Metals sector urged to seize South Africa’s beckoning Steel Master Plan opportunity

Seifsa CEO Lucio Trentini interviewed by Engineering News & Mining Weekly’s Martin Creamer. Video: Darlene Creamer.

JOHANNESBURG (miningweekly.com) – South Africa’s historic metals sector employer organisation on Wednesday urged all the sector’s employer bodies to roll up their sleeves on May 19 and 20 and get their teeth into the Steel Master Plan, which is seen to have promising reindustrialisation elements.

President Cyril Ramaphosa highlighted the Steel Master Plan in last month’s State of the Nation Address.

An upbeat Lucio Trentini, in his capacity as the CEO of the nigh-80-year-old Steel and Engineering Industries Federation of Southern Africa (Seifsa), described the challenges faced by the metals and engineering sector as being “quite daunting” and highlighted the amazing resilience that members had displayed in the last 12 to 18 months. (Also watch attached Creamer Media video.)

Seifsa has a combined membership of more than 1 200 companies that employ more than 170 000 personnel. Formed in 1943, its members range from giant steelmaking corporations to microenterprises employing fewer than 50 people.

“The message that I want to put out is that this industry stands ready to make its contribution to translating government’s vision of reindustrialising the metals and engineering sector, and to start translating visions, promises and policy into action and deliverables.

“What we need is for the government to roll out its promised infrastructure spend, which is absolutely central to the reigniting of industrial capacity in the sector. I can assure you, if we see half of what government has promised, the sector will ignite, move forward and create the much-needed economic growth and consequent jobs and job opportunities that this country so sorely needs. We’re ready, we want to do our bit,” said Trentini in a Zoom interview with Engineering News & Mining Weekly.

The knock-on effects are felt throughout the economy owing to the sector’s role as supplier and customer into the mining, automotive, motor, construction and other manufacturing sub-industries.

“Because of the nature of our economy and its size, the major sectors of our economy are all interrelated, so when one cog in the wheel experiences a stutter, the effects are felt throughout the value chain,” said Trentini.

During the three-week stoppage of the sector last year, more than R300-million a week in lost wages and more than R600-million a week in lost revenue was shed by the sector – and those are very conservative figures.

“The knock-on effect into mining, construction, automotive component manufacturers, automotive assemblers was felt very deeply,” said the head of the organisation that sets out to foster mutually-beneficial relationships between employers, labour and government in creating a business environment conducive to growth.

When Trentini joined South Africa’s metals and engineering sector from JCI Gold and Uranium Company 30-odd years ago, it employed more than half-a-million blue-collar workers. Sadly, it is now down to half that number.

“Jobs are scarce and we need to hold on to the jobs we have and allow the government to create an enabling environment,” said action-orientated Trentini.

He sees the Steel Master Plan, already signed by representatives of business, labour and government, as being an integral part of the new enabling environment that the government is heralding, and urges all relevant organisations to put their shoulder to the plan’s wheel at its upcoming conference on May 19 and 20.

“It’s not going to create any miracles overnight but it’s the first time that government, through Trade, Industry and Competition Minister Ebrahim Patel, has come to business to ask what it can do together with labour, to address the challenges that we face as a sector,” he said.

Localisation and designation without having to compromise on cost and quality is the plan’s focus.

“We now know that there are going to be massive increases in the price of steel because of what is happening in the Russian-Ukrainian conflict and the price of steel, which is a major input into all of this industry, is a major issue up for discussion,” said Trentini.

Sought will be a way of bridging the gap between the upstream primary steel producers and the downstream fabricators.

“We have to sit down, we have to talk, we have to be honest, and we have to confront the so-called brutal truths if we are going to make progress. If we don't do that, the Steel Master Plan will be another vision that doesn’t see the light of day – and I don’t think we have much time.

“There’s a lot happening in our country and the sooner we start sitting down and rolling up our sleeves and getting our teeth into the various issues that the Steel Master Plan wants to focus on, the better,” Trentini added.

Seifsa will be using the period ahead of the next round of wage negotiations in 2024 to get stuck into what it highlights as ten critical objectives.

In addition to the Steel Master Plan, these include skills development and human capital, transformation, revival and inclusiveness, electricity and energy, import-export and international trade, and talking to the economic cluster about what they see unfolding in the next year to three years.

“I was bitterly disappointed that, at the signing of the Steel Master Plan, Seifsa was the only employer organisation present. Yes, Seifsa is the largest and the most influential, but it’s not the sector's only employer organisation, and I think it’s critically important that all employer organisations play a role because all employer organisations represent their respective constituencies and those remaining outside are doing their constituencies a disservice. We don't have another metals and engineering industry. This is the only one we have. It’s best that everyone comes in to attend and best if everyone brings their sharp minds and their intellect and their creative ideas to try to move this industry forward as quickly as possible, because, I stress, we don’t have a lot of time,” said Trentini.

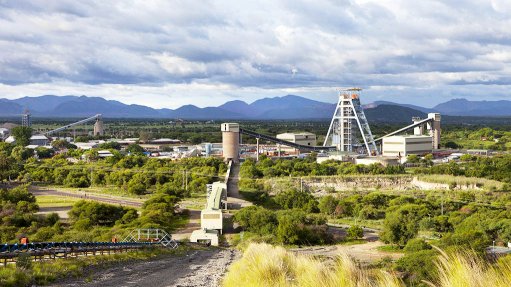

As Engineering News has reported, the launch of the Steel Master Plan took place amid the constant hum of heavy machinery at Hall Longmore’s factory in Wadeville, Gauteng.

The 80-page document has been published following nearly two years of “robust” talks, facilitated by Dr Bernie Fanaroff, the former trade unionist and leading post-Apartheid government administrator, who also played a prominent role in South Africa’s successful bid to co-host the Square Kilometre Array project.

It has been signed against the backdrop of serious Covid-linked steel supply backlogs.

During the ceremony, Barnes Group director Doron Barnes, whose company acquired steel pipe manufacturer Hall Longmore from Murray & Roberts in 2014, was quoted as saying that he had already witnessed first-hand the power of collaboration, with government’s intervention having played a key role in averting the closure of Hall Longmore and having its equipment relocated to Nigeria.

“It is always easier to complain, blame and criticise rather than to put in a meaningful effort to create sustainable solutions,” Barnes said in his address on the factory floor, adding that the master plan created the platform to “map a way forward” with the support of government.

It was stated that the plan had been developed on three pillars, namely:

- boosting demand for steel and steel products, primarily by reviving South Africa’s stalled public infrastructure roll-out; driving localisation, or import substitution; and by leveraging the market access being created through the implementation of the African Continental Free Trade Agreement;

- addressing supply-side constraints, including electricity disruptions and tariff hikes, logistics bottlenecks, uncompetitive inputs and inadequate skills, and research and development; and

- a series of cross-cutting interventions, including the creation of a Steel Industry Development Fund, to be capitalised through the introduction of a levy of between R5/t and R10/t on all steel sold domestically, whether it be produced locally or imported.

“It’s going to be about increasing domestic demand for steel,” Patel explained at the signing.

“The big gains will be made by moving our infrastructure programme from shallow waters to deep waters and to get it moving on a bigger scale and then introducing a localisation requirement not only on primary steel, but also downstream steel.”

Patel reiterated his contention that there was scope for higher levels of localisation, including localisation of steel and metal products and that an accord had been reached at the National Economic Development and Labour Council to drive progressive localisation of up to R200-billion of additional production over a five-year period.

National Union of Metalworkers of South Africa general secretary Irvin Jim, who put his signature to the master plan, argued that the steel industry needed to begin casting its mind beyond being in “survival mode” and use the platform to reverse deindustrialisation and put a stop to the jobs “bloodbath”.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation