Despite poor Q4, air, rail and sea freight on the mend as road freight loses ground – Ctrack index

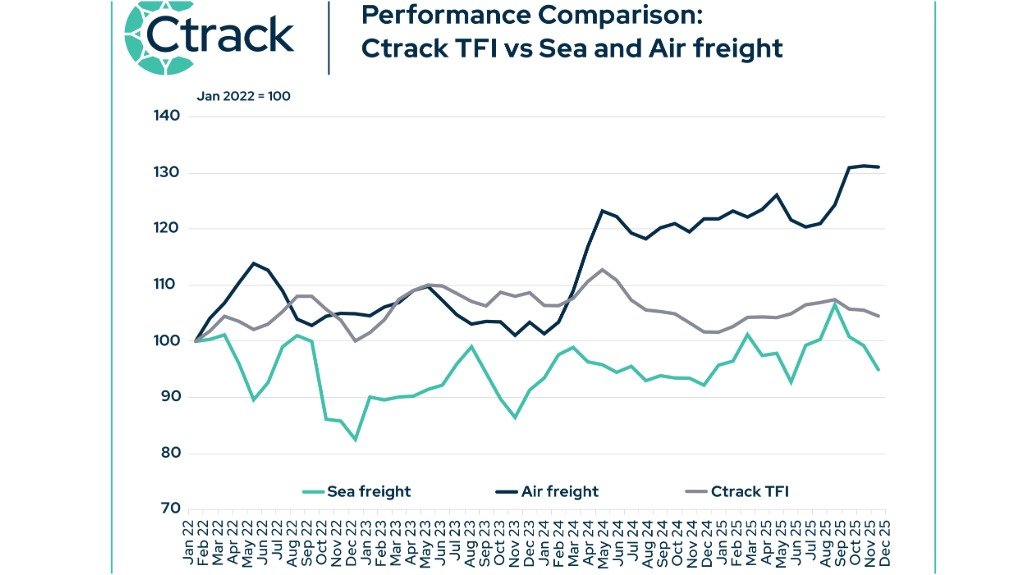

After gains in seven of the nine months to September last year, the Ctrack Transport and Freight Index (Ctrack TFI) lost momentum in the fourth quarter (Q4), ending the year at an index level of 117.1, with quarterly contractions recorded for all sectors, with the exception of rail and air freight.

When considering the full year, it is evident that the subsectors which were under pressure in 2024 remained in a tight spot in 2025 – road freight, pipeline flows and storage – while the subsectors that moved into recovery mode in 2024 managed to build on their progress and clock another growth year – rail, air and sea freight.

Given, however, that the heavy-weighted road freight subsector remained on the backfoot, the overall logistics sector declined by 1.9% for the full year compared with 2024, which is the second consecutive yearly contraction following a 0.5% decline in 2024.

Road freight recorded a 4.5% decline in 2025, pipelines were down 3.1%, and storage and handling contracted by 2.3%, notes the newest Ctrack TFI report.

Air freight was up 7.2%, rail freight grew by 3.7%, and sea freight was up 3.9%.

The TFI report states that “notable progress” was made last year on structural reforms to improve operational efficiencies and modernise South Africa’s freight logistics sector, with these improvements creating a base to support future growth in the industry and the economy at large.

“Much-needed efficiency gains at ports and the rejuvenation of the rail network will in due course – slowly, but surely – impact the economy positively by reducing transport costs, while enabling robust export growth potential.

“While acknowledging that it remains early days, with enormous potential for improvement, both the rail freight and sea freight subsectors – where the bulk of structural reforms are concentrated – performed reasonably well in 2025.”

Air Freight

The TFI report describes the air-freight sector as last year’s star performer in the logistics sector, aligning with global trends.

Following an increase of 11.3% in global cargo tonne-kilometres (CTK) in 2024, the International Air Transport Association reported a further increase of 3.3% in international air freight demand for 2025 to November.

In South Africa, cargo load on planes increased by 10.3% last year, compared with the previous year’s increase of 21.9%.

“While more costly, air freight often plays an important role in filling the gaps when other transport modalities like sea freight are under pressure,” states the TFI report.

Sea Freight

In the sea freight sector, consolidated port throughput in 2025 showed encouraging signs of recovery.

Container throughput in all ports in South Africa totalled 4 473-million twenty-foot equivalent units (TEUs) last year, up 3.2% compared with 2024.

Total bulk cargo handled last year totalled 221-million tonnes, up 4.4% compared with 2024, while vehicle throughput in 2025 totalled 899 094 units, up by 15% on 2024.

While reform progress has generally been slow and implementation challenges persist, National Treasury has renewed its fiscal commitment to support Transnet’s recovery plan, and the early signs of improvement are welcomed, notes the TFI report.

“The commitment to expand private sector participation in port operations is pivotal in revitalising South Africa’s trade-enabling infrastructure and improving logistics performance over the medium term.

“While 2025 as a whole was a better year for sea freight, the sector ended 2025 on the back foot, with the index declining by 10.8% in the fourth quarter compared with the third quarter.

“Transnet Port Terminals indicated that 30 export days were lost at the Port of Cape Town due to extremely windy conditions impacting negatively on seasonal fruit exports.”

Rail Freight

The recovery in the rail freight sector gained momentum last year, with this sub-component of the Ctrack TFI increasing by 3.7% in 2025 compared with a 4% gain in 2024.

The reforms aimed at restoring and growing rail capacity in South Africa are slowly but surely starting to impact positively on the sector’s performance, notes the TFI report.

Rail freight payload in South Africa increased by 4% (year to October) compared with increases of 0.8% and 2.5% in 2024 and 2023, respectively.

Rail freight payload has now increased for three consecutive years, though it still lags previous years’ performances.

From reaching a rock-bottom low of 9% of total freight payload transported via rail in November 2022, the performance of rail has improved to 15.2% in October last year.

The CTI report notes that the task at hand to restore rail freight “is enormous”, and that it “will take some years before a notable trend reversal will be evident”.

Road Freight

The road freight sector had another difficult year as it dealt with a number of challenges impacting negatively on the sector’s performance, including government’s efforts to move cargo back to rail.

Though the impact of this drive was only marginal in 2025, it is expected to become more notable in the medium term.

From 78.3% of total freight in 2010, road freight moved to reach an all-time high of 91% late in 2022. (The total of all freight payload for the first ten months of 2025 stood at 85.4%).

The CTI report says that the impact of exponential growth in the road freight industry in 2021 and 2022 (responding to the demise of rail freight at the time) led to an over-supply of heavy trucks, declining margins and market consolidation.

“While there are plans on the table to move cargo back from road to rail, many obstacles are still in the way, and it will likely take a considerable period and noteworthy effort to address all the challenges.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation