Road freight growth subsiding; rail sector struggling – Ctrack index

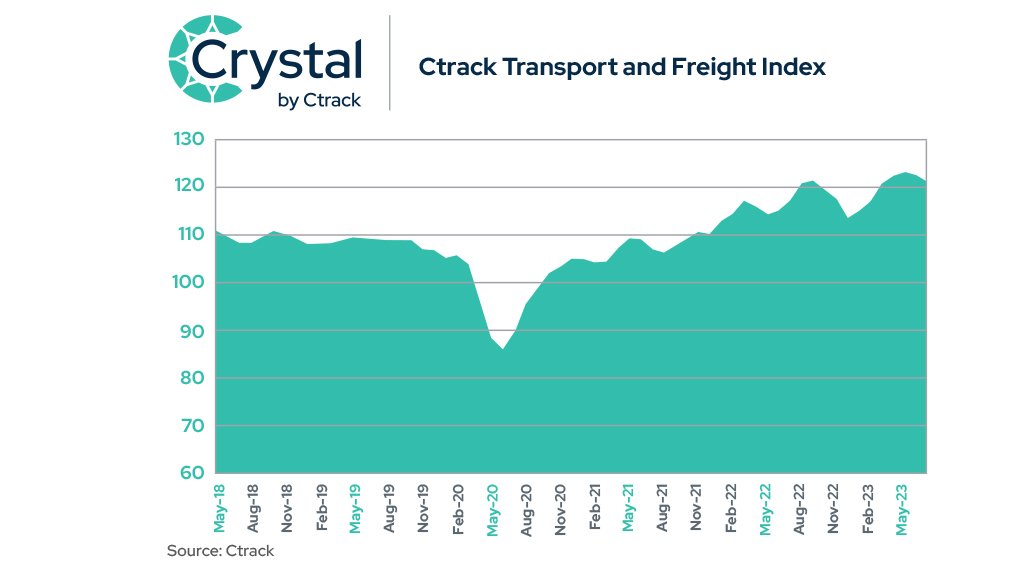

The Ctrack Transport and Freight Index (Ctrack TFI) retreated further in July to an index level of 120.8, the lowest level this year since March (120.5).

This represents a decrease of 1.2% during the month of July.

This second consecutive monthly contraction confirms that the logistics sector is losing momentum, says the TFI report, compiled by logistics firm Ctrack.

In addition, four of the six sub-sectors measured by the index declined on a monthly basis, namely rail, road, storage and air freight.

Pipeline transport recorded marginal growth, while sea freight was the only sub-sector to show strong growth.

Despite these monthly contractions, the index is still tracking 3.3% higher on a yearly basis. Many challenges remain, however, states the report.

The South African transport and freight sector has been in sharp focus in the past few months as government started to come to terms with the negative impact the underperformance of the sector has on the broader economy.

In a recent update of Operation Vulindlela, published in August, government indicated that a new Freight Logistics Roadmap is undergoing an internal consultative process for publication before the end of the year.

This roadmap is set to incorporate proposals to resolve immediate operational challenges, while also developing interventions to restructure the country’s logistics sector to support economic growth.

The implementation of the roadmap will be overseen by the National Logistics Crisis Committee (NLCC), established earlier this year to address problems afflicting the sector, including a steep deterioration in rail services and ongoing port inefficiencies.

A joint strategic operations committee is also being established between the NLCC and the private sector, with organised business having identified the logistics crisis as one of three areas in which it will provide direct support to government.

“It is great that government is finally moving forward with Operation Vulindlela,” says Ctrack CEO Hein Jordt.

“I do hope it ignites the recovery the broader transport industry and the South African economy so desperately needs.”

Fragmented Growth

The Ctrack TFI sub-sectors has been characterised by fragmented growth over the past few months, derailing any hope of a synchronised recovery, states the index report.

Only three of the six sub-sectors of the index increased on a quarterly basis in July, with road, rail and air freight the laggards.

On a yearly basis, four of the six sub-sectors still declined, despite the overall index level increasing by 3.3% compared with a year earlier.

Among the sub-sectors, road transportation (the biggest sub-sector) has always been most resilient.

Still, yearly growth subsided to only 6.9% year-on-year during July, which is a far cry from the yearly growth of 28.2% experienced in August last year.

The road freight sector has experienced multiple headwinds in the past few months, including an IT glitch that caused border crossing delays and the burning of trucks on the N3 in KwaZulu-Natal, which subsequently spread to Mpumalanga and Limpopo.

These events had a visibly negative impact on the number of heavy vehicles on the road, especially during the first weeks of July.

While heavy vehicle traffic bounced back on the N4, growing by double-digits on a monthly basis and reversing the slump in June, truck traffic on the N3 route declined further during July.

While the road-freight payload for the country as a whole remained flat on a monthly basis, as recored by Statistics South Africa in its monthly Land Transport Survey, the Ctrack index saw the road freight sector decline on both a monthly and quarterly basis during July.

This sector remains critically important for the South African economy as trucks carry around 80% of goods in and around the country.

The rail freight sub-sector also subsided further in July, remaining deeply in negative territory on a yearly basis and declining by a further 6.2% year-on-year, which represents the sixteenth month of consecutive decline.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation