrome export tax but there had been no movement from the government side to do so.

“We’re just waiting for developments on their side. There’s not much that can be done on our side,” she said.

CASH DIVIDEND

Merafe declared a final cash dividend of R549.8-million, bringing the total dividends for the year to R724.7-million. It’s record after-tax profit hit the R1 674-million mark.

Net cash generated from operating activities increased to R1 156-million, net cash on hand rose to R972-million from R278-million in 2020, and a cash dividend of 22c a share was declared compared with nil in 2020.

Ferrochrome production rose 43% to 379 000 t and revenue rose 69% to R8 063-million, which rocketed earnings to R2 432-million from R168-million in 2020.

Strong growth in global stainless steel production, as well as developments in China, were key to the buoyancy of the ferrochrome market in 2021.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation